The Kin and Carta (LON:KCT) Share Price Is Up 77% And Shareholders Are Holding On

By buying an index fund, you can roughly match the market return with ease. But if you buy good businesses at attractive prices, your portfolio returns could exceed the average market return. For example, the Kin and Carta plc (LON:KCT) share price is up 77% in the last three years, clearly besting the market decline of around 11% (not including dividends). However, more recent returns haven't been as impressive as that, with the stock returning just 40% in the last year.

View our latest analysis for Kin and Carta

Given that Kin and Carta didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

Kin and Carta actually saw its revenue drop by 0.2% per year over three years. The revenue growth might be lacking but the share price has gained 21% each year in that time. Unless the company is going to make profits soon, we would be pretty cautious about it.

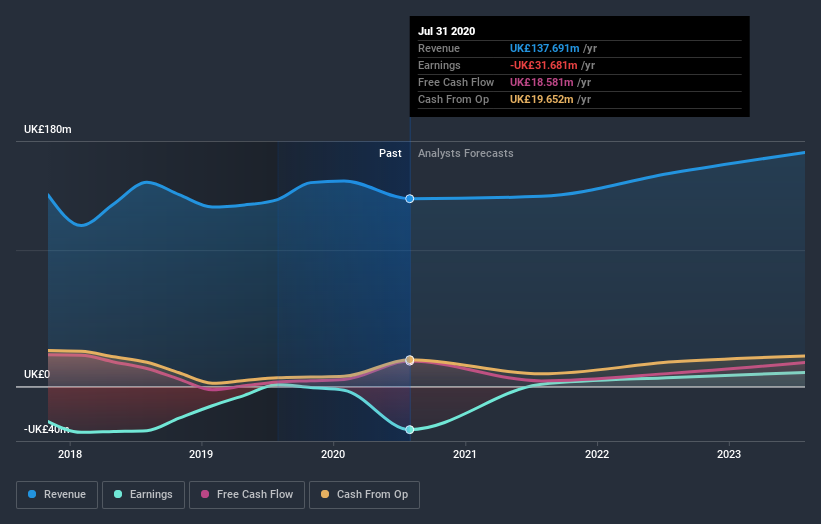

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

What about the Total Shareholder Return (TSR)?

We'd be remiss not to mention the difference between Kin and Carta's total shareholder return (TSR) and its share price return. The TSR attempts to capture the value of dividends (as if they were reinvested) as well as any spin-offs or discounted capital raisings offered to shareholders. Dividends have been really beneficial for Kin and Carta shareholders, and that cash payout contributed to why its TSR of 84%, over the last 3 years, is better than the share price return.

A Different Perspective

It's good to see that Kin and Carta has rewarded shareholders with a total shareholder return of 40% in the last twelve months. That certainly beats the loss of about 5% per year over the last half decade. The long term loss makes us cautious, but the short term TSR gain certainly hints at a brighter future. It's always interesting to track share price performance over the longer term. But to understand Kin and Carta better, we need to consider many other factors. For instance, we've identified 1 warning sign for Kin and Carta that you should be aware of.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on GB exchanges.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

Yahoo Finance

Yahoo Finance