Key Factors to Impact JLL's Performance This Earnings Season

Jones Lang LaSalle Inc. JLL, better known as JLL, is slated to report third-quarter 2019 results on Nov 5, before the market opens. The company is anticipated to display year-over-year growth in revenues, while earnings might display a decline.

In the last reported quarter, this Chicago, IL-headquartered global professional services and investment management firm specializing in real estate, delivered a 26.2% positive earnings surprise. Results highlighted robust Real Estate Services revenue growth.

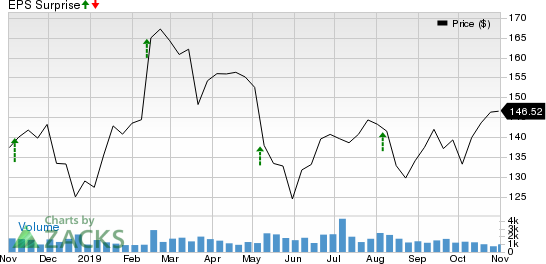

In fact, JLL has surpassed estimates in each of the trailing four quarters, the average positive beat being 28.07%. The graph below depicts this surprise history:

Jones Lang LaSalle Incorporated Price and EPS Surprise

Jones Lang LaSalle Incorporated price-eps-surprise | Jones Lang LaSalle Incorporated Quote

JLL is focused on balanced revenue growth across profitable markets. Additionally, its superior client services and strategic investment in technology and data capabilities offer a competitive advantage over the company’s peers. These are also anticipated to have helped boost its market share and win relationships. Significant capital availability and low interest rates are also likely to have aided the real estate market fundamentals.

In addition, JLL has banked on strategic acquisitions and gained strength to capitalize on an improving market environment. Notably, on Jul 1, JLL announced about its completion of HFF Inc.’s acquisition. This cash-and-stock transaction, valued at about $1.8 billion and first announced in March 2019, came as part of JLL’s effort to substantially boost its Capital Markets business.

Moreover, JLL’s Corporate Solutions business, which is the company’s multi-service outsourcing business, and includes integrated Facility Management and Corporate Solutions-related services from Leasing, Project & Development, as well as Advisory & Consulting, is well poised to capitalize on the favorable trends. In fact, amid rising trend of outsourcing of real estate needs by companies, new contract awards and expansion of services with existing clients are expected to have supported JLL’s performance in the quarter under review.

Amid these, the Zacks Consensus Estimate for third-quarter 2019 revenues is currently pegged at $4.35 billion, indicating projected growth of 9.6% year over year.

However, investment volumes are expected to have remained soft following a record 2018 as investors have adopted a cautious approach. Furthermore, trade tensions, political uncertainties and volatile equity markets might have added to the woes, affecting transaction levels. Moreover, though leasing demand is expected to have been robust, it might have declined slightly from the year ago levels.

However, JLL’s activities during the July-September quarter did not gain analysts’ confidence. The Zacks Consensus Estimate for third-quarter earnings remained unchanged over the last 30 days at $2.73. This also reflects an estimated decline of around 9.6% year over year.

Here is what our quantitative model predicts:

Our proven model does not conclusively predict a positive earnings surprise for JLL this season. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. But that’s not the case here. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Although JLL carries a Zacks Rank of 3, its Earnings ESP of -1.35% makes surprise prediction difficult.

Stocks That Warrant a Look

Here are a few stocks in the broader real sector that you may want to consider, as our model shows that these have the right combination of elements to report a positive surprise this quarter:

Paramount Group, Inc. PGRE, scheduled to release earnings on Nov 6, has an Earnings ESP of +1.41% and currently carries a Zacks Rank of 2. You can see the complete list of today’s Zacks #1 Rank stocks here.

Realty Income Corp. O, slated to report third-quarter results on Nov 4, has an Earnings ESP of +0.33% and holds a Zacks Rank of 2.

Senior Housing Properties Trust SNH, set to release quarterly numbers on Nov 7, has an Earnings ESP of +3.23% and carries a Zacks Rank of 2, currently.

7 Best Stocks for the Next 30 Days

Just released: Experts distill 7 elite stocks from the current list of 220 Zacks Rank #1 Strong Buys. They deem these tickers “Most Likely for Early Price Pops.”

Since 1988, the full list has beaten the market more than 2X over with an average gain of +24.5% per year. So be sure to give these hand-picked 7 your immediate attention.

See them now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Jones Lang LaSalle Incorporated (JLL) : Free Stock Analysis Report

Realty Income Corporation (O) : Free Stock Analysis Report

Paramount Group, Inc. (PGRE) : Free Stock Analysis Report

Senior Housing Properties Trust (SNH) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance