Kohl's (KSS) Stock Declines on Q4 Loss & Sluggish Revenues

Kohl's Corporation KSS posted drab fourth-quarter fiscal 2022 results as both the top and bottom lines declined year over year and fell short of the Zacks Consensus Estimate. Results reflect pressure on sales due to the inflationary landscape and the company’s actions to better place its business for 2023. Shares of the company fell more than 7% during the pre-market trading session on Mar 1.

For the full-year 2023, Kohl’s expects net sales to decline 2-4%, which includes the impact of a 53rd week. The operating margin is likely to be about 4%. Earnings per share (EPS), excluding non-recurring charges, are envisioned in the band of $2.10-$2.70 compared to the adjusted loss of 15 cents reported in fiscal 2022.

Quarter in Detail

Kohl's posted an adjusted loss of $2.49 per share against the adjusted EPS of $2.20 reported in the year-ago period. The bottom line came way below the Zacks Consensus Estimate of earnings of $1.03 and our estimate of 94 cents.

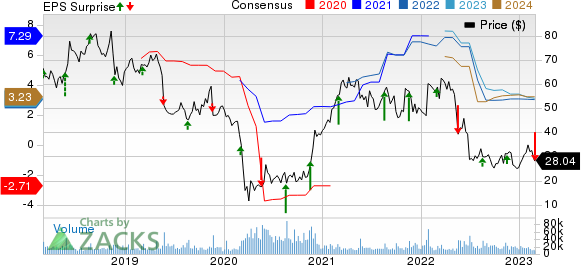

Kohl's Corporation Price, Consensus and EPS Surprise

Kohl's Corporation price-consensus-eps-surprise-chart | Kohl's Corporation Quote

Total revenues came in at $6,019 million, down from the prior-year quarter’s level of $6,499 million. The metric also missed the Zacks Consensus Estimate of $6,226 million and our estimate of $6,226.8 million. Net sales dipped 7.2% year over year, and comparable sales or comps decreased by 6.6%.

Kohl's gross margin contracted 1,016 basis points (bps) to 23% in the reported quarter due to clearance markdowns and product cost inflation. SG&A expenses fell by 0.6% to $1,677 million. As a percentage of total revenues, SG&A expenses expanded 190 basis points to 27.9%. The company reported an operating loss of $302 million against the operating income of $450 million in the year-ago period.

Other Financial Details

Kohl’s ended the quarter with cash and cash equivalents of $153 million, long-term debt of $1,637 million and shareholders’ equity of $3,763 million. KSS generated operating cash flow of $282 million during the 52-week period ended Jan 28, 2023. Management expects capital expenditures in the band of $600-$625 million in the full-year 2023 (including the expansion of its Sephora collaboration and store refresh actions).

On Feb 21, 2023, Kohl’s declared a quarterly cash dividend of 50 cents per share, payable on Mar 29, 2023, to shareholders of record as of Mar 15.

Shares of this Zacks Rank #3 (Hold) company have decreased 11.8% in the past three months compared with the industry’s decline of 7.5%.

Have a Look at These Retail Picks

Here we have highlighted three better-ranked stocks.

Burlington Stores BURL is a retailer of branded apparel products. BURL currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Zacks Consensus Estimate for Burlington Stores’ current financial-year EPS suggests a decline of 52.2% from the year-ago reported figure. Burlington Stores has a trailing four-quarter negative earnings surprise of 0.6%, on average.

Costco Wholesale Corporation COST operates membership warehouses. The stock currently carries a Zacks Rank #2. COST has an expected EPS growth rate of 9.6% for three to five years.

The Zacks Consensus Estimate for Costco’s current financial-year EPS suggests a rise of 8.6% from the year-ago reported figure. Costco has a trailing four-quarter earnings surprise of 3.7%, on average.

Ross Stores ROST operates off-price retail apparel and home fashion stores. ROST currently carries a Zacks Rank #2.

The Zacks Consensus Estimate for Ross Stores’ current financial-year EPS suggests a drop of 11.7% from the year-ago reported figure. Ross Stores has a trailing four-quarter earnings surprise of 10.5%, on average.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Kohl's Corporation (KSS) : Free Stock Analysis Report

Costco Wholesale Corporation (COST) : Free Stock Analysis Report

Ross Stores, Inc. (ROST) : Free Stock Analysis Report

Burlington Stores, Inc. (BURL) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance