Key Things To Consider Before Buying Catering International & Services Société Anonyme (EPA:CTRG) For Its Dividend

Today we'll take a closer look at Catering International & Services Société Anonyme (EPA:CTRG) from a dividend investor's perspective. Owning a strong business and reinvesting the dividends is widely seen as an attractive way of growing your wealth. If you are hoping to live on the income from dividends, it's important to be a lot more stringent with your investments than the average punter.

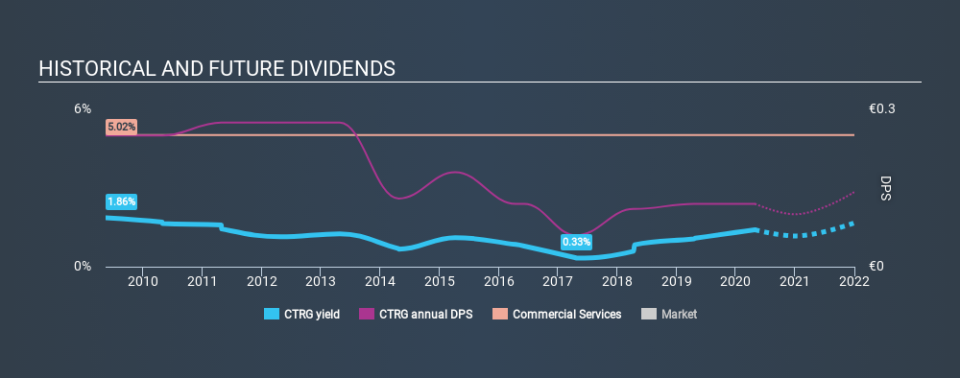

A slim 1.4% yield is hard to get excited about, but the long payment history is respectable. At the right price, or with strong growth opportunities, Catering International & Services Société Anonyme could have potential. The company also returned around 1.1% of its market capitalisation to shareholders in the form of stock buybacks over the past year. Remember that the recent share price drop will make Catering International & Services Société Anonyme's yield look higher, even though recent events might have impacted the company's prospects. Some simple research can reduce the risk of buying Catering International & Services Société Anonyme for its dividend - read on to learn more.

Click the interactive chart for our full dividend analysis

Payout ratios

Companies (usually) pay dividends out of their earnings. If a company is paying more than it earns, the dividend might have to be cut. Comparing dividend payments to a company's net profit after tax is a simple way of reality-checking whether a dividend is sustainable. In the last year, Catering International & Services Société Anonyme paid out 19% of its profit as dividends. Given the low payout ratio, it is hard to envision the dividend coming under threat, barring a catastrophe.

While the above analysis focuses on dividends relative to a company's earnings, we do note Catering International & Services Société Anonyme's strong net cash position, which will let it pay larger dividends for a time, should it choose.

Remember, you can always get a snapshot of Catering International & Services Société Anonyme's latest financial position, by checking our visualisation of its financial health.

Dividend Volatility

From the perspective of an income investor who wants to earn dividends for many years, there is not much point buying a stock if its dividend is regularly cut or is not reliable. Catering International & Services Société Anonyme has been paying dividends for a long time, but for the purpose of this analysis, we only examine the past 10 years of payments. Its dividend payments have declined on at least one occasion over the past ten years. During the past ten-year period, the first annual payment was €0.25 in 2010, compared to €0.12 last year. This works out to be a decline of approximately 7.1% per year over that time. Catering International & Services Société Anonyme's dividend has been cut sharply at least once, so it hasn't fallen by 7.1% every year, but this is a decent approximation of the long term change.

A shrinking dividend over a ten-year period is not ideal, and we'd be concerned about investing in a dividend stock that lacks a solid record of growing dividends per share.

Dividend Growth Potential

Given that dividend payments have been shrinking like a glacier in a warming world, we need to check if there are some bright spots on the horizon. Over the past five years, it looks as though Catering International & Services Société Anonyme's EPS have declined at around 3.9% a year. A modest decline in earnings per share is not great to see, but it doesn't automatically make a dividend unsustainable. Still, we'd vastly prefer to see EPS growth when researching dividend stocks.

Conclusion

When we look at a dividend stock, we need to form a judgement on whether the dividend will grow, if the company is able to maintain it in a wide range of economic circumstances, and if the dividend payout is sustainable. Firstly, we like that Catering International & Services Société Anonyme has a low and conservative payout ratio. Earnings per share are down, and Catering International & Services Société Anonyme's dividend has been cut at least once in the past, which is disappointing. While we're not hugely bearish on it, overall we think there are potentially better dividend stocks than Catering International & Services Société Anonyme out there.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. At the same time, there are other factors our readers should be conscious of before pouring capital into a stock. As an example, we've identified 4 warning signs for Catering International & Services Société Anonyme that you should be aware of before investing.

Looking for more high-yielding dividend ideas? Try our curated list of dividend stocks with a yield above 3%.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

Yahoo Finance

Yahoo Finance