Kaz Minerals edges closer to long-awaited dividend on surging profits

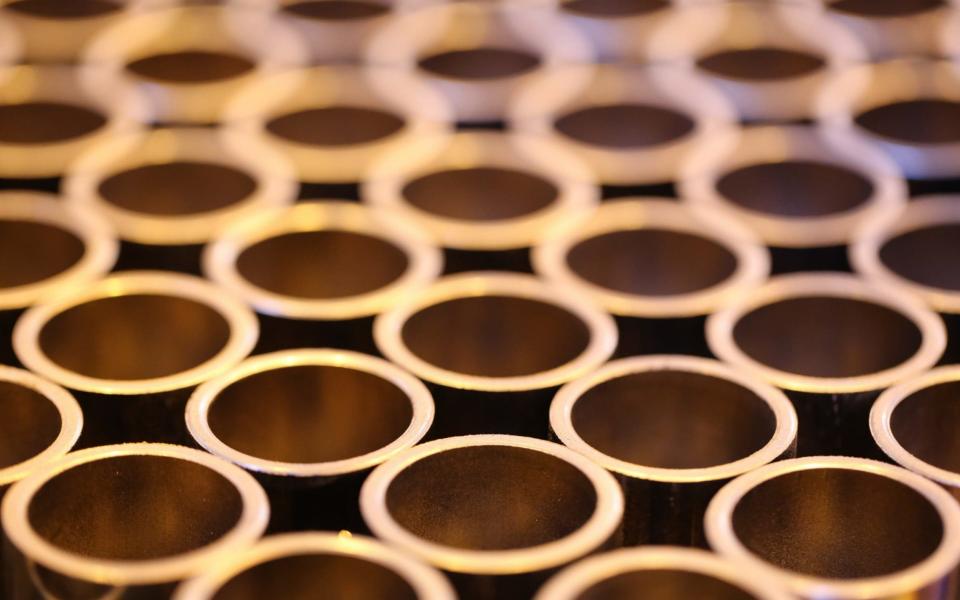

Kazak-based copper miner Kaz Minerals is edging closer to resuming its dividends after reporting a surge in sales and profits.

“We’re coming out of a period in which we were investing heavily and our position to pay dividends is improving by the day,” said Andrew Southam, who stepped up to chief executive last month having served as chief financial officer since 2013.

“The Kaz Minerals brand is rapidly improving and you see it reflected in our share price as well. We’ve still got further to go, but we’re delivering everything we said we would.”

The company’s stock has risen 42pc in the last year but was down around 1pc in lunchtime trade amid a general sell-off in mining stocks. Kaz has not paid a dividend since 2013 when it changed its strategy to focus on expanding its mines, but Mr Southam said it reviewed the payout policy every six months.

The FTSE 250 company has spent $4bn (£2.87bn) in the last four years expanding output at two of its mines in Kazakhstan, including a $1.2bn project approved in December.

Revenues in 2017 more than doubled to $1.6bn on the back of an 80pc jump in production, to 259,000 tonnes. Kaz, which supplies all of its metal to China across Kazakhstan’s land border, was also helped by a 27pc jump in average copper prices on the London Metal Exchange.

Mr Southam declared himself increasingly bullish on copper’s future, noting it is “the fundamental product of the new economy”. The metal, prized for its conductive properties, is tipped to be in high demand for electrical vehicles, and most of the major miners have expressed a desire to lay their hands on more of it.

While electric vehicles are not yet widespread, Mr Southam noted: “In a sector that is extremely finely balanced, incremental demand can and will move the copper market. Electric vehicles will make a meaningful difference over the coming decades.”

Yahoo Finance

Yahoo Finance