Kellogg (K) Highlights Growth Plans for Kellanova & WK Kellogg

Kellogg Company K, which has been reaching greater heights on its brand strength, is on track to conclude its previously unveiled separation in the fourth quarter of 2023. On the completion of this spin-off transaction, Kellanova will trade on the New York Stock Exchange (“NYSE”) under the ticker symbol "K," while WK Kellogg Co. shares will be traded on the NYSE under "KLG."

With the spin-off, both entities will be able to better allocate their resources toward distinct strategic goals with increased operational flexibility, allowing them to have a considerable standalone scope and create greater shareholder value.

About Kellanova and WK Kellogg

Kellanova’s portfolio will be more focused on snacks and emerging markets, including differentiated brands with a robust scope for expansion. Management earlier informed that Kellanova would flaunt a portfolio of renowned snacking brands like Pringles, Pop-Tarts, Cheez-It, Rice Krispies Treats, RXBAR, MorningStar Farms and Eggo, among others. It will also house some international cereal brands, such as Kellogg's, Frosties, Special K, Zucaritas, Crunchy Nut, Corn Flakes, Nutri-Grain and others.

Kellanova’s net sales are anticipated to be roughly $13.4-13.6 billion in 2024, with adjusted EBITDA projected at about $2.25-2.3 billion. Kellanova also unveiled its long-term annual growth rates, which include 3-5% for organic net sales, 5-7% for adjusted operating profit (on a currency-neutral basis) and 7-9% for adjusted earnings per share (on a currency-neutral basis).

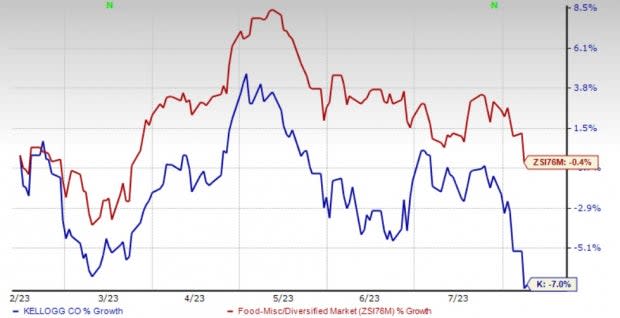

Image Source: Zacks Investment Research

With a dominant market position in North American cereal, WK Kellogg Co will concentrate on enhancing its business execution and modernizing its supply chain. This is likely to yield better competitiveness, profitability and cash flow. WK Kellogg Co. will house a portfolio of leading brands like Kellogg's, Frosted Flakes, Froot Loops, Mini-Wheats, Special K, Raisin Bran, Rice Krispies, Corn Flakes, Kashi and Bear Naked.

The company envisions 2024 net sales of about $2.7 billion and an adjusted EBITDA of roughly $255-265 million. Over the course of the upcoming three years, WK Kellogg Co anticipates achieving a 500-basis point improvement in its adjusted EBITDA margins by the 2026 end. This is likely to be driven by the modernization of the supply chain and a consistent revenue performance.

What’s More?

Kellogg recently delivered second-quarter 2023 results, with the top and bottom lines increasing year over year. Earnings beat the Zacks Consensus Estimate, while sales missed the same. Due to solid first-half results and robust trends, management raised its 2023 sales and profit view.

Management expects organic net sales growth to be up nearly 7% compared with the earlier guidance of 6-7% growth. The revised outlook reflects solid first-half results, price/mix growth and a gradual increase in price elasticities. The adjusted operating profit is now expected to rise 9-10% at cc, up from its earlier guidance of 8-10% growth. The outlook reflects efforts toward profit-margin recovery. Management expects the adjusted EPS to decline 1-2% at cc. The company had earlier predicted the metric to drop 1-3% at cc.

Shares of this Zacks Rank #3 (Hold) company have tumbled 7% in the past six months compared with the industry’s decrease of 0.4%.

Solid Staple Stocks

Some better-ranked consumer staple stocks are The J.M. Smucker SJM, Post Holdings POST and Ingredion Incorporated INGR.

The J.M. Smucker, which provides pasture-raised products, currently carries a Zacks Rank #2 (Buy). SJM has a trailing four-quarter earnings surprise of 14%, on average. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Zacks Consensus Estimate for The J.M. Smucker’s current fiscal-year earnings suggests growth of 6.7% from the year-ago period reported number.

Post Holdings, a consumer-packaged goods holding company, currently has a Zacks Rank #2. POST has a trailing four-quarter earnings surprise of 59.6%, on average.

The Zacks Consensus Estimate for Post Holdings’ current fiscal-year earnings suggests growth of 141.1% from the year-ago reported figure.

Ingredion Incorporated, which produces and sells sweeteners, starches, nutrition ingredients and biomaterial solutions, currently carries a Zacks Rank #2. The Zacks Consensus Estimate for INGR’s current fiscal-year earnings per share has increased from $9.10 to $9.23 over the past seven days.

The consensus mark for Ingredion Incorporated’s current fiscal-year earnings suggests growth of 23.9% from the year-ago reported numbers.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The J. M. Smucker Company (SJM) : Free Stock Analysis Report

Kellogg Company (K) : Free Stock Analysis Report

Ingredion Incorporated (INGR) : Free Stock Analysis Report

Post Holdings, Inc. (POST) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance