Keep an Eye on JPMorgan (JPM) Stock Ahead of Investor Day

JPMorgan JPM is hosting its first Investor Day in two years this Monday. Market participants will be closely following the event to understand how the current operating backdrop will shape the company’s financial performance.

At present, all the stocks are getting hammered mainly due to global macroeconomic and geopolitical concerns. This can turn out to be a good entry point for investors looking for fundamentally strong companies like JPM from a long-term investment perspective.

Currently, the biggest U.S. bank (in terms of total assets and market cap) is trading at a deep discount compared with the broader markets. The company’s price-to-tangible book (P/TB) of 1.81X and forward price-to-earnings (P/E) of 10.62X are lower than S&P 500’s 14.58X and 17.53X, respectively. This makes the company undervalued at present.

The company has been faring well financially amid the tough operating backdrop. Last year, JPM recorded $48.3 billion in net income backed by managed revenues of $125.3 billion (up 2%) and provision benefit of $9.3 billion. On the other hand, total non-interest expenses rose 7% to $71.3 billion.

Further, JPMorgan was on an expansion spree, having acquired and/or invested in more than 30 companies across the globe. Some of the notable deals are a 75% stake in Volkswagen's payment arm Volkswagen Financial Services, OpenInvest, 40% stake in Brazil's C6 Bank, the U.K.-based robo-advisor Netmeg and 55ip. This momentum continued this year as well, with the company announcing deals to acquire Ireland-based Global Shares and a 49% stake in Greece-based Viva Wallet.

Along with these transactions, JPM launched its digital retail bank Chase in the U.K. in 2021 and continues to expand investment banking and asset management businesses in China. These efforts will enable it to diversify revenues and expand its fee income product suite and consumer bank digitally. The company is also on track to open 400 branches across the United States.

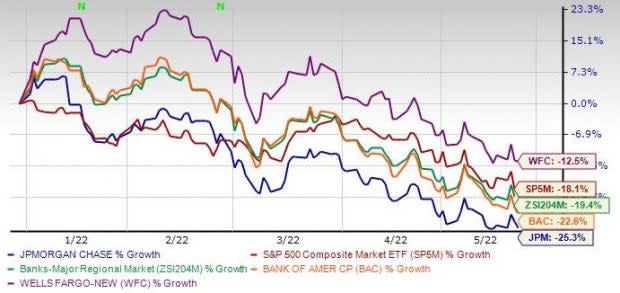

These initiatives should make investors optimistic about JPMorgan’s prospects. But the company’s shares have tanked more than 25% so far this year, significantly more than the industry and the S&P 500. Also, the stock is the worst performer compared with its peers like Bank of America BAC, Citigroup C and Wells Fargo WFC.

With the broader markets witnessing a bearish stance, Bank of America, Citi and Wells Fargo too are trading in red in the year-to-date period. But JPM seems to be out of favor.

Year-to-Date Price Performance

Image Source: Zacks Investment Research

What could be the reasons for investor apathy toward the stock? Well, this seems to be tied to management commentary and/or lack of it. JPMorgan has guided for an 8% increase in expenses this year, while not providing much detail about how total revenues will fare. The only guidance is for net interest income or NII (excluding CIB Markets NII) to be $53 billion, up $8.5 billion from the 2021 level.

JPMorgan remains in the top position in capital markets, investment banking, credit cards and consumer banking businesses. Leveraging on its position and scale, the company has generated solid growth and superior operating efficiency since the 2008 financial crisis. Since the beginning of 2009, shares of the company have surged more than 400%.

JPMorgan is focused on acquiring the industry's best deposit franchise and strengthening its loan portfolio. Also, it maintains investment-grade ratings of A-/A2 and a positive outlook from Standard and Poor’s, and Moody’s Investors Service, respectively, as well as AA- ratings and a stable outlook from Fitch Ratings.

As the Federal Reserve has already raised the interest rates twice this year and more such hikes are expected, JPM’s net yield on interest-earning assets will improve. Lower interest rates have hurt the company’s yields over the past several quarters. Now, the rising rate environment and steadily increasing loan demand are expected to turn around the tables for the company.

Despite these favorable factors that are expected to keep aiding the company’s profitability, a lack of clarity on how new business investments will support financials seems to be leading to pessimistic sentiments.

Nonetheless, at the Investor Day conference, market participants will be looking forward to seeing what changes management makes in its outlook for NII and expenses. Also, guidance for fee income and profitability will be closely watched.

Further, the CEO Jamie Dimon and other top executives are expected to face questions on recession risks, inflation and current market volatility. Also, how the company intends to navigate these adverse situations and management's take on loan growth and borrower defaults will be on everyone’s mind.

All stocks mentioned in the article – JPM, BAC, C and WFC – carry a Zacks Rank #3 (Hold) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Bank of America Corporation (BAC) : Free Stock Analysis Report

Wells Fargo & Company (WFC) : Free Stock Analysis Report

JPMorgan Chase & Co. (JPM) : Free Stock Analysis Report

Citigroup Inc. (C) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance