Kraft Heinz Q1 2024 Earnings: Aligns with Analyst EPS Projections Amidst Sales Decline

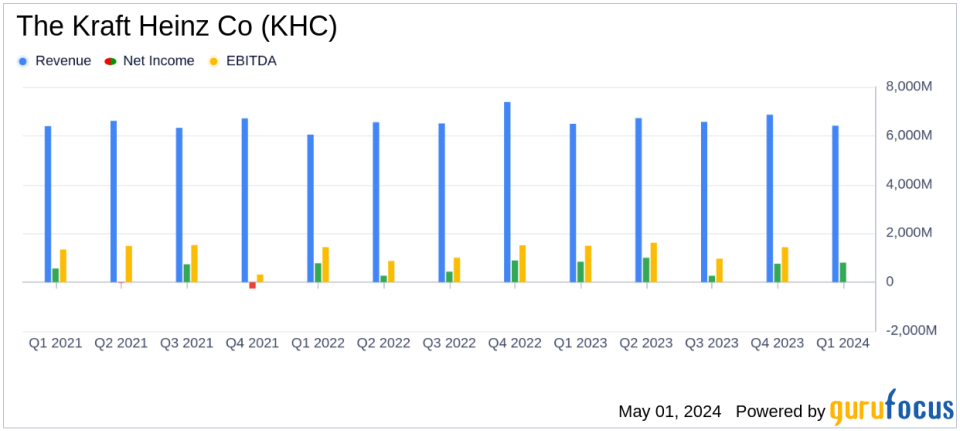

Net Sales: Reported at $6.411 billion, a decrease of 1.2% year-over-year, falling short of the estimated $6.429 billion.

Net Income: Totaled $801 million, down 4.2% from the previous year, below the estimate of $842.59 million.

Diluted EPS: Came in at $0.66, a decrease of 2.9% year-over-year, below the estimated $0.69.

Gross Profit Margin: Increased to 35.0%, reflecting a 240 basis point improvement from the previous year.

Operating Income: Rose by 4.7% to $1.302 billion, driven by unrealized gains on commodity hedges and higher adjusted operating income.

Free Cash Flow: Increased significantly by 116.8% to $477 million, supported by lower cash outflows for inventories.

Capital Return: Paid $486 million in cash dividends and repurchased $329 million of common stock under the share repurchase program.

On May 1, 2024, The Kraft Heinz Co (NASDAQ:KHC) disclosed its financial results for the first quarter of 2024 through an 8-K filing. The company, a major player in the global food and beverage sector, reported a slight decrease in net sales by 1.2% to $6.4 billion, aligning closely with analyst expectations of $6.429 billion. Despite the sales dip, KHC achieved a gross profit margin increase and a modest rise in operating income.

Company Overview

Formed from the merger of Kraft and Heinz in July 2015, The Kraft Heinz Co stands as the third-largest food and beverage manufacturer in North America and the fifth-largest globally. Its portfolio includes well-known brands like Oscar Mayer, Velveeta, and Philadelphia. Predominantly focused on the retail channel, which accounts for about 85% of its sales, Kraft Heinz also has a significant presence in foodservice and operates in over 190 countries.

Financial Highlights and Challenges

The company's adjusted earnings per share (EPS) for the quarter was $0.69, consistent with analyst projections, and marked a 1.5% increase from the previous year. This performance was primarily driven by higher adjusted operating income and reduced share count, despite higher taxes on adjusted earnings. However, net income saw a decline of 3.9%, settling at $804 million compared to $837 million in the prior year.

One of the notable challenges faced by Kraft Heinz this quarter was the decline in volume/mix across its North America and International Developed Markets segments. This was largely due to the elasticity impacts from pricing actions and the reduction of Supplemental Nutrition Assistance Program (SNAP) benefits in the United States, although partially offset by growth in Emerging Markets.

Strategic Initiatives and Market Adaptation

CEO Carlos Abrams-Rivera highlighted the company's strategic focus on enhancing efficiencies and reinvesting in the business to spur growth. The adoption of the Agile@Scale methodology has been pivotal in driving these improvements. Despite the challenges, Kraft Heinz is maintaining its full-year outlook for 2024, expecting organic net sales growth between 0 to 2% and adjusted EPS growth from $3.01 to $3.07.

Operational and Financial Metrics

The company's operational success this quarter can be attributed to strategic pricing adjustments and cost management, which helped counterbalance the unfavorable volume/mix and investment increases in marketing and R&D. Additionally, Kraft Heinz reported a significant increase in free cash flow, which surged by 116.8% to $477 million, bolstered by efficient management of operating activities and capital expenditures.

Investor and Market Reactions

In response to its steady performance, Kraft Heinz continues its shareholder return programs, having paid $486 million in cash dividends and repurchased $329 million of common stock during the quarter. The ongoing $3.0 billion share repurchase program underscores the company's commitment to delivering shareholder value amidst market volatility.

Conclusion

While The Kraft Heinz Co navigates through market fluctuations and operational challenges, its strategic initiatives and focus on efficiency continue to hold promise for sustainable growth. Investors and stakeholders will likely keep a close watch on how the company's strategies unfold in the coming quarters, especially in light of the dynamic global economic landscape.

For a deeper dive into The Kraft Heinz Co's financial details and strategic outlook, visit our detailed analysis on GuruFocus.com.

Explore the complete 8-K earnings release (here) from The Kraft Heinz Co for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance