June Undervalued Utilities Opportunities

utilities stocks, such as Owens & Minor and Patterson Companies, are trading at a value below what they may actually be worth. Investors can profit from the difference by investing in these stocks as the current market prices should eventually move towards their true values. If capital gains are what you’re after in your next investment, I’ve put together a list of undervalued stocks you may be interested in, based on the latest financial data from each company.

Owens & Minor, Inc. (NYSE:OMI)

Owens & Minor, Inc., together with its subsidiaries, operates as a healthcare services company in the United States, the United Kingdom, Ireland, France, Germany, and other European countries. Established in 1882, and currently lead by Paul Phipps, the company currently employs 8,600 people and with the company’s market capitalisation at USD $992.38M, we can put it in the small-cap group.

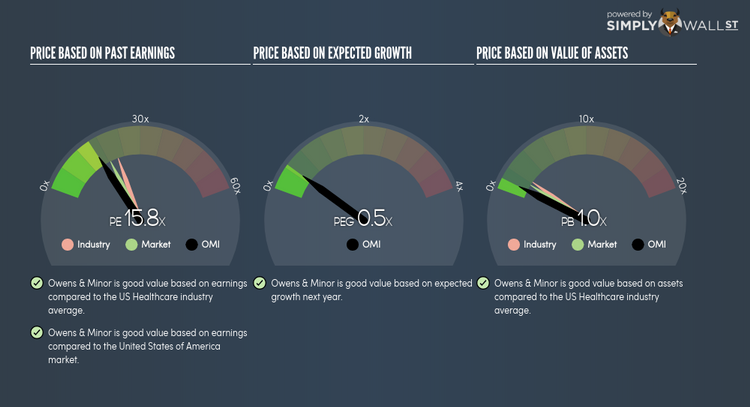

OMI’s stock is now floating at around -34% under its true value of $24.25, at the market price of US$16.06, according to my discounted cash flow model. The discrepancy signals an opportunity to buy low. Moreover, OMI’s PE ratio is currently around 15.79x while its Healthcare peer level trades at, 21.61x indicating that relative to other stocks in the industry, OMI’s shares can be purchased for a lower price. OMI also has a healthy balance sheet, as short-term assets amply cover upcoming and long-term liabilities.

More on Owens & Minor here.

Patterson Companies, Inc. (NASDAQ:PDCO)

Patterson Companies, Inc. distributes and sells dental and animal health products in the United States, the United Kingdom, and Canada. Established in 1877, and now run by Mark Walchirk, the company now has 7,500 employees and with the stock’s market cap sitting at USD $1.98B, it comes under the small-cap stocks category.

PDCO’s stock is now trading at -62% under its value of $56.15, at the market price of US$21.44, according to my discounted cash flow model. The difference between value and price signals a potential opportunity to buy PDCO shares at a discount. What’s even more appeal is that PDCO’s PE ratio is currently around 8.26x against its its Healthcare peer level of, 21.61x indicating that relative to its peers, you can buy PDCO’s shares at a cheaper price. PDCO is also strong in terms of its financial health, as short-term assets amply cover upcoming and long-term liabilities.

Continue research on Patterson Companies here.

Cardinal Health, Inc. (NYSE:CAH)

Cardinal Health, Inc. operates as an integrated healthcare services and products company worldwide. Founded in 1979, and run by CEO Michael Kaufmann, the company size now stands at 40,400 people and with the company’s market cap sitting at USD $16.45B, it falls under the large-cap stocks category.

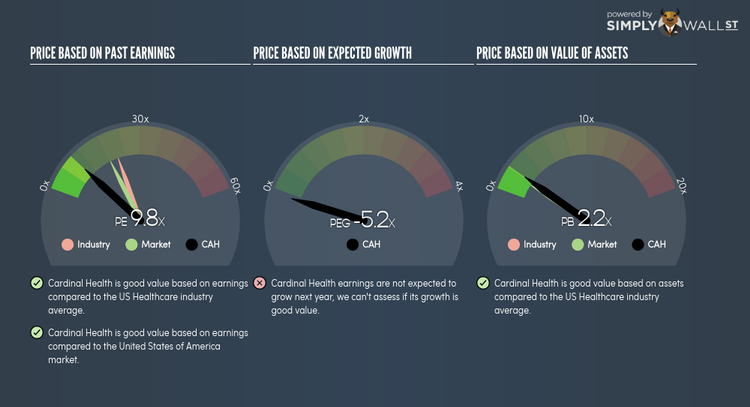

CAH’s shares are now floating at around -52% under its true level of $109.98, at a price of US$52.95, according to my discounted cash flow model. signalling an opportunity to buy the stock at a low price. Also, CAH’s PE ratio stands at 9.8x compared to its Healthcare peer level of, 21.61x meaning that relative to its comparable company group, CAH’s shares can be purchased for a lower price. CAH is also strong in terms of its financial health, with near-term assets able to cover upcoming and long-term liabilities.

Interested in Cardinal Health? Find out more here.

For more financially sound, undervalued companies to add to your portfolio, explore this interactive list of undervalued stocks.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.

Yahoo Finance

Yahoo Finance