Juniper (JNPR) Surpasses Q1 Earnings & Revenue Estimates

Juniper Networks Inc. JNPR reported relatively healthy first-quarter 2018 results on the back of a solid performance from the cloud vertical and growth in enterprise business. Despite year-over-year decrease in earnings and revenues, the company was able to beat the respective estimates and remains confident of returning to a growth trajectory by the end of the year.

GAAP earnings decreased to $34.4 million or 10 cents per share from $108.8 million or 28 cents per share in the year-earlier quarter primarily due to lower revenues, which fell 11% year over year. Non-GAAP earnings for the reported quarter were $99.5 million or 28 cents per share compared with $178 million or 46 cents per share in the year-ago quarter owing to top-line woes. Non-GAAP earnings, however, beat the Zacks Consensus Estimate of 26 cents.

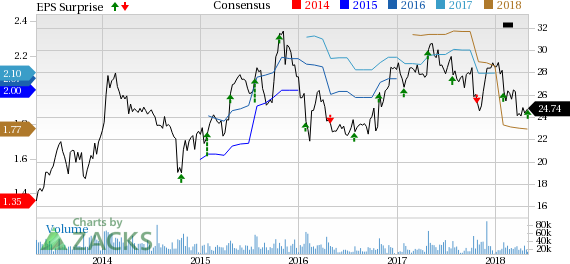

Juniper Networks, Inc. Price, Consensus and EPS Surprise

Juniper Networks, Inc. Price, Consensus and EPS Surprise | Juniper Networks, Inc. Quote

Top-Line Details

Net revenues for the quarter were $1,082.6 million compared with $1,221 million in the prior-year period. Product revenues (accounting for 65.7% of total revenues) decreased 14.2% on a year-over-year basis to $710.8 million on lower demand for routing and switching products, partially offset by positive momentum in security products.

Services revenues (34.3% of total revenues) were down 5.2% year over year to $371.8 million, largely due to the adoption of new accounting standards (ASC 606).

Geographically, revenues increased to $308 million from $284.5 million in EMEA (Europe, Middle East and Africa) due to higher number of projects associated with the cloud business and decreased 17.4% and 16.9% in the Americas and Asia Pacific, respectively, to $587.6 million and $187 million.

By verticals, revenues from Cloud and Service Provider businesses declined 19.1% and 15.6, respectively, to $268.3 million and $479.9 million due to architectural shifts in the former and seasonality issues and customer transition in the latter. Revenues from the Enterprise vertical were up to $334.4 million from $320.9 million in the year-ago quarter, due to strong financial services and healthy trends across all technologies.

Margins

Non-GAAP gross margin was 58.2% for the quarter while non-GAAP operating margin decreased to 12.3% from 20.8% due to lower revenues, customer and product mix and higher service costs, partially offset by improvements in the cost structure.

Balance Sheet & Cash Flow

Total cash, cash equivalents and investments as of Mar 31, 2018 were $3,448.4 million compared with $4,043.7 million in the year-ago period. Long-term debt at quarter end was $1,787.7 million. Net cash flow from operations was $271.1 million in the first three months of 2018 compared with $546.6 million in prior-year period.

During the quarter, the company initiated a new share repurchase program worth $750 million.

Outlook

Juniper anticipates recording sequential growth in the second quarter with margin improvement, driven by steady demand patterns, higher volumes and cost structure efficiencies. The company expects revenues of approximately $1,175 million (+/- $30 million) for second-quarter 2018. Non-GAAP gross margin is projected to be around 59% (+/- 1%). The company expects non-GAAP operating margin of 17.5%. Non-GAAP earnings are anticipated to be 44 cents per share (+/- 3 cents).

Zacks Rank and Stocks to Consider

Juniper currently carries a Zacks Rank #3 (Hold). Some better-ranked stocks in the broader industry are SITO Mobile, Ltd. SITO, United States Cellular Corporation USM and PCTEL, Inc. PCTI, each carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

SITO Mobile has long-term earnings growth expectations of 25%.

United States Cellular Corporation has long-term earnings growth expectations of 1%. It has a positive earnings surprise history with an average of 306.5% in the trailing four quarters, beating estimates thrice.

PCTEL has a positive earnings surprise history with an average of 17.9% in the trailing four quarters, beating estimates twice.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look.

See the pot trades we're targeting>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Juniper Networks, Inc. (JNPR) : Free Stock Analysis Report

PC-Tel, Inc. (PCTI) : Free Stock Analysis Report

SITO Mobile, Ltd. (SITO) : Free Stock Analysis Report

United States Cellular Corporation (USM) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance