Just Retirement merger pays off as combined group sees profits soar

The merger of pension experts Just Retirement and Partnership last year is continuing to prove fruitful as profits at the combined company soared during the first half.

Just Group, which sells financial products to savers and companies for retirement, said its adjusted operating profit had jumped 39pc in the six months to June 30, compared to the prior year, helped by a boost in retirement income sales as well as lower costs.

The company worked quickly to slash costs following the April 2016 merger, helping it hit a £40m savings target a year earlier than planned. So far this year it has reduced its capacity in London from four to two floors, moving some functions from the City to Reigate, Surrey.

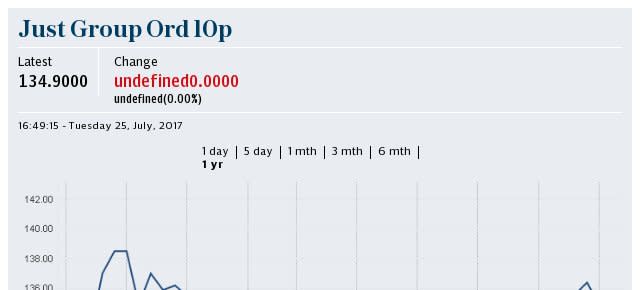

Shares in the company were broadly flat on Wednesday, with the strong set of results largely anticipated by the market following a positive mid-July trading update.

Chief executive Rodney Cook said the group is now bracing for a boost in demand for lifetime mortgages as "increasing numbers reach retirement with greater wealth invested in housing rather than pension assets".

He added that the guaranteed income for life market is also set to grow, "driven by demographics, individual customer defined benefit pension scheme transfers, and continued growth in shopping around", with lifetime mortgages to remain active "as a property rich, but pension poor, generation prepares to retire".

Mr Cook told The Telegraph earlier this year that the company was looking to fill 60 new jobs, with deputy chief executive David Richardson noting on Wednesday that the hiring spree was well on its way. The firm does not expect to make any further job cuts, he said.

The two legacy companies decided to merge after their share prices were slammed by reforms to pensions following George Osborne's 2014 Budget that weakened demand for annuity products.

Yahoo Finance

Yahoo Finance