Kinross Gold Is Betting on the Great Bear Project

On Feb. 14, Toronto-based Kinross Gold Corp. (NYSE:KGC) reported its fourth-quarter and full-year 2023 results.

Kinross Gold is one of my top four long-term gold miners, alongside Newmont (NYSE:NEM), Agnico Eagle (NYSE:AEM) and Barrick Gold (NYSE:GOLD). These companies should be the first choice for the average investor looking to make a long-term investment in gold.

Agnico Eagle and Kinross Gold outperformed the VanEck Gold Miner ETF (GDX), rising 14.30% and 38.10% year over year, while the exchange-traded fund fell 1.60%. Barrick Gold and Newmont, on the other hand, have continued to underperform, falling 11.70% and 24.80% in a single year.

Gold rose today, closing at $2,190 per ounce. However, the U.S. Core Personal Consumption Expenditures Price Index (PCE) data for February is due on Friday and could be a significant indicator. Gold is currently bullish, with analysts forecasting a 70% chance of a rate cut in June. Conversely, high gold prices may reduce demand, particularly in India, where imports fell by 90% in March.

Operations

Kinross has six producing mines and two major advanced projects: the Great Bear in Canada and the smaller Manh Choh project in Alaska (70% owned), both of which have near-term production potential.

The two most important mines are Paracatu in Brazil and Tasiast in Mauritania. Tasiast is regarded as relatively safe in the region due to its location on the coast, far from the Mali border. The company has now completed the construction of a 34-megawatt solar power plant and, despite its lower grade, it expects high output in 2024.

Paracatu had a strong 2023, but costs are expected to be higher, so gold production will likely be lower in 2024.

Finally, La Coipa in Chile is expected to have a strong production this year, while the U.S. operations at Bald Mountain, Round Mountain and Fort Knox are all doing well. Fort Knox is on track to finish the mill modification for the Man Choh project, which is expected to be completed in the second half of the year.

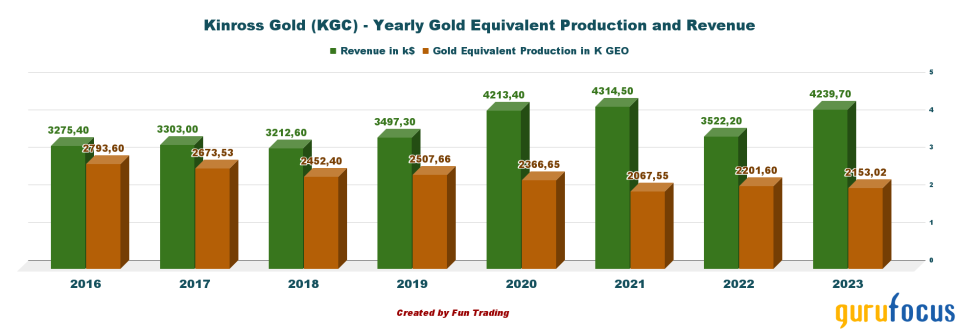

2023 gold production was 2,153,020 ounces, up from 2,201,599 ounces the year prior, which included the sale of the Kupol mine in the second quarter of 2022. In addition, revenue in 2022 may vary slightly due to the quarterly results being restated.

The Great Bear and Manh Choh projects

The Great Bear Project is the company's largest operation and is scheduled to be completed by 2027. Exploration in 2023 added significant measured and indicated mineral resources, now reaching 2.81 million ounces. The increase was primarily due to underground growth at the 500- to 1,000-meter level.

The project was acquired in February 2022 and is regarded as having high potential to become a top-tier deposit that will boost the company's future production.

CEO Paul Rollinson said during the conference call:

"At Great Bear, we continue to make excellent progress. Looking back to the time of the acquisition just two years ago, we started with no declared resources. Today, we have approximately 2.8 million ounces of high-grade M&I and an incremental 3.3 million of high-grade inferred ounces."

Further, the 70%-owned Manh Choh Project in Alaska is on track for first production in the second half of the year. The project is expected to boost the company's production profile in Alaska by approximately 640,000 attributable gold equivalent ounces, while lowering costs over the mine's lifetime. Manh Choh's initial production is expected in the second half of 2024. The Manh Choh ore will be processed at Fort Knox's mill, which has been modified to accommodate the increased capacity.

Fourth-quarter results snapshot

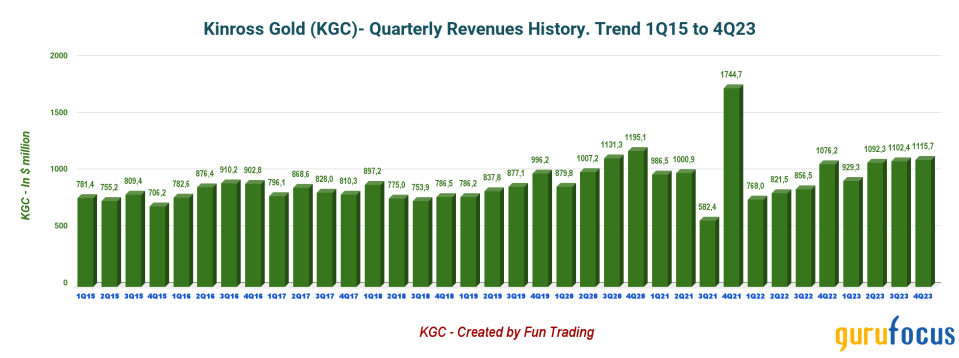

Revenue in the fourth quarter of 2023 was $1.11 billion with net income of $65.40 million, or 5 cents per diluted share. The adjusted net earnings of $140 million, or 11 cents, exceeded analysts' expectations.

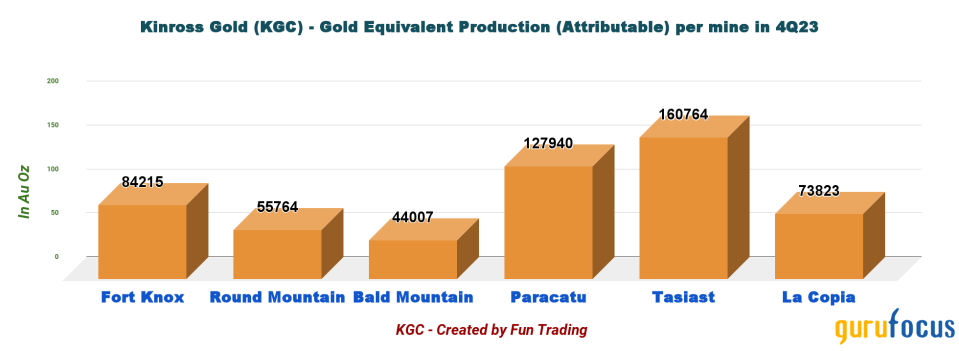

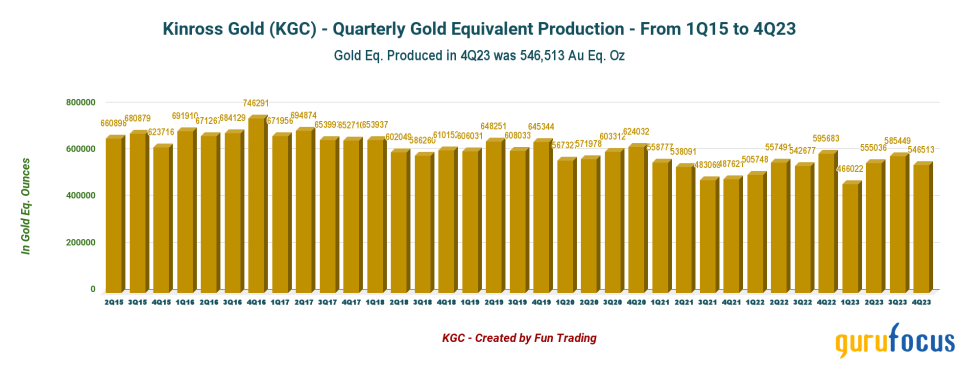

In the fourth quarter, production was 546,513 gold equivalent ounces, an 8.25% decrease from the previous year, with sales of 565,389 gold equivalent ounces. Kinross Gold indicated production of 1,957,237 gold equivalent ounces for 2022, omitting the production of Kupol Mine in Russia, which was sold in the second quarter of that year.

If we compare production per mine, we can see that production at Paracatu is declining significantly. This trend is likely to continue in 2024.

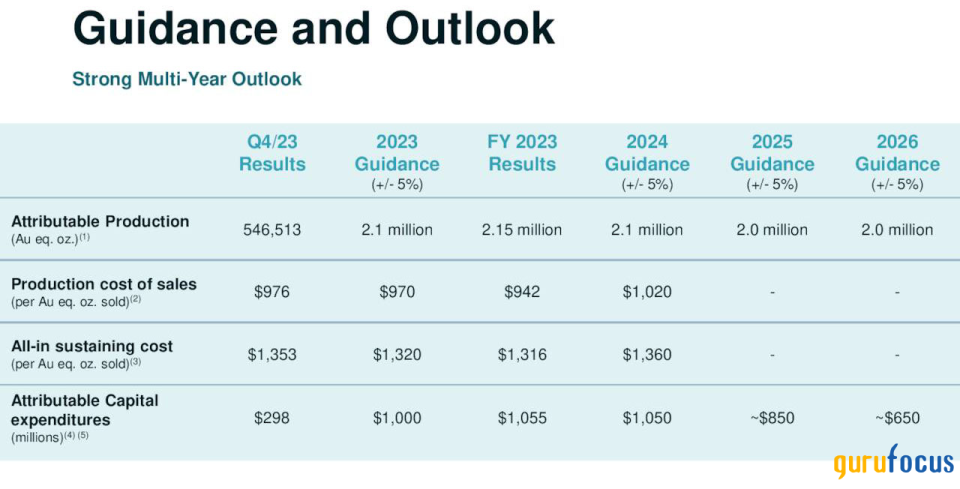

The company expects its 2024 production to be approximately 2.10 million gold equivalent ounces, dropping slightly to 2 million in 2025 and 2026.

Source: Kinross Gold presentation.

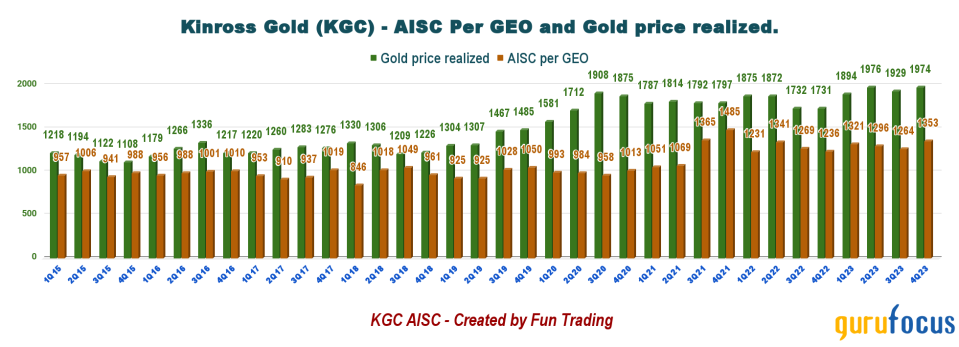

The realized gold price was $1,974 per ounce sold, and the all-in sustaining cost was $1,353. Production in 2023 met expectations. The AISC remains well above $1,300 per ounce and is expected to remain high until 2026.

Hopefully, the company will be able to reduce its AISC below $1,300 per ounce by 2025 due to production from Manh Choh in Alaska and lower energy costs at Tasiast.

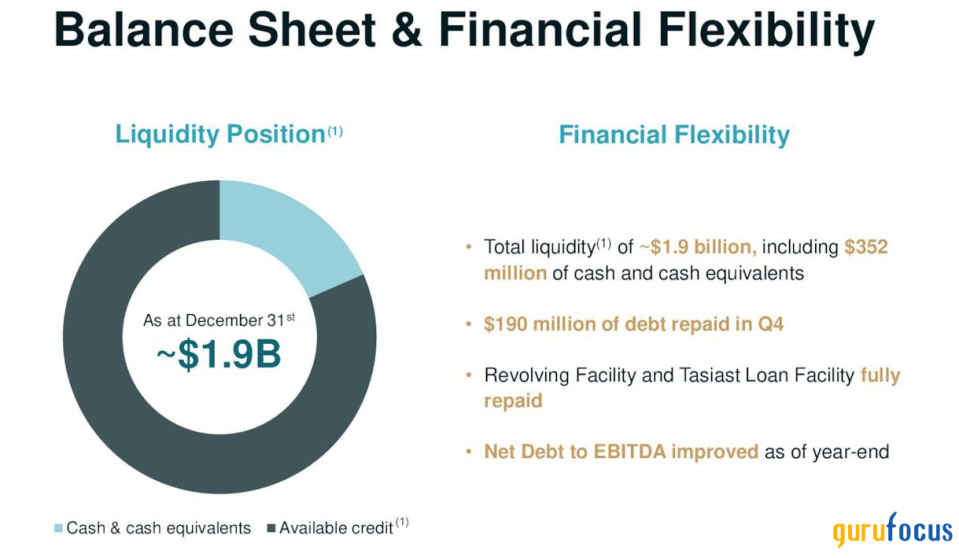

As of December, cash and cash equivalents were $352.40 million and total liquidity was approximately $1.90 billion. Long-term debt, including current, is now $2.23 billion. The net debt is now $1.88 billion and continues to go down.

Source: Kinross Gold presentation.

During the conference call, Chief Financial Officer Andrea Freeborough said:

"We aimed to further delever our balance sheet in 2024, as we plan to allocate excess free cash generated this year, against the 2025 term loan. The term loan will be re-classified to current in our Q1 financials given its maturity in March 2025."

Kinross' board of directors also declared a quarterly dividend of 3 cents per common share for the fourth quarter.

Rollinson also noted during the conference call:

"We have a strong 2023, and successfully delivered on our targets and are well-positioned for another strong year ahead. Our operations are performing well. Our projects are advancing on schedule and on budget. Our exploration program, is delivering value. We are generating substantial free cash flow, and our balance sheet is in excellent condition, and continues to deliver."

Finally, trailing 12-month free cash flow was $392.90 million. The company had a free cash flow of $75.30 million for the quarter. I expect free cash flow to climb substantially in 2024 with gold prices now around $2,200 per ounce.

Technical analysis and commentary

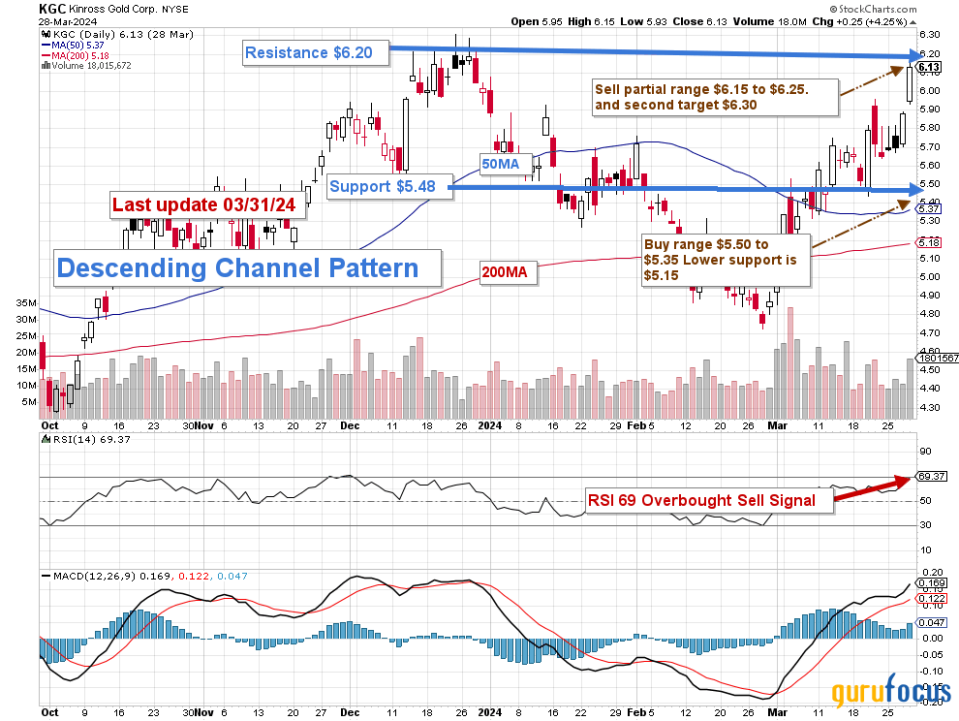

Note: The chart is adjusted for the dividend.

Shares of Kinross Gold follow a descending channel pattern, with resistance at $6.20 and support at $5.48.

Descending channel patterns are bearish formations that typically result in a bullish breakout. Kinross moves slowly and can be tedious for action traders.

I recommend trading short-term LIFO for about 50% and maintaining a core long-term position with a final target of $7 or higher. The gold price is now around $2,200 per ounce, and the next quarter's earnings should be a good catalyst for a significant breakout.

I recommend selling roughly half of your position between $6.15 and $6.25, with possible upper resistance at $6.30, and buying the stock between $5.50 and $5.35, with potential lower support at $5.15.

Trading LIFO allows you to keep your old position, typically underwater in Kinross' case, while trading your most recent position for a profit without selling your long position at an unnecessary loss. You never sell LIFO for a loss; instead, you sell for a profit of 3% to 10% depending on your strategy and available cash.

Repeating this exercise can provide a steady income, allowing you to derisk your long-term position.

Warning: To remain relevant, the technical chart must be updated regularly.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance