LabCorp (LH) Base Line Growth Solid, COVID-Related Sales Drop

On May 4, we issued an updated research report on LabCorp LH. The company is working successfully on new innovations with academic institutions in order to capture the growing lab testing market with its advanced assays and tools. Economic uncertainties, including a challenging volume environment for testing laboratories and softness in utilization, are headwinds for LabCorp. The stock currently carries a Zacks Rank #3 (Hold).

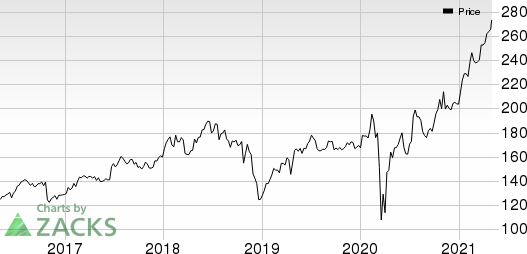

Over the past three months, shares of LabCorp have risen 16.6% compared with the industry’s 4.2% rise.

LabCorp exited the first quarter of 2021 with better-than-expected earnings and revenues. These figures improved on a year-over-year basis as well. Diagnostics revenues in the quarter were significantly high on organic volume improvements as a result of growing demand for COVID-19 testing. Also, Covance Drug Development delivered higher sales. In the quarter under review, Drug Development benefited from broad-based demand across businesses, including COVID-19 vaccine and therapeutic work. The company also delivered 15% year-over-year growth in base business.

Laboratory Corporation of America Holdings Price

Laboratory Corporation of America Holdings price | Laboratory Corporation of America Holdings Quote

In Diagnostics and Drug Development, base business revenues increased 8% and 24% respectively. Despite its expectation of significant sinking of COVID-related testing revenues, the company’s raised 2021 guidance, banking on fast recovering base business, buoys optimism.

In oncology, Labcorp expanded its leadership position through the launch of a new noninvasive liquid biopsy test, using next-generation sequencing for patients with non-small cell lung cancer. It also collaborated with Tempus to accelerate clinical trial patient participation.

Further, LabCorp is continuing to integrate digital, data analytics and artificial intelligence in every sphere of its development. The Walgreens partnership has been expanded to include new integrated digital experiences available to all Walgreens customers and to provide access to Pixel Home Kit in over 6,000 locations. The company is also helping patients securely access their results through their personal devices and apps like Common Health and Common Pass. Added to that, LabCorp is working for the CDC to genetically sequence approximately 5,000 virus samples every week in order to identify variance.

On the flip side, for 2021, LabCorp expects a decline in diagnostics revenues in the range of 0.5% to 7.5% compared with the 2020 figure. This guidance projects significant sinking of COVID-related testing revenues. Specifically, while the company projected 2021 base business to grow 13.5% to 16% over 2020 figure, COVID-19 testing revenues are expected to decline 35% to 50%.

Further, challenging volume environment for the testing laboratories, divestitureof certain businesses and the implementation of the Protecting Access to Medicare Act (PAMA) are denting growth.

Key Picks

Some better-ranked stocks in the broader medical space are Boston Scientific Corporation BSX, West Pharmaceutical Services, Inc. WST and Omnicell, Inc. OMCL.

Boston Scientific has a projected long-term earnings growth rate of 9.3%. It currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

West Pharmaceutical’s long-term projected earnings growth rate is pegged at 22.6%. The company too carries a Zacks Rank #2.

Omnicell’s long-term historical earnings growth rate is 19.6%. It currently carries a Zacks Rank #2.

Infrastructure Stock Boom to Sweep America

A massive push to rebuild the crumbling U.S. infrastructure will soon be underway. It’s bipartisan, urgent, and inevitable. Trillions will be spent. Fortunes will be made.

The only question is “Will you get into the right stocks early when their growth potential is greatest?”

Zacks has released a Special Report to help you do just that, and today it’s free. Discover 7 special companies that look to gain the most from construction and repair to roads, bridges, and buildings, plus cargo hauling and energy transformation on an almost unimaginable scale.

Download FREE: How to Profit from Trillions on Spending for Infrastructure >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Omnicell, Inc. (OMCL) : Free Stock Analysis Report

Boston Scientific Corporation (BSX) : Free Stock Analysis Report

Laboratory Corporation of America Holdings (LH) : Free Stock Analysis Report

West Pharmaceutical Services, Inc. (WST) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance