KEN ROGOFF: I worry about China

REUTERS/Ruben Sprich

Ken Rogoff, the former chief economist of the International Monetary Fund, says a Chinese economic slowdown is one of the biggest problems facing the world economy.

Rogoff, now a professor at Harvard, said in an interview with the BBC published Monday: "If you want to look at a part of the world that has a debt problem, look at China. They've seen credit-fuelled growth, and these things don't go on forever."

He added: "Everyone says China's different, the state owns everything they can control it. Only to a point. It's definitely a worry, a hard landing in China."

He also said the Chinese economy was "slowing down much more than the official figures show."

"We're having a pretty sharp landing already," he said, "and I worry about China becoming more of a problem."

Rogoff is the latest to voice concerns over level of Chinese debt. The Bank of England last week warned that the expansion of debt in the Chinese economy was a risk to financial stability.

The British central bank's Financial Policy Committee said "credit growth in China continues to materially outpace GDP growth, and the level and growth of credit relative to GDP in China are very high by international standards."

A Chinese economic slowdown is a global problem for two reasons.

First, the world has come to depend on China as an engine for growth while Europe, the US, and Japan all struggle with low inflation and low growth.

Second, with debt levels so high, a slowdown in growth could trigger a financial crisis similar to that of 2008.

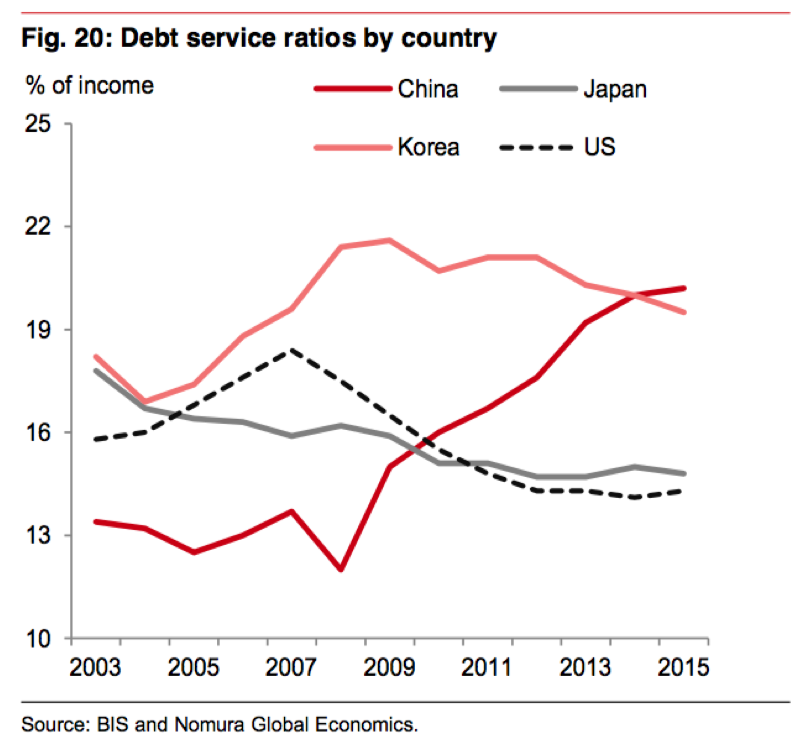

Here is a chart from Nomura that shows the percent of income China's companies put toward servicing their debts. The rate has doubled since the 2008 financial crisis:

REUTERS/Ruben Sprich

The Bank for International Settlements, a global organisation of central banks that is based in Basel, Switzerland, released data last week showing just how dangerous China's debt bubble was becoming.

The BIS said China's credit-to-gross-domestic-product gap stood at 30.1%, the highest of any country since data was collected in 1995.

The measure describes how fast credit has been growing in a country, and it is an early warning signal for financial crises. It displays the difference between a country's debt-to-GDP ratio and the long-term trend. The BIS said anything above 10% needed attention.

NOW WATCH: Self-made millionaire reveals the biggest money mistake you might be making

See Also:

There are 4 cities in China that show how the country has a dangerous property bubble

'Many clients have asked us for a Big Short-type trade regarding China'

SEE ALSO: The first really meaningful and massive Chinese bankruptcy has arrived

Yahoo Finance

Yahoo Finance