June Top Dividend Stocks To Look Out For

Air Partner is one of the ten dividend stocks that can help raise your investment income by paying sizeable dividends. These stocks are a safe bet to increase your portfolio value as they provide both steady income and cushion against market risks. A large part of investment returns can be generated by dividend-paying stock given their role in compounding returns over time. As a long term investor with a short term temperament, I highly recommend these top dividend stocks.

Air Partner plc (LSE:AIR)

Air Partner plc provides aircraft charter broking services worldwide. Formed in 1961, and currently lead by Mark Briffa, the company now has 257 employees and has a market cap of GBP £52.11M, putting it in the small-cap group.

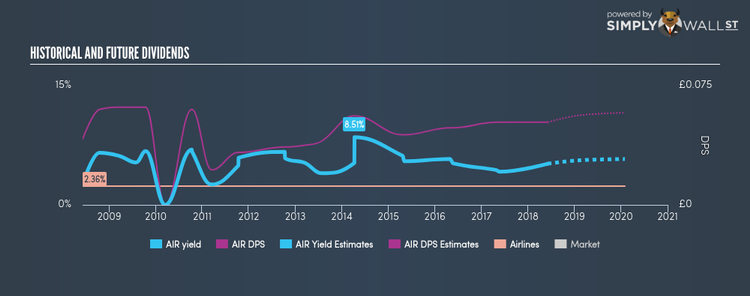

AIR has an alluring dividend yield of 5.18% and has a payout ratio of 79.97% . While there’s been some fluctuation in the yield over the last 10 years, the dividends per share have increased in this time. The company recorded earnings growth of 48.78% in the past year, comparing favorably with the gb airlines industry average of 11.83%. Continue research on Air Partner here.

U and I Group PLC (LSE:UAI)

U and I Group PLC, together with its subsidiaries, invests and trades in, and develops real estate properties in the United Kingdom. Formed in 1980, and now run by Matthew Weiner, the company provides employment to 119 people and with the market cap of GBP £312.25M, it falls under the small-cap category.

UAI has a juicy dividend yield of 7.19% and has a payout ratio of 18.35% , with analysts expecting the payout ratio in three years to be 72.10%. While there’s been some level of instability in the yield, UAI has overall increased DPS over a 10 year period from UK£0.072 to UK£0.18. U and I Group seems reasonably priced when looking at its PE ratio (7.7). The industry average suggests that GB Real Estate companies are more expensive on average 8.6. Dig deeper into U and I Group here.

PayPoint plc (LSE:PAY)

PayPoint plc provides specialist consumer payment, transaction processing, settlement, and other services and products in the United Kingdom, Ireland, Romania, and North America. Formed in 1996, and currently headed by CEO Dominic Taylor, the company currently employs 661 people and with the stock’s market cap sitting at GBP £733.63M, it comes under the small-cap stocks category.

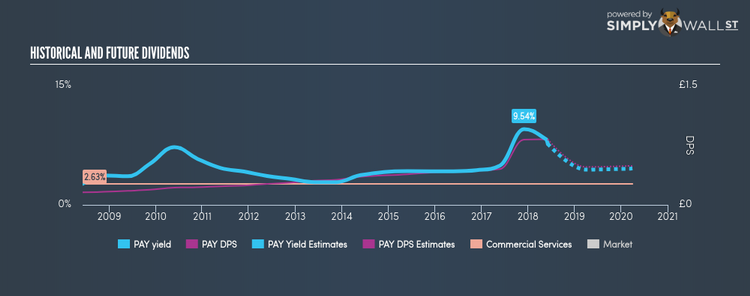

PAY has a juicy dividend yield of 7.68% and is paying out 72.82% of profits as dividends . Over the past 10 years, PAY has increased its dividends from UK£0.16 to UK£0.83. During this period, the company has not missed a dividend payment – as you would expect from a company increasing their dividend. Dig deeper into PayPoint here.

For more solid dividend paying companies to add to your portfolio, explore this interactive list of top dividend payers.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.

Yahoo Finance

Yahoo Finance