Can Kroger's Rally Continue?

Shares of The Kroger Co. (NYSE:KR) have moved sharply higher. Over the past three months, the stock has delivered a total return of approximately 25%. Comparably, the S&P 500 has delivered a total return of roughly 10% over the same period.

Kroger's shares have benefited from strong fourth-quarter 2023 earnings, strong 2024 guidance and renewed hopes that it may find a way to win approval for its proposed acquisition of Albertsons Companies Inc. (NYSE:ACI).

Despite the recent rally, Kroger's shares trade at a reasonable valuation relative to historical norms and at a significant discount to the broader market. Moreover, consensus expectations regarding 2024 earnings remain fairly conservative. For these reasons, I believe the stock can continue to move higher.

Strong earnings and outlook

On March 7, Kroger reported fourth-quarter results. Adjusted earnings came in at $1.34 per share versus consensus estimates of $1.13. Revenue was $37.10 billion, which beat consensus estimates by $40 million.

For fiscal 2023, adjusted earnings per share came in at $4.76 ($4.56 excluding the impact of an additional week in 2023 versus 2022), up from $4.23 for the previous year. The increase was driven by margin improvement as FIFO gross margins improved by 13 basis points from 2022, excluding the impact of the 53rd week.

For 2024, Kroger expects same-store sales excluding fuel to increase by 0.25% to 1.75% and adjusted earnings per share of $4.30 to $4.50. The adjusted earnings guidance compared favorably to the $4.28 consensus estimate for 2024 earnings at the time of the release.

Currently, consensus estimates call for Kroger to report 2024 adjusted earnings per share of $4.44. While this is within the range of the company's recent guidance, I believe there is a good chance the grocer reports earnings that are better than this estimate. Companies are often conservative when providing guidance as executives typically do not want to disappoint investors by missing expectations. Historically, an average of roughly 78% of S&P 500 companies have beaten estimates on a quarterly basis.

In early 2023, Kroger predicted adjusted earnings of $4.45 to $4.60 per share and ultimately delivered adjusted earnings of $4.76 for the year despite what was a fairly challenging year for consumers.

A similar beat on a percentage basis would imply adjusted earnings per share of $4.63, which is above current consensus estimates.

Renewed hope for proposed Albertsons acquisition

In late February, the Federal Trade Commission sued to block Kroger's proposed acquisition of Albertsons on the basis the deal would result in price increases. This lawsuit came despite the fact that the company had put together a significant divestiture plan that included the sale of roughly 413 stores to C&S Wholesale. However, government officials did not view this proposal as compelling.

In March, it was reported that Kroger has been working to increase the size of the proposed divestiture plan in order to gain government support for the transaction. While the final details remain to be seen, a larger store divestiture count could help the company bolster its argument in court that the proposed acquisition of Albertsons will still allow plenty of room for competition.

Talk of an improved divestiture plan has been a positive for the stock, but I believe significant upside remains should the company ultimately prevail with its proposed acquisition.

In my view, Kroger's acquisition of Albertsons is unlikely to result in materially higher consumer prices. However, I do believe the proposed transaction will better allow the company to compete with Walmart (NYSE:WMT), the largest seller of groceries in the U.S, due to improved economies of scale and potential consolidation of total store count.

Valuation remains attractive

Despite the recent rally, Kroger shares currently trade at a forward price-earnings ratio of 12.80. Comparably, the S&P 500 trades at roughly 22 times forward earnings. While the grocer operates in a highly competitive industry with muted growth prospects, its business is fairly defensive in nature and tends to be significantly less cyclical than the broader economy.

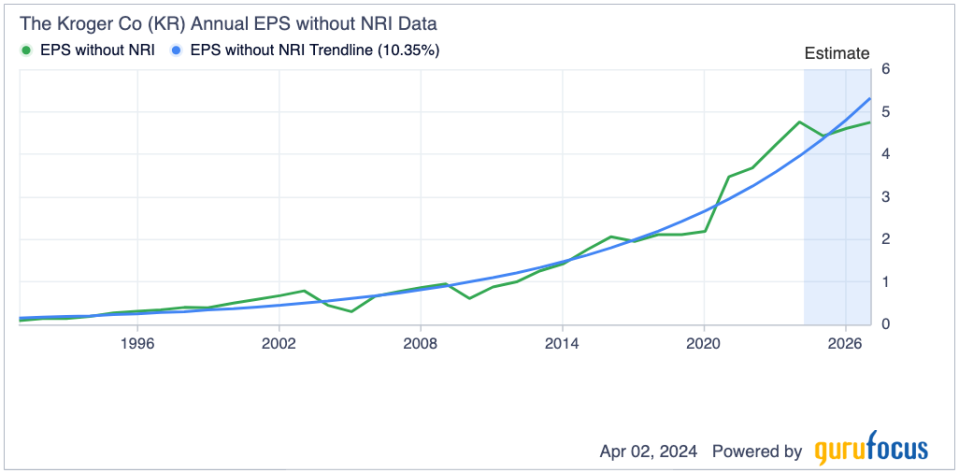

Historically, the company has grown adjusted earnings per share at a roughly 10% rate, which is in line with the broader market. While it may be difficult for Kroger to achieve this level of growth going forward, I believe it can continue to grow earnings by a mid-single-digit percentage over the medium term. While this is lower than the broader market, I believe Kroger should get some valuation premium due to the defensive nature of its business as other defensive stocks, such as Coca Cola (NYSE:KO), Procter & Gamble (NYSE:PG) and Walmart, tend to trade at a market multiple or even a premium.

Over the past 10 years, Kroger has traded at a median forward price-earnings ratio of roughly 12.40 and thus the stock's current valuation remains reasonable relative to historical norms.

Key risks to consider

One potential risk to consider is that Kroger is unable to succeed in acquiring Albertsons. While I believe its focus on improving its divestiture plan will increase the probability that the transaction receives regulatory support, the outcome remains highly uncertain. If the company were forced to abandon the proposed transaction, the share price could experience some near-term selling pressure given recent renewed optimism around the potential completion of the deal.

Another key risk to consider is that the company fails to meet its 2024 earnings projections. While I believe guidance is currently conservative, the ongoing uncertainty regarding the Albertsons deal has the potential to become a distraction for the company's management team and result in lackluster operational performance and focus on the existing business.

Conclusion

Kroger's shares have moved sharply higher over the past few months on the back of positive developments. However, the stock remains reasonably valued and trades at a significant discount to the broader market and other recession-resistant companies.

Developments related to the company's proposed acquisition of Albertsons and the Federal Trade Commission's lawsuit to block this deal will be a key near-term driver of the stock. If the deal is approved, I expect Kroger shares to move sharply higher as the transaction has potential to create significant value for shareholders.

On the other hand, even if the transaction does not get approved, I believe Kroger is poised to beat consensus earnings estimates, which may also serve as an upside catalyst.

For these reasons, I believe Kroger can continue moving higher.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance