Another key signal that cash is dying out in Britain

Cash is dying out in Britain. And according to the latest figures on withdrawals from cash machine network Link, it looks like the trend is set to continue.

Link said in its latest report that the volume of cash withdrawals from ATMs massively fell year-on-year across all UK regions in the first four months of 2019 compared to a year earlier.

The sharpest declines were seen in Britain’s capital London at -8.7% where contactless card payment ability has been integrated into even the transport infrastructure. Other sharp declines were seen in the South East (-7.9%) and in the South West (-7.7%) where card and contactless payment ability is prolifically available.

It is perhaps unsurprising that the weakest declines were seen in regions that have more volume of rural communities, such as the the north east of England (-3.7%), Northern Ireland (-4.6%), and Scotland (-5.4%).

READ MORE: Millions of Brits will suffer in cashless society

In December last year, an independent review of consumer spending called Access to Cash warned that a cashless society would make eight million people suffer.

The report detailed how Britain risks “sleepwalking” into becoming a cashless society and that, in turn, creates huge problems for the millions of people who live in rural areas, have physical or mental health problems, the indebted, old people, and those in difficult or abusive relationships.

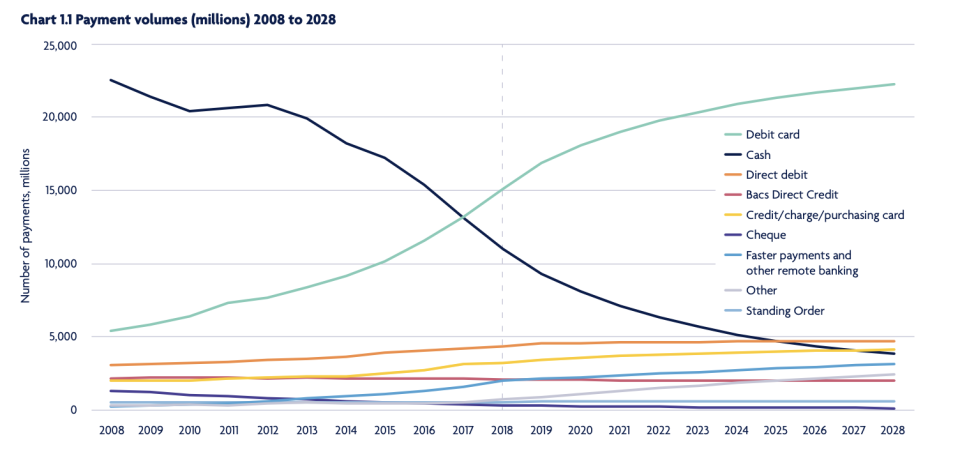

In 2017, the trade body for the UK banking and financial services sector UK Finance, revealed that debit card payments overtook cash as the most popular form of payment in Britain for the first time. In its latest report, UK Finance said “UK consumers are taking a ‘pick n mix’ approach to how they make payments, with mobile banking, mobile payments and contactless all becoming increasingly popular.”

“The growth in contactless and mobile payments has meant consumers are choosing to pay less with cash, with overall cash payments falling by 16% in 2018 and one in ten adults (5.4 million consumers) opting not to use cash at all,” it added.

Here is a breakdown of the regional declines in Link cash withdrawals in the first four months of 2019 versus a year earlier:

East Midlands: -5.9%

East of England: -6.4%

London: -8.7%

North East: -3.7%

North West: -6.4%

Northern Ireland: -4.6%

Scotland: -5.4%

South East: -7.9%

South West: -7.7%

Wales: -5.0%

West Midlands: -6.0%

Yorkshire and the Humber: -4.9%

Yahoo Finance

Yahoo Finance