K, BYND & 3 Other Food Stocks to Watch for Earnings on August 5

With the earnings season back in force, a number of food companies are lined up to showcase results this week. Companies in the food space are likely to have benefited from recovery in the away-from-home food channel, with restaurants, cafes and other foodservice locations opening up and curbs being lifted. Improving traffic at such locations have been boosting demand in the foodservice channel.

Meanwhile, food companies’ retail businesses have been seeing tough comparisons with the year-ago period’s major boom in demand that stemmed from the initial stock hoarding trends. Although below the year-ago levels, at-home consumption still remains elevated as a number of Americans have cultivated cooking and baking at home as a new habit. These upsides work well for companies offering packaged food and snacks, ready to cook meals, spices and condiments, meat-based food offerings as well as bakery items.

Companies have been making the most of these trends on the back of their concerted strategic endeavors like focus on innovation, product upgrades and portfolio refinement via prudent buyouts and divestitures. Also, food companies have been undertaking efforts to resonate with consumers’ changing tastes and preferences. Speaking of which, these companies have been coming up with organic and natural food choices — as health and wellness have gained further importance amid the pandemic. Companies operating in the agriculture space have particularly been gaining on the organic movement prompted by consumers’ increasing demand for healthier food.

Apart from this, growing online sales are working in favor of a number of food companies, which have been focused on investing toward boosting omnichannel and fulfillment center capabilities. That said, escalated costs of inputs, freight and logistics might have posed concerns for the quarter under review. Companies have also been facing disruptions in the supply-chain network, which is expected to have impacted margins.

Let’s take a closer look at five food stocks, which are slated to release results for the June-ending quarter, on Aug 5. These stocks form part of the Zacks Consumer Staples sector. Per the latest Earnings Preview, the total earnings of the Consumer Staples sector are projected to witness year-over-year growth of 12.7%, while revenues are anticipated to jump 17.4%.

According to the Zacks model, the combination of a positive Earnings ESP, and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold), increases the odds of an earnings beat. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

You can see the complete list of today’s Zacks #1 Rank stocks here.

Here’s How Kellogg is Placed

Kellogg Company K is slated to report second-quarter 2021 results. This manufacturer and marketer of ready-to-eat cereal and convenience foods has been encountering cost-related challenges due to high input costs and COVID-19 expenses. While Kellogg had been gaining on increased demand stemming from elevated at-home consumption, the trends have been moderating as consumers are gradually getting back to normal activities. That said, Kellogg has been benefiting from the strength in its major brands and categories, along with the emerging market growth.

The Zacks Consensus Estimate for quarterly revenues currently stands at $3,418 million, suggesting a dip of 1.4% from the prior-year quarter’s reported figure. The Zacks Consensus Estimate for earnings has moved north by a cent over the past seven days to $1.03 per share, which suggests a decrease of 16.9% from the figure reported in the prior-year period. Kellogg carries a Zacks Rank #3 and has an Earnings ESP of 0.00%, at present.

Kellogg Company Price and EPS Surprise

Kellogg Company price-eps-surprise | Kellogg Company Quote

What’s in the Offing for Beyond Meat?

Beyond Meat, Inc.’s BYND top line is likely to have gained from foodservice business recovery, and retail channel growth during the April-June period. Solid product offerings and focus on expanding the distribution channel by teaming up with renowned retail giants have been working well for this manufacturer, seller and marketer of plant-based meat products. However, higher costs are likely to have affected the company’s bottom-line performance.

The Zacks Consensus Estimate for second-quarter revenues is currently pegged at $140.2 million, calling for an increase of 23.7%. The consensus mark for the bottom line is currently pegged at a loss of 27 cents per share. In the year-ago quarter, the company incurred a loss of 2 cents. Beyond Meat currently carries a Zacks Rank #5 (Strong Sell) and has an Earnings ESP of -18.87%. (Read More: Beyond Meat to Post Q2 Earnings: What Awaits the Stock?)

Beyond Meat, Inc. Price and EPS Surprise

Beyond Meat, Inc. price-eps-surprise | Beyond Meat, Inc. Quote

Factors Likely to Impact Post Holdings

Post Holdings, Inc.’s POST third-quarter fiscal 2021 performance is likely to have been driven by contributions from the acquisitions of Henningsen, Peter Pan and Almark. The company has also been seeing strength across its BellRing Brands and Refrigerated Retail segments for a while now. Post Holdings’ cost-reduction and innovation efforts are also on track. That said, input cost inflation is a concern.

The Zacks Consensus Estimate for the to-be-reported quarter’s revenues is currently pegged at $1,502 million, indicating growth of more than 12% from the year-ago quarter’s reported number. The consensus estimate for the quarterly earnings stands at 94 cents, suggesting an increase of 25.3% from the year-earlier quarter’s tally. At present, Post Holdings has a Zacks Rank #5 and an Earnings ESP of +3.98%. (Read More: Here's How Post Holdings is Placed Before Q3 Earnings).

Post Holdings, Inc. Price and EPS Surprise

Post Holdings, Inc. price-eps-surprise | Post Holdings, Inc. Quote

What’s in the Cards for Celsius Holdings?

Celsius Holdings, Inc. CELH is scheduled to report second-quarter 2021 results. This developer, marketer, distributer, and seller of functional calorie-burning fitness beverages has been benefiting from its portfolio strength, as well as a sturdy distribution network. Rising demand for energy drinks has been working well for the company, while escalated raw material and transportation costs pose concerns.

The Zacks Consensus Estimate for revenues is pegged at $51.7 million, suggesting an increase of 72% from the prior-year quarter’s reported figure. The consensus mark for earnings is pegged at 1 cent per share, which has remained unrevised in the past 30 days. This, however, indicates a slump of 50% from the figure reported in the prior-year quarter. The company has a Zacks Rank #3 and an Earnings ESP of 0.00%.

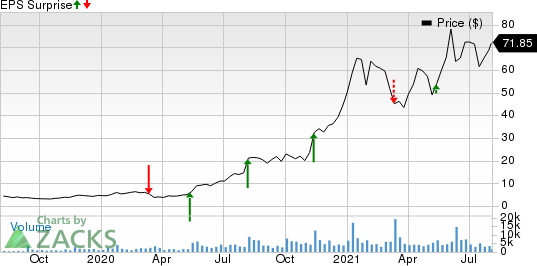

Celsius Holdings Inc. Price and EPS Surprise

Celsius Holdings Inc. price-eps-surprise | Celsius Holdings Inc. Quote

What Awaits Corteva?

Corteva, Inc. CTVA is likely to display top-line growth when it reports second-quarter 2021 results. The company, operating in the agriculture space, has been gaining on favorable demand for its differentiated products. Also, focus on cost and productivity enhancements have been working well. Nevertheless, pandemic-induced global uncertainties, along with high raw material and freight costs, might have impacted the company’s performance during the period in discussion.

The Zacks Consensus Estimate for quarterly revenues is pegged at $5,287 million, suggesting an increase of 1.9% from the prior-year period’s reported figure. The consensus mark for earnings is pegged at $1.25 per share, which has remained stable in the past 30 days. This, however, calls for a decline of 0.8% from the figure reported in the prior-year quarter. The company currently carries a Zacks Rank #4 and has an Earnings ESP of 0.00%.

Corteva, Inc. Price and EPS Surprise

Corteva, Inc. price-eps-surprise | Corteva, Inc. Quote

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Kellogg Company (K) : Free Stock Analysis Report

Post Holdings, Inc. (POST) : Free Stock Analysis Report

Celsius Holdings Inc. (CELH) : Free Stock Analysis Report

Beyond Meat, Inc. (BYND) : Free Stock Analysis Report

Corteva, Inc. (CTVA) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance