Koninklijke Vopak (AMS:VPK) Has Announced That It Will Be Increasing Its Dividend To €1.30

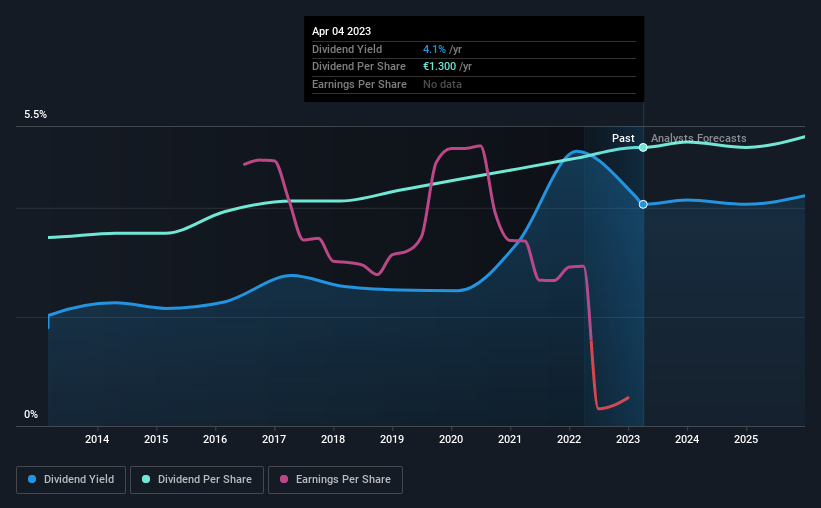

Koninklijke Vopak N.V. (AMS:VPK) will increase its dividend from last year's comparable payment on the 5th of May to €1.30. Although the dividend is now higher, the yield is only 4.1%, which is below the industry average.

See our latest analysis for Koninklijke Vopak

Koninklijke Vopak's Earnings Easily Cover The Distributions

While yield is important, another factor to consider about a company's dividend is whether the current payout levels are feasible. Koninklijke Vopak is not generating a profit, but its free cash flows easily cover the dividend, leaving plenty for reinvestment in the business. This gives us some comfort about the level of the dividend payments.

Looking forward, earnings per share is forecast to rise exponentially over the next year. If the dividend continues along recent trends, we estimate the payout ratio will be 50%, so there isn't too much pressure on the dividend.

Koninklijke Vopak Has A Solid Track Record

The company has been paying a dividend for a long time, and it has been quite stable which gives us confidence in the future dividend potential. Since 2013, the dividend has gone from €0.88 total annually to €1.30. This means that it has been growing its distributions at 4.0% per annum over that time. While the consistency in the dividend payments is impressive, we think the relatively slow rate of growth is less attractive.

Dividend Growth Potential Is Shaky

Investors could be attracted to the stock based on the quality of its payment history. However, initial appearances might be deceiving. Over the past five years, it looks as though Koninklijke Vopak's EPS has declined at around 24% a year. A sharp decline in earnings per share is not great from from a dividend perspective. Even conservative payout ratios can come under pressure if earnings fall far enough. On the bright side, earnings are predicted to gain some ground over the next year, but until this turns into a pattern we wouldn't be feeling too comfortable.

Our Thoughts On Koninklijke Vopak's Dividend

Overall, this is probably not a great income stock, even though the dividend is being raised at the moment. The company has been bring in plenty of cash to cover the dividend, but we don't necessarily think that makes it a great dividend stock. We would be a touch cautious of relying on this stock primarily for the dividend income.

Companies possessing a stable dividend policy will likely enjoy greater investor interest than those suffering from a more inconsistent approach. Still, investors need to consider a host of other factors, apart from dividend payments, when analysing a company. For instance, we've picked out 2 warning signs for Koninklijke Vopak that investors should take into consideration. Looking for more high-yielding dividend ideas? Try our collection of strong dividend payers.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Join A Paid User Research Session

You’ll receive a US$30 Amazon Gift card for 1 hour of your time while helping us build better investing tools for the individual investors like yourself. Sign up here

Yahoo Finance

Yahoo Finance