Koppers' (KOP) Stock Down 10% Since Earnings Miss in Q3

Koppers Holdings Inc.’s KOP stock is down around 10% since the company came up with its third-quarter 2021 results, wherein earnings missed the Zacks Consensus Estimate.

The Pennsylvania-based company saw lower sales and profitability in its Railroad and Utility Products and Services (“RUPS”) and Performance Chemicals (“PC”) segments in the reported quarter, hurt by supply-chain challenges and higher raw material and transportation costs.

Earnings and Revenues Discussion

Koppers logged profits (attributable to the company) of $10.2 million or 47 cents per share for the reported quarter, down from a profit of $75.6 million or $3.53 a year ago.

Barring one-time items, adjusted earnings were $1.01 per share for the quarter, down from $1.64 per share a year ago. Earnings missed the Zacks Consensus Estimate of $1.26.

Koppers recorded revenues of $424.8 million for the quarter, down around 3% year over year. It trailed the Zacks Consensus Estimate of $446 million. Lower sales across RUPS and PC units were partly offset by an increase in the Carbon Materials and Chemicals (“CMC”) segment.

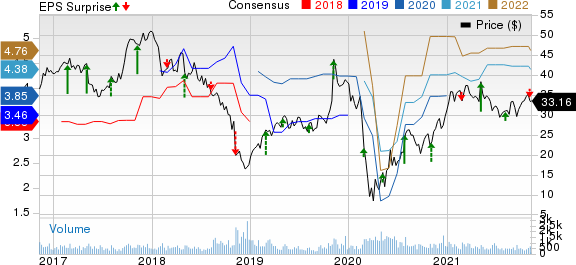

Koppers Holdings Inc. Price, Consensus and EPS Surprise.

Koppers Holdings Inc. price-consensus-eps-surprise-chart | Koppers Holdings Inc. Quote

Segment Highlights

Sales from the RUPS segment fell around 2% year over year to $186.9 million in the reported quarter. Sales were impacted by a decline in crosstie treating volumes from Class I customers, reduced volumes for U.S. utility poles and maintenance-of-way businesses that more than offset increased activity in commercial crossties and rail joints as well as price increases.

The PC segment recorded sales of $115.2 million in the quarter, down around 22% year over year. Sales were hurt by reduced volumes of preservatives in North America, partly offset by higher pricing for copper-based preservatives in certain regions.

Sales from the CMC division rose around 24% year over year to $122.7 million. Sales were driven by higher pricing for carbon pitch, carbon black feedstock and phthalic anhydride that more than offset reduced volumes of carbon pitch in specific regions.

Financials

Koppers ended the quarter with cash and cash equivalents of $44.9 million, up around 14% year over year. Long-term debt was $802.6 million, up around 0.8% year over year.

Outlook

Koppers noted that it remains focused on driving improvements through the execution of its strategic initiatives and making progress toward its long-term financial goals.

The company anticipated sales for 2021 to be roughly $1.7 billion. It also expects adjusted EBITDA to be $220 million for the year. Moreover, Koppers sees adjusted earnings per share for 2021 to be around $4.12.

The company also expects investments of $115-$120 million in capital expenditures this year.

Price Performance

Koppers’ shares have gained 27.9% over a year compared with 21.3% rise recorded by the industry.

Image Source: Zacks Investment Research

Zacks Rank & Key Picks

Koppers currently carries a Zacks Rank #4 (Sell).

Better-ranked stocks worth considering in the basic materials space include Nutrien Ltd. NTR, Methanex Corporation MEOH and Steel Dynamics, Inc. STLD, each sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Nutrien has an expected earnings growth rate of 206.11% for the current year. The stock has also rallied around 63% over a year.

Methanex has a projected earnings growth rate of 453.7% for the current year. The company’s shares have gained around 29% in a year.

Steel Dynamics has a projected earnings growth rate of 477.5% for the current year. The company’s shares have surged around 97% in a year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Steel Dynamics, Inc. (STLD) : Free Stock Analysis Report

Methanex Corporation (MEOH) : Free Stock Analysis Report

Koppers Holdings Inc. (KOP) : Free Stock Analysis Report

Nutrien Ltd. (NTR) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance