What To Know Before Buying Fountain Set (Holdings) Limited (HKG:420) For Its Dividend

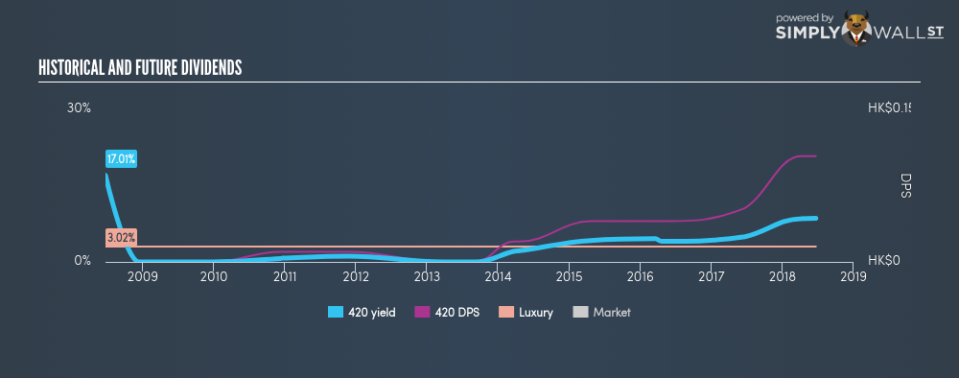

Dividends can be underrated but they form a large part of investment returns, playing an important role in compounding returns in the long run. Over the past 10 years, Fountain Set (Holdings) Limited (HKG:420) has returned an average of 3.00% per year to shareholders in terms of dividend yield. Does Fountain Set (Holdings) tick all the boxes of a great dividend stock? Below, I’ll take you through my analysis. Check out our latest analysis for Fountain Set (Holdings)

5 questions to ask before buying a dividend stock

If you are a dividend investor, you should always assess these five key metrics:

Is their annual yield among the top 25% of dividend payers?

Does it consistently pay out dividends without missing a payment of significantly cutting payout?

Has the amount of dividend per share grown over the past?

Does earnings amply cover its dividend payments?

Based on future earnings growth, will it be able to continue to payout dividend at the current rate?

Does Fountain Set (Holdings) pass our checks?

The company currently pays out 79.90% of its earnings as a dividend, according to its trailing twelve-month data, which means that the dividend is covered by earnings. Furthermore, analysts have not forecasted a dividends per share for the future, which makes it hard to determine the yield shareholders should expect, and whether the current payout is sustainable, moving forward.

If there’s one type of stock you want to be reliable, it’s dividend stocks and their stable income-generating ability. Whilst its per-share payments have increased during the past 10 years, there has been some hiccups. Shareholders would have seen a few years of reduced payments in this time.

Compared to its peers, Fountain Set (Holdings) has a yield of 8.60%, which is high for Luxury stocks.

Next Steps:

With this in mind, I definitely rank Fountain Set (Holdings) as a strong dividend stock, and makes it worth further research for anyone who likes steady income generation from their portfolio. Given that this is purely a dividend analysis, I urge potential investors to try and get a good understanding of the underlying business and its fundamentals before deciding on an investment. There are three fundamental aspects you should further research:

Future Outlook: What are well-informed industry analysts predicting for 420’s future growth? Take a look at our free research report of analyst consensus for 420’s outlook.

Historical Performance: What has 420’s returns been like over the past? Go into more detail in the past track record analysis and take a look at the free visual representations of our analysis for more clarity.

Other Dividend Rockstars: Are there better dividend payers with stronger fundamentals out there? Check out our free list of these great stocks here.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.

Yahoo Finance

Yahoo Finance