The De La Rue (LON:DLAR) Share Price Has Soared 305%, Delighting Many Shareholders

For many, the main point of investing in the stock market is to achieve spectacular returns. When you find (and hold) a big winner, you can markedly improve your finances. For example, the De La Rue plc (LON:DLAR) share price rocketed moonwards 305% in just one year. It's also good to see the share price up 19% over the last quarter. In contrast, the longer term returns are negative, since the share price is 59% lower than it was three years ago.

View our latest analysis for De La Rue

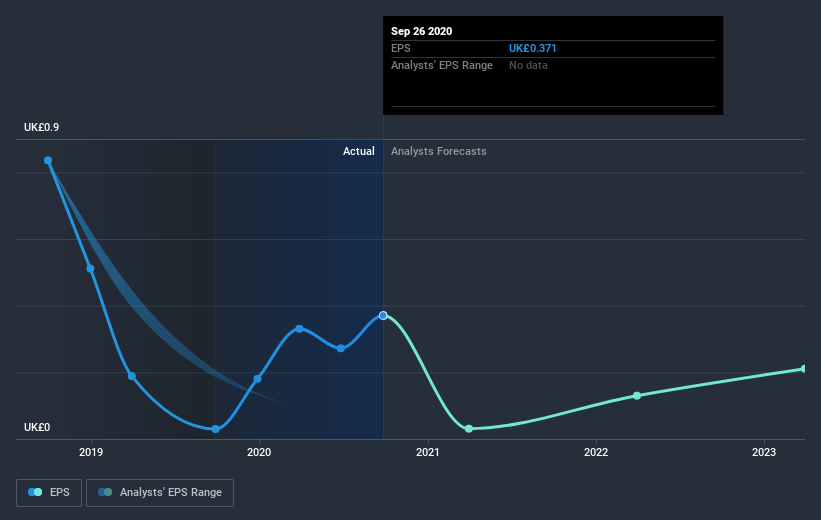

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

During the last year De La Rue saw its earnings per share (EPS) increase strongly. This remarkable growth rate may not be sustainable, but it is still impressive. We are not surprised the share price is up. Strong growth like this can be evidence of a fundamental inflection point in the business, making it a good time to investigate the stock more closely.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

We consider it positive that insiders have made significant purchases in the last year. Even so, future earnings will be far more important to whether current shareholders make money. It might be well worthwhile taking a look at our free report on De La Rue's earnings, revenue and cash flow.

A Different Perspective

We're pleased to report that De La Rue shareholders have received a total shareholder return of 305% over one year. There's no doubt those recent returns are much better than the TSR loss of 8% per year over five years. The long term loss makes us cautious, but the short term TSR gain certainly hints at a brighter future. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Take risks, for example - De La Rue has 3 warning signs (and 1 which is significant) we think you should know about.

There are plenty of other companies that have insiders buying up shares. You probably do not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on GB exchanges.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

Yahoo Finance

Yahoo Finance