Kuaishou Technology And 2 Other High Growth Tech Stocks In Hong Kong

The Hong Kong market has recently experienced a significant boost, driven by China's robust stimulus measures aimed at revitalizing its economy, which in turn has lifted sentiment across the region. In this context of heightened optimism and potential growth opportunities, investors are keenly observing high-growth tech stocks like Kuaishou Technology that exhibit strong fundamentals and innovative capabilities to capitalize on the evolving market dynamics.

Top 10 High Growth Tech Companies In Hong Kong

Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

Wasion Holdings | 22.37% | 25.47% | ★★★★★☆ |

MedSci Healthcare Holdings | 48.74% | 48.78% | ★★★★★☆ |

Inspur Digital Enterprise Technology | 25.31% | 39.04% | ★★★★★☆ |

Cowell e Holdings | 31.82% | 35.43% | ★★★★★★ |

RemeGen | 26.30% | 52.19% | ★★★★★☆ |

Akeso | 32.59% | 54.56% | ★★★★★★ |

Biocytogen Pharmaceuticals (Beijing) | 21.53% | 109.17% | ★★★★★☆ |

Innovent Biologics | 22.24% | 59.39% | ★★★★★☆ |

Beijing Airdoc Technology | 37.47% | 93.35% | ★★★★★☆ |

Sichuan Kelun-Biotech Biopharmaceutical | 24.70% | 8.53% | ★★★★★☆ |

Click here to see the full list of 45 stocks from our SEHK High Growth Tech and AI Stocks screener.

Here's a peek at a few of the choices from the screener.

Kuaishou Technology

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Kuaishou Technology is an investment holding company offering live streaming, online marketing, and other services in the People's Republic of China, with a market cap of approximately HK$246.70 billion.

Operations: The company generates revenue primarily from domestic operations, totaling CN¥117.32 billion, with a smaller contribution of CN¥3.57 billion from overseas markets.

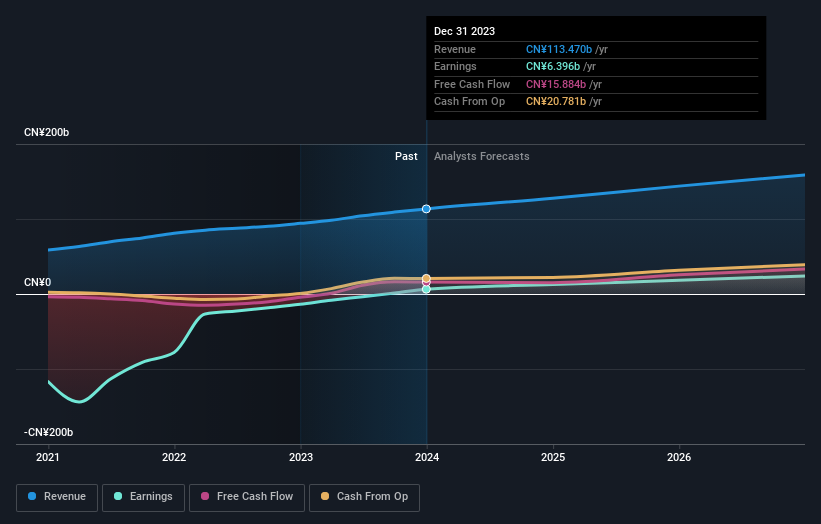

Kuaishou Technology, a contender in Hong Kong's tech scene, has demonstrated robust growth with second-quarter sales rising to CNY 30.98 billion from CNY 27.74 billion year-over-year, alongside a substantial increase in net income to CNY 3.98 billion from CNY 1.48 billion. This performance is part of a broader trend where the company's revenue and earnings are projected to grow annually by 9% and 18.7%, respectively, outpacing the Hong Kong market averages of 7.3% and 12.2%. Contributing significantly to this trajectory is Kuaishou’s strategic emphasis on R&D, dedicating substantial resources that enhance its innovative edge in AI-driven content creation—a move evident from recent enhancements to its Kling AI video generation model which now offers upgraded features like improved video quality and extended generation durations for better user engagement.

Dive into the specifics of Kuaishou Technology here with our thorough health report.

Assess Kuaishou Technology's past performance with our detailed historical performance reports.

Kingdee International Software Group

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Kingdee International Software Group Company Limited is an investment holding company involved in the enterprise resource planning business, with a market capitalization of approximately HK$34.27 billion.

Operations: The company primarily generates revenue through its Cloud Service Business, contributing CN¥4.86 billion, and its ERP Business, which adds CN¥1.13 billion. The focus on cloud services reflects a significant portion of the revenue model.

Kingdee International Software Group has shown resilience in a challenging market, with its half-year sales climbing to CNY 2.87 billion from CNY 2.57 billion, reflecting a growth of 13.9%. Despite facing a net loss, the company reduced its losses to CNY 217.85 million from CNY 283.54 million year-over-year, indicating effective cost management and operational improvements. This performance is underpinned by Kingdee's commitment to R&D which remains robust; the firm invested heavily in innovation, evident from their recent enhancements in enterprise resource planning systems tailored for cloud integration—an area poised for significant expansion as businesses increasingly shift towards digital solutions.

Tencent Holdings

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Tencent Holdings Limited is a multinational investment holding company that provides value-added services, online advertising, and fintech and business services both in China and globally, with a market capitalization of approximately HK$4.29 trillion.

Operations: Tencent generates revenue primarily from value-added services (CN¥302.28 billion), online advertising (CN¥111.89 billion), and fintech and business services (CN¥209.17 billion).

Tencent Holdings, a stalwart in the tech landscape of Hong Kong, demonstrated robust financial health in its recent earnings report, with a notable revenue jump to CNY 320.62 billion over six months—an increase from CNY 299.19 billion year-over-year. This growth is complemented by a surge in net income to CNY 89.52 billion, up significantly from CNY 52.01 billion, reflecting strong operational efficiency and market adaptability. The company's commitment to innovation is evident from its R&D investment trends which align closely with its strategic priorities in expanding digital services and enhancing user engagement across its platforms. With an expected annual profit growth outpacing the local market at 12.8%, Tencent is not just keeping pace but setting benchmarks within the tech sector, underlining its potential for sustained growth amidst evolving industry dynamics.

Delve into the full analysis health report here for a deeper understanding of Tencent Holdings.

Explore historical data to track Tencent Holdings' performance over time in our Past section.

Make It Happen

Investigate our full lineup of 45 SEHK High Growth Tech and AI Stocks right here.

Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Seeking Other Investments?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include SEHK:1024 SEHK:268 and SEHK:700.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com