Kimberly-Clark's (KMB) Saving Efforts Aid Amid Rising Costs

Kimberly-Clark Corporation KMB benefited from focusing on three key strategic growth pillars along with the K-C Strategy 2022. Strength in the company’s K-C Professional segment, which continued in the first quarter of 2022, has been a key driver. The consumer products company is undertaking vital steps to cut costs and enhance supply-chain productivity amid high input cost environment.

Let’s delve deeper.

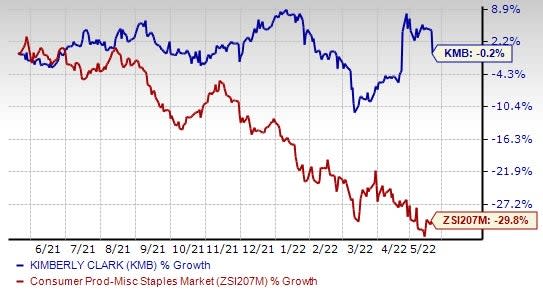

Image Source: Zacks Investment Research

Solid Sales Performance & Raised View

Kimberly-Clark’s top line increased year over year and surpassed the Zacks Consensus Estimate in the recently-released first-quarter 2022 results. Kimberly-Clark’s sales came in at $5,095 million, rising 7%. Organic sales rose 10%, with net selling prices increasing 6%, volumes growing 2% and product mix sales moving up 2 points. Sales increased across all the company’s reporting segments. In the Personal Care segment, sales increased 11%. Sales in the Consumer Tissue unit rose 4%. K-C Professional segment sales gained 4%.

During the first-quarter earnings release, management raised the 2022 net sales and organic sales views. Net sales in 2022 are now expected to grow 2-4% year over year. Earlier, the company expected the metric to rise 1-2% in 2022. Organic sales are now anticipated to increase 4-6%, up from the previous guidance of 3-4% growth. Management projects net selling prices to be higher. The recently-concluded Thinx buyout (in February 2022) will slightly increase sales.

Factors Working Well for Kimberly-Clark

Kimberly-Clark is committed to its three key strategic growth pillars. These include focus on improving its core business in the developed markets, speed up growth of the Personal Care segment in developing and emerging markets and enhancing digital and e-commerce capacities. The company expects to meet these objectives through product development across different categories and leveraging capabilities in marketing and sales. The company has been progressing well with these objectives, which have been aiding its portfolio and expanding global business. In October 2020, Kimberly-Clark completed the acquisition of Softex Indonesia — a leading player in the Indonesian personal care market. In February 2022, Kimberly-Clark acquired a majority stake in Thinx, Inc. — the pioneer in the reusable period and incontinence underwear category. The investment in Thinx is in tandem with Kimberly-Clark’s intentions to create a portfolio of period and light bladder leakage solutions. The move will allow Kimberly-Clark to accelerate category growth with its retail partners.

Kimberly-Clark's K-C Strategy 2022, which was introduced in January 2019, bodes well. The strategy is focused on generating balanced and sustainable growth to return value to shareholders in a tough environment. The program also concentrates on strengthening the company’s brand portfolio, undertaking efficient capital allocation and executing robust cost discipline.

Will Cost Hurdles be Countered?

Kimberly-Clark has been battling high input costs for the past few quarters. The trend persisted in the first quarter of 2022, with a gross margin of 29.8%, which contracted 420 basis points compared with the year-ago quarter’s adjusted gross margin. The metric was hurt by significant and more-than-anticipated input cost inflation. Adjusted operating profit amounted to $629 million, down from $804 million in the year-ago quarter. The upside can be attributed to a rise in input costs to the tune of $470 million. An increase in pulp and polymer-based materials, distribution and energy costs led to a rise in input costs. Escalated marketing, research and general expenses and unfavorable foreign currency also affected operating profit.

Management expects adjusted operating profit to be down low to mid-single digits percent in 2022. Key input costs are estimated to escalate by $1.1-$1.3 billion in 2022, up from the initial expectation of $750-$900 million. Management expects costs to rise or remain escalated for most inputs like polymer-based materials and pulp and distribution and energy.

While input costs are expected to flare up in 2022, management is focused on undertaking relevant pricing actions to counter inflation and efficiently manage costs. The Zacks Rank #3 (Hold) company is aggressively cutting costs and enhancing supply-chain productivity through the Focus on Reducing Costs Everywhere or FORCE Program. During the first quarter, the company generated savings of $50 million from the FORCE program.

KMB’s shares have dipped 0.2% in the past year, outperforming the industry’s decline of 29.8%.

3 Solid Staple Stocks

Some better-ranked stocks are Pilgrim’s Pride PPC, Sysco Corporation SYY and Medifast MED.

Pilgrim’s Pride, which produces, processes, markets and distributes fresh, frozen and value-added chicken and pork products, sports a Zacks Rank #1 (Strong Buy). PPC has a trailing four-quarter earnings surprise of 31.4%, on average. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Pilgrim’s Pride’s current financial year earnings per share (EPS) suggests growth of 42.1% from the year-ago reported number.

Sysco, which engages in the marketing and distribution of various food and related products, sports a Zacks Rank #1. SYY has a trailing four-quarter earnings surprise of 9.1%, on average.

The Zacks Consensus Estimate for Sysco’s current financial year sales and EPS suggests growth of 32.6% and 122.9%, respectively, from the year-ago reported number.

Medifast, which manufactures and distributes weight loss, weight management, healthy living products and other consumable health and nutritional products, currently carries a Zacks Rank #2 (Buy). MED has a trailing four-quarter earnings surprise of 12.9%, on average.

The Zacks Consensus Estimate for Medifast’s current financial year sales and EPS suggests growth of almost 19% and 11.5%, respectively, from the year-ago reported figure.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

KimberlyClark Corporation (KMB) : Free Stock Analysis Report

Sysco Corporation (SYY) : Free Stock Analysis Report

Pilgrim's Pride Corporation (PPC) : Free Stock Analysis Report

MEDIFAST INC (MED) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance