Do You Know What CLS Holdings plc’s (LON:CLI) P/E Ratio Means?

This article is written for those who want to get better at using price to earnings ratios (P/E ratios). We’ll show how you can use CLS Holdings plc’s (LON:CLI) P/E ratio to inform your assessment of the investment opportunity. CLS Holdings has a price to earnings ratio of 7.74, based on the last twelve months. That means that at current prices, buyers pay £7.74 for every £1 in trailing yearly profits.

Check out our latest analysis for CLS Holdings

Want to help shape the future of investing tools and platforms? Take the survey and be part of one of the most advanced studies of stock market investors to date.

How Do You Calculate A P/E Ratio?

The formula for price to earnings is:

Price to Earnings Ratio = Share Price ÷ Earnings per Share (EPS)

Or for CLS Holdings:

P/E of 7.74 = £2.25 ÷ £0.29 (Based on the trailing twelve months to June 2018.)

Is A High Price-to-Earnings Ratio Good?

A higher P/E ratio implies that investors pay a higher price for the earning power of the business. That is not a good or a bad thing per se, but a high P/E does imply buyers are optimistic about the future.

How Growth Rates Impact P/E Ratios

Companies that shrink earnings per share quickly will rapidly decrease the ‘E’ in the equation. Therefore, even if you pay a low multiple of earnings now, that multiple will become higher in the future. A higher P/E should indicate the stock is expensive relative to others — and that may encourage shareholders to sell.

CLS Holdings shrunk earnings per share by 29% over the last year. But EPS is up 10% over the last 5 years.

How Does CLS Holdings’s P/E Ratio Compare To Its Peers?

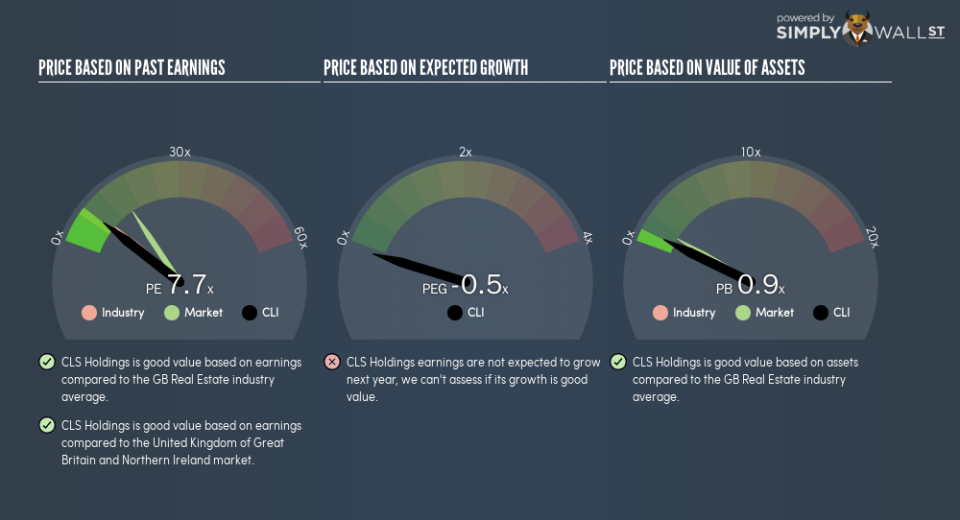

We can get an indication of market expectations by looking at the P/E ratio. We can see in the image below that the average P/E (8.9) for companies in the real estate industry is higher than CLS Holdings’s P/E.

Its relatively low P/E ratio indicates that CLS Holdings shareholders think it will struggle to do as well as other companies in its industry classification. While current expectations are low, the stock could be undervalued if the situation is better than the market assumes. If you consider the stock interesting, further research is recommended. For example, I often monitor director buying and selling.

A Limitation: P/E Ratios Ignore Debt and Cash In The Bank

It’s important to note that the P/E ratio considers the market capitalization, not the enterprise value. Thus, the metric does not reflect cash or debt held by the company. Hypothetically, a company could reduce its future P/E ratio by spending its cash (or taking on debt) to achieve higher earnings.

Spending on growth might be good or bad a few years later, but the point is that the P/E ratio does not account for the option (or lack thereof).

Is Debt Impacting CLS Holdings’s P/E?

CLS Holdings’s net debt is 91% of its market cap. This is enough debt that you’d have to make some adjustments before using the P/E ratio to compare it to a company with net cash.

The Verdict On CLS Holdings’s P/E Ratio

CLS Holdings has a P/E of 7.7. That’s below the average in the GB market, which is 15.6. When you consider that the company has significant debt, and didn’t grow EPS last year, it isn’t surprising that the market has muted expectations.

Investors should be looking to buy stocks that the market is wrong about. If it is underestimating a company, investors can make money by buying and holding the shares until the market corrects itself. So this free visualization of the analyst consensus on future earnings could help you make the right decision about whether to buy, sell, or hold.

But note: CLS Holdings may not be the best stock to buy. So take a peek at this free list of interesting companies with strong recent earnings growth (and a P/E ratio below 20).

To help readers see past the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price-sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned. For errors that warrant correction please contact the editor at editorial-team@simplywallst.com.

Yahoo Finance

Yahoo Finance