a.k.a. Brands Holding Corp (AKA) Navigates Challenging Year with Strategic Debt Reduction and U. ...

Net Sales: Slight decrease in Q4 but U.S. market shows growth.

Net Loss: Significant reduction in net loss compared to the previous year.

Adjusted EBITDA: Decline observed in both Q4 and full-year figures.

Debt Paydown: Substantial debt reduction achieved in FY23.

Omnichannel Strategy: Expansion plans set for 2024 with new stores and marketplace opportunities.

Inventory Management: Year-end inventory reduced by 28% from the previous year.

On March 7, 2024, a.k.a. Brands Holding Corp (NYSE:AKA), a pioneering online fashion retailer, released its 8-K filing, detailing the financial outcomes for the fourth quarter and the full year ended December 31, 2023. The company, known for acquiring and growing digitally native fashion brands that resonate with Gen Z and Millennial consumers, reported mixed results amidst a challenging global economic landscape.

Financial Performance and Challenges

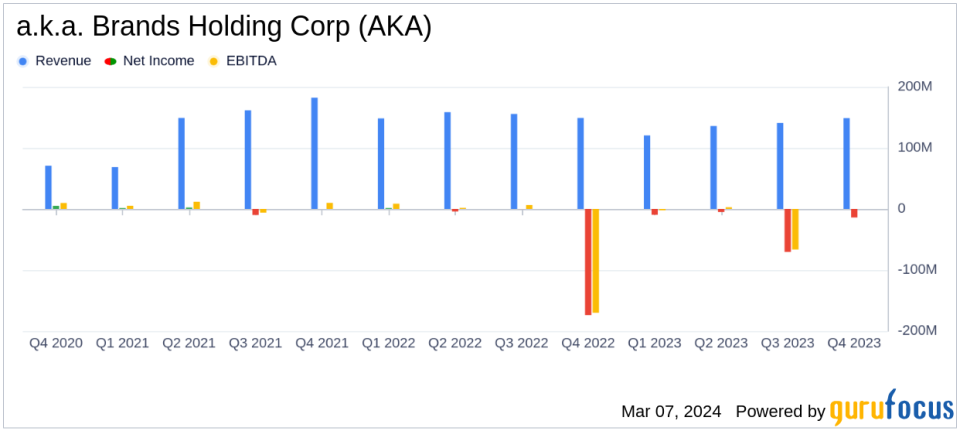

a.k.a. Brands Holding Corp (NYSE:AKA) experienced a marginal decrease in net sales for the fourth quarter, down 0.1% to $148.9 million, compared to $149.1 million in the same period last year. However, the U.S. market displayed resilience with an 11.6% increase in net sales. The company's net loss improved significantly, with a reduction from $(173.9) million in Q4 2022 to $(13.9) million in Q4 2023. Despite these improvements, Adjusted EBITDA for the quarter fell to $1.3 million from $6.1 million in the previous year, reflecting tighter margins and operational challenges.

For the full year, net sales saw a 10.7% decline to $546.3 million, with net loss improving to $(98.9) million from $(176.7) million in 2022. The Adjusted EBITDA for the year also decreased to $13.8 million from $31.9 million in the prior year. These figures underscore the importance of the company's strategic initiatives to navigate economic headwinds, particularly in the Australian and New Zealand markets, which have been significantly impacted by adverse macroeconomic conditions.

Strategic Financial Achievements

The company's financial achievements in 2023 include a noteworthy debt paydown of $50.7 million, effectively reducing its debt by 35%. This strategic move strengthens a.k.a. Brands' balance sheet and positions the company for future growth. The reduction in year-end inventory by 28% compared to the previous year also highlights the company's efficient inventory management and its ability to adapt to changing market demands.

Interim CEO and CFO Ciaran Long commented on the company's performance, stating:

"2023 was a transformational year for a.k.a. Brands, and I want to thank our teams for their continued dedication to building next-generation fashion brands for the next generation of consumers."

Future Outlook and Expansion Plans

Looking ahead, a.k.a. Brands is set to deepen customer relationships by launching new categories and leveraging innovative technologies. The company plans to expand its omnichannel strategy by opening three to four Princess Polly stores and exploring new marketplace and wholesale opportunities in 2024. These initiatives are expected to attract new customers and expand the company's total addressable market.

For the full year fiscal 2024, a.k.a. Brands anticipates net sales between $540 million and $555 million, with Adjusted EBITDA between $16 million and $18 million. The company's capital expenditures are projected to be approximately $10 million to $12 million, supporting its expansion plans.

Key Financial Details

The company's balance sheet reflects a cash and cash equivalents total of $21.9 million at the end of the fourth quarter, a decrease from $46.3 million at the end of the previous year. The debt level stood at $93.4 million, down from $143.6 million, showcasing the company's commitment to reducing financial leverage. Cash flow from operations for the year was a positive $33.4 million, a significant improvement from the cash used in operations of $0.3 million in the previous year.

Overall, a.k.a. Brands Holding Corp (NYSE:AKA) has demonstrated a capacity to manage its finances effectively in a challenging retail environment. The company's strategic debt reduction and growth in the U.S. market are positive signs for investors, even as it faces ongoing macroeconomic pressures. With a focus on expanding its omnichannel presence and streamlining operations, a.k.a. Brands aims to achieve long-term profitable growth.

For more detailed information on a.k.a. Brands Holding Corp's financial results, please refer to the full 8-K filing.

Investors and interested parties can access the conference call discussing these results through the company's investor relations website or by dialing the provided numbers.

For further inquiries, investors may contact investors@aka-brands.com, and media representatives may reach out to media@aka-brands.com.

Explore the complete 8-K earnings release (here) from a.k.a. Brands Holding Corp for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance