KRX Growth Companies With Up To 38% Insider Ownership

The South Korean market has shown robust performance, climbing 2.2% in the last week and achieving a 9.2% increase over the past year, with earnings expected to grow by 30% annually. In such a thriving environment, stocks with high insider ownership can be particularly appealing as they often indicate strong confidence from those who know the company best.

Top 10 Growth Companies With High Insider Ownership In South Korea

Name | Insider Ownership | Earnings Growth |

ALTEOGEN (KOSDAQ:A196170) | 26.6% | 73.1% |

Global Tax Free (KOSDAQ:A204620) | 18.1% | 72.4% |

Seojin SystemLtd (KOSDAQ:A178320) | 27.9% | 58.7% |

Fine M-TecLTD (KOSDAQ:A441270) | 17.3% | 36.4% |

Park Systems (KOSDAQ:A140860) | 33% | 35.6% |

Vuno (KOSDAQ:A338220) | 19.5% | 105% |

UTI (KOSDAQ:A179900) | 34.1% | 122.7% |

HANA Micron (KOSDAQ:A067310) | 20% | 96.3% |

INTEKPLUS (KOSDAQ:A064290) | 16.3% | 77.4% |

Techwing (KOSDAQ:A089030) | 18.7% | 77.8% |

Let's take a closer look at a couple of our picks from the screened companies.

ALTEOGEN

Simply Wall St Growth Rating: ★★★★★★

Overview: ALTEOGEN Inc. is a biopharmaceutical company specializing in the development of long-acting biobetters, proprietary antibody-drug conjugates, and antibody biosimilars, with a market capitalization of approximately ₩14.32 billion.

Operations: The company specializes in three primary revenue segments: long-acting biobetters, proprietary antibody-drug conjugates, and antibody biosimilars.

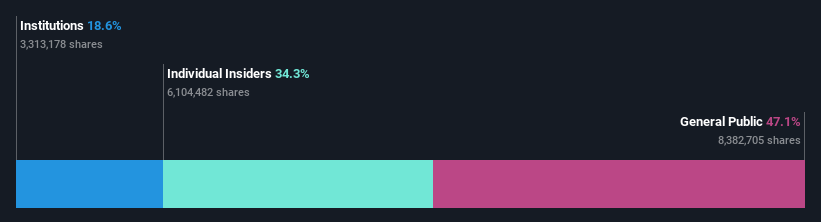

Insider Ownership: 26.6%

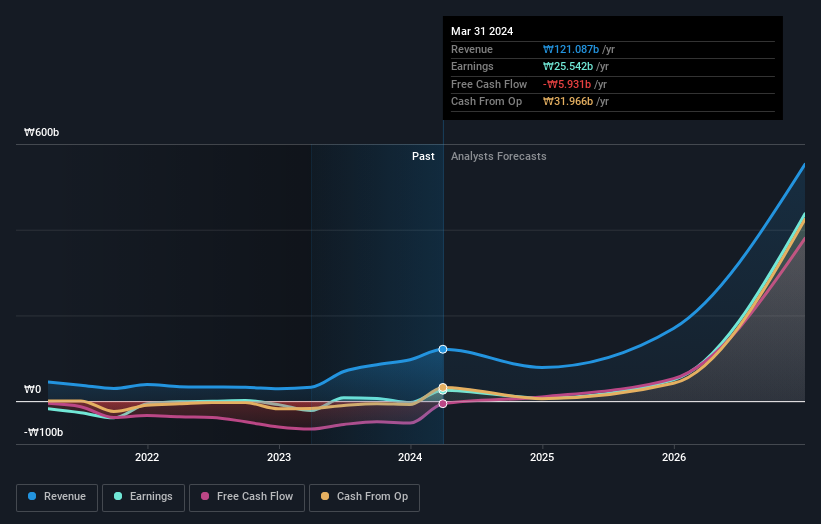

ALTEOGEN, a South Korean biotech firm, recently gained significant traction with the approval of its innovative drug Tergase®, marking its transition to a commercial-stage company. Despite trading at 73.1% below estimated fair value and experiencing share dilution last year, ALTEOGEN shows robust growth prospects with expected annual revenue and earnings growth rates surpassing local market averages significantly. However, the company's stock has been highly volatile recently, which may concern some investors.

Click here and access our complete growth analysis report to understand the dynamics of ALTEOGEN.

Upon reviewing our latest valuation report, ALTEOGEN's share price might be too optimistic.

ST PharmLtd

Simply Wall St Growth Rating: ★★★★☆☆

Overview: ST Pharm Co., Ltd. specializes in custom manufacturing services for active pharmaceutical ingredients and intermediates, operating both in South Korea and internationally, with a market capitalization of approximately ₩1.84 billion.

Operations: ST Pharm Co., Ltd. generates ₩251.86 billion from raw drug manufacturing and ₩34.40 billion from its clinical trial site consignment research institute.

Insider Ownership: 13%

ST PharmLtd, while trading at a significant discount to fair value, demonstrates robust growth potential in South Korea with earnings expected to increase considerably over the next three years. The company's revenue is also projected to outpace the local market average. However, challenges such as shareholder dilution and a highly volatile share price may raise concerns. Recent governance adjustments include proposed director appointments, potentially impacting future management dynamics and strategic direction.

Doosan

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Doosan Corporation operates in heavy industry, machinery manufacturing, and apartment construction across South Korea, the United States, Asia, the Middle East, Europe, and other international markets with a market capitalization of approximately ₩3.76 billion.

Operations: The company's revenue is generated from three primary segments: heavy industry, machinery manufacturing, and apartment construction across various global markets.

Insider Ownership: 38.9%

Doosan Corporation, with significant insider ownership, is positioned below its fair value and shows promising profitability within three years. Despite a slower revenue growth rate (3.6% per year) compared to the South Korean market average (10.8%), earnings are expected to surge by 72.89% annually. Recent financials reveal a rebound, with first-quarter sales rising to KRW 180.97 billion and net income shifting from a substantial loss to KRW 4.98 billion year-over-year, indicating potential recovery and growth momentum.

Key Takeaways

Dive into all 82 of the Fast Growing KRX Companies With High Insider Ownership we have identified here.

Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Searching for a Fresh Perspective?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include KOSDAQ:A196170 KOSDAQ:A237690 and KOSE:A000150.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com