Kin and Carta's (LON:KCT) Shareholders Are Down 72% On Their Shares

Generally speaking long term investing is the way to go. But unfortunately, some companies simply don't succeed. To wit, the Kin and Carta plc (LON:KCT) share price managed to fall 72% over five long years. We certainly feel for shareholders who bought near the top. We also note that the stock has performed poorly over the last year, with the share price down 54%. Even worse, it's down 22% in about a month, which isn't fun at all.

Check out our latest analysis for Kin and Carta

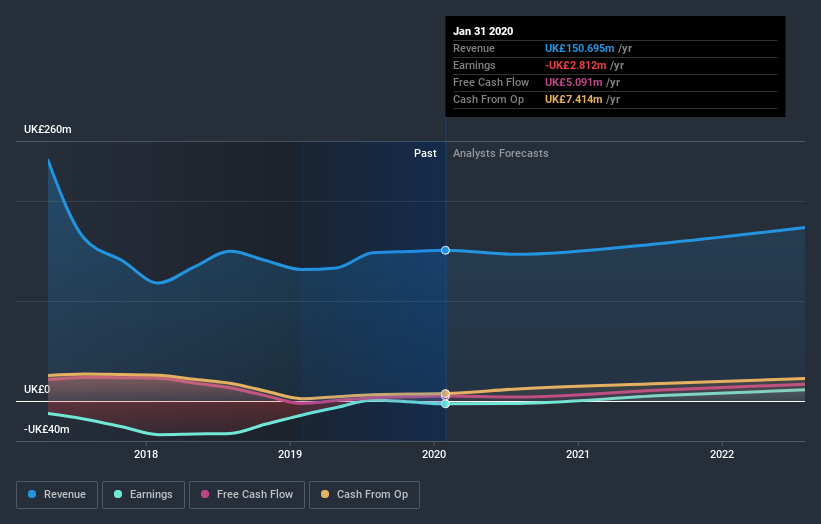

Kin and Carta isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. When a company doesn't make profits, we'd generally expect to see good revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

In the last five years Kin and Carta saw its revenue shrink by 25% per year. That puts it in an unattractive cohort, to put it mildly. So it's not that strange that the share price dropped 11% per year in that period. We don't think this is a particularly promising picture. Ironically, that behavior could create an opportunity for the contrarian investor - but only if there are good reasons to predict a brighter future.

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

If you are thinking of buying or selling Kin and Carta stock, you should check out this FREE detailed report on its balance sheet.

What about the Total Shareholder Return (TSR)?

We've already covered Kin and Carta's share price action, but we should also mention its total shareholder return (TSR). The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Dividends have been really beneficial for Kin and Carta shareholders, and that cash payout explains why its total shareholder loss of 68%, over the last 5 years, isn't as bad as the share price return.

A Different Perspective

While the broader market lost about 12% in the twelve months, Kin and Carta shareholders did even worse, losing 53%. Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 11% per year over five years. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Case in point: We've spotted 2 warning signs for Kin and Carta you should be aware of.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on GB exchanges.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

Yahoo Finance

Yahoo Finance