Knowles' (KN) Q2 Earnings Beat Estimates, Revenues Miss

Knowles Corporation KN reported mixed second-quarter 2022 results, wherein the bottom line beat the Zacks Consensus Estimate but the top line missed the same.

The company is focused on delivering high-value, differentiated solutions to a diverse set of growing end markets to expand its gross margin.

Net Income

On a GAAP basis, the loss in the quarter was $242.9 million or loss of $2.64 per share against a net income of $17.6 million or 19 cents per share in the prior-year quarter.

Non-GAAP net income was $ 31.7 million or 33 cents per share compared with $30.1 million or 31 cents per share in the year-ago quarter. The bottom line beat the Zacks Consensus Estimate by 2 cents.

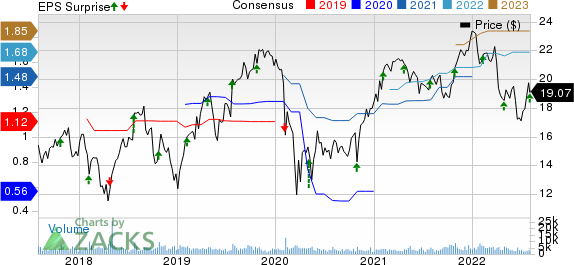

Knowles Corporation Price, Consensus and EPS Surprise

Knowles Corporation price-consensus-eps-surprise-chart | Knowles Corporation Quote

Revenues

Due to macroeconomic headwinds, quarterly revenues fell 5.9% year over year to $188 million. The top line missed the consensus estimate of $200 million.

Audio revenues fell 14.2% year over year to $128.5 million due to weak computing and mobile market demand and supply chain headwinds. The segment’s gross profit was $50.4 million compared with $63.3 million in the prior-year quarter. This was due to COVID lockdowns in China and excess PC and smartphone channel inventory.

Precision Devices revenues jumped 19% to $59.5 million, driven by strong organic growth in defense, industrial and medtech markets. Gross profit was $27.7 million compared with $20.8 million in the year-ago quarter.

Other Details

Cost of goods sold decreased to $110.3 million from $116.1 million year over year. Gross profit declined to $77.7 million from $83.7 million for a margin of 41.3% and 41.9%, respectively. Total operating expenses were $292.3 million compared with $61.4 million in the prior-year quarter. Operating loss came in at $214.6 million against an operating income of $22.3 million a year ago.

Cash Flow & Liquidity

During the first six months of 2022, Knowles generated $ 20.4 million from operating activities compared with $61 million in the prior-year period. As of Jun 30, 2022, the company had $47.7 million in cash and cash equivalents with $73 million of long-term debt.

Q3 Outlook

Knowles has guided for the third quarter. The company is accelerating its strategy to reduce exposure to lower-margin commodity microphones. It expects non-GAAP revenues in the range of $170-$185 million. Non-GAAP gross profit margin is estimated within 37-39%. Non-GAAP earnings are projected in the band of 17-21 cents per share.

Zacks Rank & Stocks to Consider

Knowles currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Lemonade, Inc. LMND, sporting a Zacks Rank #1, delivered an earnings surprise of 4.6%, on average, in the trailing four quarters. Over the past year, the stock has fallen 76.7%.

Earnings estimates for the current year have moved down 41.7% since August 2021. Lemonade’s primary strategy is to provide insurance products in the U.S. and Europe.

Celsius Holdings, Inc. CELH, sporting a Zacks Rank #1, is another key pick for investors. It delivered an earnings surprise of 200% in the previous quarter and a stellar earnings surprise of 206.25%, on average, in the trailing four quarters. Celsius develops, markets, distributes and sells functional drinks and liquid supplements in North America, Europe, Asia and internationally.

Earnings estimates for the current year have moved up 23.7% since August 2021.

Delek US Holdings, Inc. DK sports a Zacks Rank #1. The Zacks Consensus Estimate for Delek’s current-year earnings has been revised 3239.1% upward since August 2021.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance