Who Just Ramped Up Their Shares In QEP Resources And More?

Using insider buying as an indicator of when to buy makes sense. Company executives and directors have the most recent and in-depth information on the prospect of their firm. They have valuable insights into the business operations which a typical individual investor does not have. Though it is certainly not enough to base your investment decision merely on these signals alone, below I’ve put together three stocks you should examine further.

QEP Resources, Inc. (NYSE:QEP)

QEP Resources, Inc., through its subsidiaries, operates as a natural gas and crude oil exploration and production company in the United States. The company now has 656 employees and has a market cap of USD $2.66B, putting it in the mid-cap stocks category.

QEP Resources Inc (NYSE:QEP) is one of United States’s large-cap stocks that saw some insider buying over the past three months, with insiders investing in 10,000 shares during this period. In total, individual insiders own over 2 million shares in the business, which makes up around 1.01% of total shares outstanding.

The insider that recently bought more shares is David Trice (board member) .

With a notable expected earnings growth rate of 56.62% per year for the next five years, the current bullish sentiment around the company’s outlook may be a key driver for insiders to rally behind their own stock if they believe this growth potential has not yet been properly factored into the share price. Interested in QEP Resources? Find out more here.

Aerie Pharmaceuticals, Inc. (NASDAQ:AERI)

Aerie Pharmaceuticals, Inc., an ophthalmic pharmaceutical company, focuses on the discovery, development, and commercialization of first-in-class therapies for the treatment of glaucoma and other eye diseases. Founded in 2005, and currently run by Vincente Anido, the company size now stands at 160 people and with the company’s market cap sitting at USD $2.23B, it falls under the mid-cap category.

Aerie Pharmaceuticals Inc (NASDAQ:AERI) is one of United States’s large-cap stocks that saw some insider buying over the past three months, with insiders investing in 2,000 shares during this period. In total, individual insiders own less than one million shares in the business, or around 2.15% of total shares outstanding.

The insider that recently bought more shares is Gerald Cagle (board member) .

Dig deeper into Aerie Pharmaceuticals here.

Sunrun Inc. (NASDAQ:RUN)

Sunrun Inc. engages in the design, development, installation, sale, ownership, and maintenance of residential solar energy systems in the United States. Founded in 2007, and currently run by Lynn Jurich, the company currently employs 3,260 people and with the company’s market capitalisation at USD $1.34B, we can put it in the small-cap group.

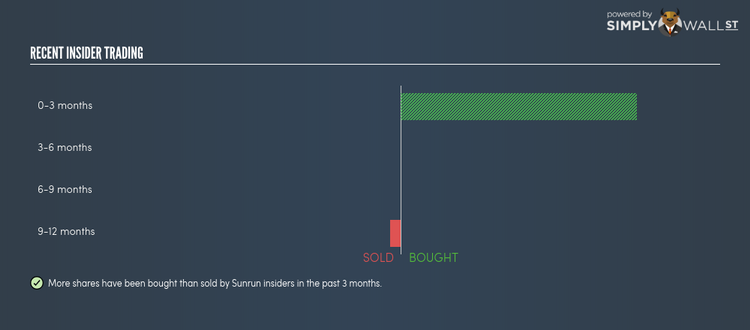

Sunrun Inc (NASDAQ:RUN) is one of United States’s large-cap stocks that saw some insider buying over the past three months, with insiders investing in 776,138 shares during this period. In total, individual insiders own over 7 million shares in the business, which makes up around 6.37% of total shares outstanding.

The entity that bought on the open market in the last three months was

Tiger Global Management LLC. Although this is an institutional investor, rather than a company executive or board member, the insights gained from direct access to management as a large investor would make it more well-informed than the average retail investor. In this specific instance, I would classify this investor as a company insider.

Within the past three months, Sunrun’s share price traded at a high of $12.82 and a low of $6.69. This signals meaningful movements in the share price, with a change of 91.63%, which could be a reason why insiders have decided to increase their shareholdings. Interested in Sunrun? Find out more here.

For more stocks with high, positive trading volume by insiders, explore this interactive list of stocks with recent insider buying.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.

Yahoo Finance

Yahoo Finance