Need To Know: Analysts Are Much More Bullish On Atomos Limited (ASX:AMS)

Shareholders in Atomos Limited (ASX:AMS) may be thrilled to learn that the analysts have just delivered a major upgrade to their near-term forecasts. The analysts have sharply increased their revenue numbers, with a view that Atomos will make substantially more sales than they'd previously expected. Investors have been pretty optimistic on Atomos too, with the stock up 35% to AU$0.71 over the past week. It will be interesting to see if today's upgrade is enough to propel the stock even higher.

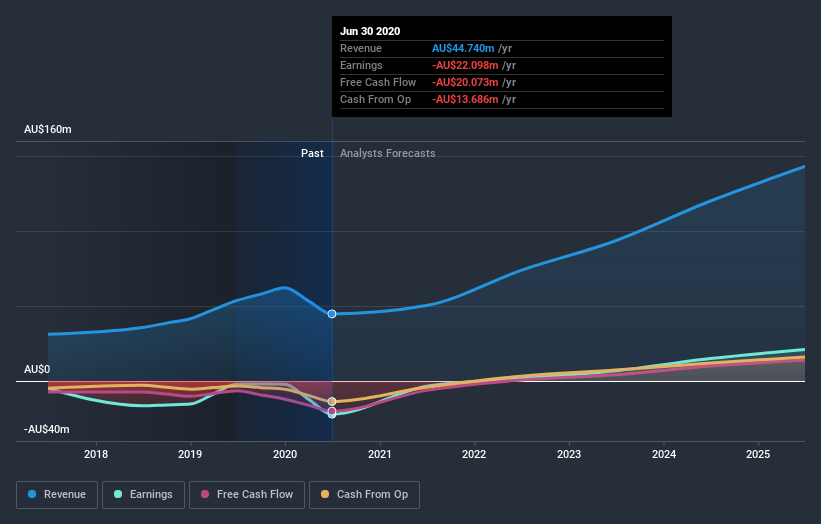

After this upgrade, Atomos' three analysts are now forecasting revenues of AU$50m in 2021. This would be a decent 12% improvement in sales compared to the last 12 months. Prior to the latest estimates, the analysts were forecasting revenues of AU$42m in 2021. The consensus has definitely become more optimistic, showing a solid increase in revenue forecasts.

See our latest analysis for Atomos

One way to get more context on these forecasts is to look at how they compare to both past performance, and how other companies in the same industry are performing. We would highlight that Atomos' revenue growth is expected to slow, with forecast 12% increase next year well below the historical 19% p.a. growth over the last three years. By way of comparison, the other companies in this industry with analyst coverage are forecast to grow their revenue at 8.7% next year. Even after the forecast slowdown in growth, it seems obvious that Atomos is also expected to grow faster than the wider industry.

The Bottom Line

The highlight for us was that analysts increased their revenue forecasts for Atomos this year. Analysts also expect revenues to grow faster than the wider market. With a serious upgrade to expectations, it might be time to take another look at Atomos.

Better yet, Atomos is expected to break-even soon - within the next few years - according to analyst forecasts, which would be a momentous event for shareholders. You can learn more about these forecasts, for free on our platform here.

Another way to search for interesting companies that could be reaching an inflection point is to track whether management are buying or selling, with our free list of growing companies that insiders are buying.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

Yahoo Finance

Yahoo Finance