KKR Stock Up on Q1 Earnings Beat, Planned Structural Changes

Shares of KKR & Co. L.P. KKR gained nearly 7% since the release of its first-quarter 2018 earnings last week. The company’s economic net income per unit of 42 cents handily surpassed the Zacks Consensus Estimate of 19 cents. However, the bottom line deteriorated 35% from the prior-year quarter.

Apart from the earnings beat, KKR’s decision to change its business structure also cheered investors. The company approved the plan to convert from a partnership to a corporation, effective July 1, 2018.

Following this change, KKR intends to pay an annualized dividend of 50 cents per share. Also, the company announced a rise in its share repurchase authorization to $500 million, effective immediately.

Results primarily reflected drastic decline in expenses and impressive growth in assets under management (AUM). However, lower revenues acted as a headwind.

Net income attributable to KKR for the quarter was $178.4 million or 32 cents per unit, down from $267.7 million or 52 cents per unit in the year-ago quarter.

Revenues & Expenses Decrease, AUM Improves

Total revenues (GAAP basis) amounted to $472.6 million, plunging 38% on a year-over-year basis. The fall was largely due to a lower level of carried interest gains.

Total operating expenses declined 19% from the prior-year quarter to $436.6 million. The fall was mainly due to lower compensation & benefits costs.

As of Mar 31, 2018, total AUM grew 28% year over year to $176.4 billion. Also, fee-paying AUM summed $119.7 billion, improving 12% from the Mar 31, 2017 figure.

Our Viewpoint

KKR will continue exploiting lucrative investment opportunities on the back of its efficient fund-raising capability, in the quarters ahead. However, due to the company’s continuous expansion of its global footprint, expenses are anticipated to remain elevated. Further, the company’s revenues are expected to remain muted in the near term.

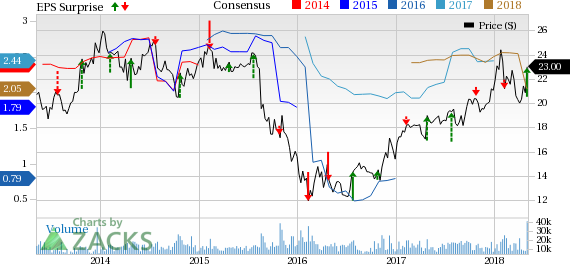

KKR & Co. L.P. Price, Consensus and EPS Surprise

KKR & Co. L.P. Price, Consensus and EPS Surprise | KKR & Co. L.P. Quote

Currently, KKR carries a Zacks Rank #5 (Strong Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performance of Other Investment Managers

BlackRock’s BLK first-quarter 2018 adjusted earnings came in at $6.70 per share, which handily outpaced the Zacks Consensus Estimate of $6.42. Results benefited from an improvement in revenues, rise in AUM and steady long-term inflows. However, increase in operating expenses acted as a headwind.

The Blackstone Group L.P. BX reported first-quarter 2018 economic net income of 65 cents per share, which handily surpassed the Zacks Consensus Estimate of 46 cents. The quarter saw an improvement in AUM, mainly driven by inflows. However, lower revenues and a rise in expenses were the undermining factors.

Ameriprise Financial Inc.’s AMP first-quarter 2018 adjusted operating earnings per share of $3.70 comfortably surpassed the Zacks Consensus Estimate of $3.47. Results benefited from an improvement in revenues. Also, growth in AUM and assets under administration supported earnings. However, a rise in expenses was an undermining factor.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ameriprise Financial, Inc. (AMP) : Free Stock Analysis Report

The Blackstone Group L.P. (BX) : Free Stock Analysis Report

BlackRock, Inc. (BLK) : Free Stock Analysis Report

KKR & Co. L.P. (KKR) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance