When will Labour’s first Budget be – and when will tax changes come into effect?

Sir Keir Starmer has been elected Britain’s 58th prime minister after campaigning with a manifesto entitled “Change”.

Labour has promised to shorten NHS waiting times, crack down on anti-social behaviour and hire 6,500 more teachers. When it comes to money, however, the situation is far less clear. The party has said more about what won’t happen than what will.

Here, Telegraph Money takes you through what Labour has promised to do, when the next Budget might be and what Labour’s win could now mean for you.

When is the first Budget?

The date is not yet set, but the first Budget is unlikely to be before September 13, according to the Institute for Government, a think tank. This is because Labour has committed to including a forecast from the Office for Budget Responsibility, which requires 10 weeks’ notice.

There is no obstacle to a chancellor announcing a Budget without an OBR forecast, as Liz Truss did in September 2022. However, given Labour’s pledge to strengthen and “never sideline” the OBR, this seems very unlikely.

Chris Rudden, of digital wealth manager Moneyfarm, said: “I wouldn’t be surprised if we at least saw something this year. After 14 years in opposition, they will be itching to get stuck in.”

Changes announced in the Budget require legislation, so they are included in a new Finance Bill which is put to Parliament. This puts in place the proposals for taxation made by the chancellor in the Budget statement, bringing them into law. Technically, a government can be defeated on its Budget in the House of Commons, but this is very rare.

The last chancellor to face defeat was Kenneth Clarke in 1994, when he tried to raise VAT. Some Conservative MPs voted against the measure, seeing it as a clear breach of the 1992 election manifesto.

The State Opening of Parliament and the King’s Speech are scheduled for Wednesday 17 July. This speech sets out the programme of legislation that the newly-elected Government intends to pursue over that parliamentary session and could include more details about what Labour will do first and when changes may come into effect.

What could Labour do first?

As part of its “first steps”, Labour has promised to “deliver economic stability, with tough spending rules” to grow the economy and keep taxes, inflation and mortgages as low as possible.

This ties in with its first of five “missions” – kick-starting economic growth. It has also committed to ensuring the current budget moves into balance, enabling day-to-day costs to be met by revenues.

There are more specific manifesto pledges Labour has promised to deliver on, too.

Labour will seek to enhance job security by banning zero hours contracts and ending the practice of “fire and rehire”, while workers will get parental leave and statutory sick pay from day one of a new job.

Low earners will get a boost with minimum pay that is a “genuine living wage”, regardless of age.

Families will benefit from expanded childcare and free breakfast clubs in every primary school. Communities will regain control of their bus routes and first-time buyers will get more support to get onto the housing ladder, Labour says.

The new government wants to also tighten energy market regulation, which its manifesto says will reduce bills and hold providers to account for wrongdoing.

Labour will also take aim at non-doms by abolishing the status “once and for all”. The Tories scrapped non-doms’ special status in the Budget, but Labour will go one step further and close a “loophole” that allows non-doms to move their money into an offshore trust before the ban comes into place in April 2025.

With a convincing mandate and comfortable majority, it should be easy to deliver on these quickly. The Salisbury Convention will also nullify any potential opposition in the House of Lords, as peers do not vote down Bills mentioned in a manifesto.

What is Labour committed to that is less clear?

Some of Labour’s commitments are low on detail, leaving the door open to speculation. As the new government launches into its first 100 days, more detail should be forthcoming and this article will be updated accordingly.

A pensions review

Labour has previously committed to a pensions review. Its manifesto said this would aim to “improve security in retirement” and deliver better returns for savers.

With detail scarce on what this could mean in reality, however, speculation ran riot during the election campaign.

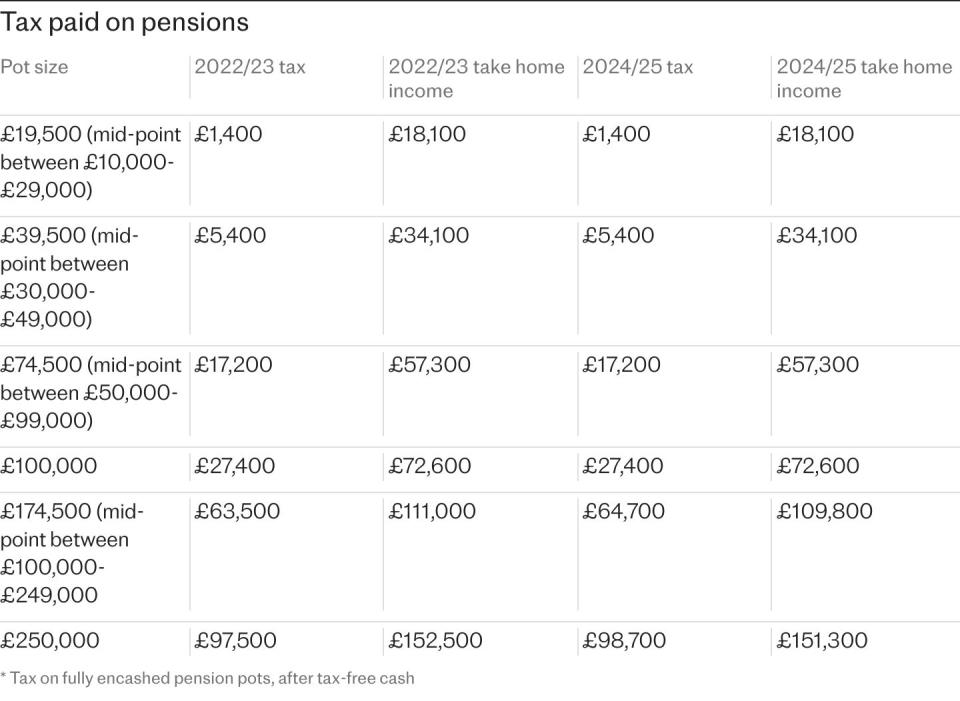

Chancellor Rachel Reeves previously suggested that tax relief on pension contributions should be set at a flat rate for everyone, rather than relief granted at your highest rate of income tax as it is currently.

The party has said this is not policy and it is understood to no longer be Ms Reeves’ view, but Labour has not ruled out any attacks on tax relief in its manifesto. Figures suggest the move could cost some pension savers more than £100,000.

Experts also say Labour might now move on the 25pc tax-free lump sum that pension savers can currently draw, which Liz Kendall recently failed to deny.

Helen Morrissey, of Hargreaves Lansdown, said: “Labour’s promised review of the pension landscape is sorely needed to ensure people continue to get good outcomes from retirement.

“The Government is running out of road when it comes to deploying strategies like hiking the state pension age. People need certainty in terms of what they are going to get from the state pension and when, so the state pension needs to be sustainable in the long term.

“The review also needs to look carefully at the pension tax system. We’ve seen many changes to the various allowances and there are rumours Labour may look to tinker with tax relief. The review needs to take an overarching view of the system to make sure it is working as it should in terms of incentivising people to save without being too complex.”

Labour’s review will also look at how to increase investment in the UK market by pension funds, which had a mixed reaction from experts.

Andrew Tully, of Nucleus Financial, said: “A new Labour government is likely to want to encourage more investment within the UK from pensions, and potentially wider savings such as Isas. That sounds sensible given the significant funds held within UK pensions which could be helping grow the UK economy.

“But if any new rules require a portion of people’s pensions to be invested in certain, possibly high risk, assets, that may not be the best outcome for an individual.”

Now in government, Labour is highly likely to move forward with the review – but it’s unclear where that may lead and how it might affect savers.

VAT on schools

Labour has been very clear that it will remove the VAT and business rates exemption from private schools. It means 20pc in tax will become due on revenue, notably school fees. This could mean the costs are passed on to families, meaning some children could be withdrawn from school as families struggle with rising costs.

Sir Keir initially pledged to deliver the change straight away, but it is now understood the plans will not be unveiled until the first Budget, coming into effect in September 2025. Labour has said it will introduce “anti-forestalling” legislation, which would make VAT payable from the announcement of the change rather than when the law comes into effect. However, the party has said VAT will not be charged retrospectively.

Alice Haine, of Bestinvest, said Ms Reeves had been “vague”, leading to confusion over the start date.

Can Labour afford all of its plans?

Experts have already warned that Labour might struggle to keep to its spending rules and deliver on its promises in the current economic climate.

The Conservatives say that Labour’s plan has a £2bn black hole that early tax increases will need to fill, while think tanks the Institute for Fiscal Studies and the Resolution Foundation have both suggested tax rises could be needed to balance the books.

Sarah Coles, of Hargreaves Lansdown, said: “Labour made some expensive commitments during the campaign, including sticking with the pensions triple lock and ruling out rises in income tax, National Insurance or VAT.

“However, money will be tight. All the maths in the manifesto factored in planned cuts by the former government, so it will be pinning its hopes on squeezing more growth from the economy to help make the maths stack up. If it doesn’t get the growth, it’s going to need to make some tough choices between spending cuts or additional taxes.”

There are potential revenue-raising opportunities that could be announced during a Budget should a cash injection be needed – and Labour has failed to rule many of these out while riding high in the polls.

Which changes could Labour make in the first Budget?

Labour’s lack of clarity and potential need to raise funds has left experts to speculate on which taxes will be targeted.

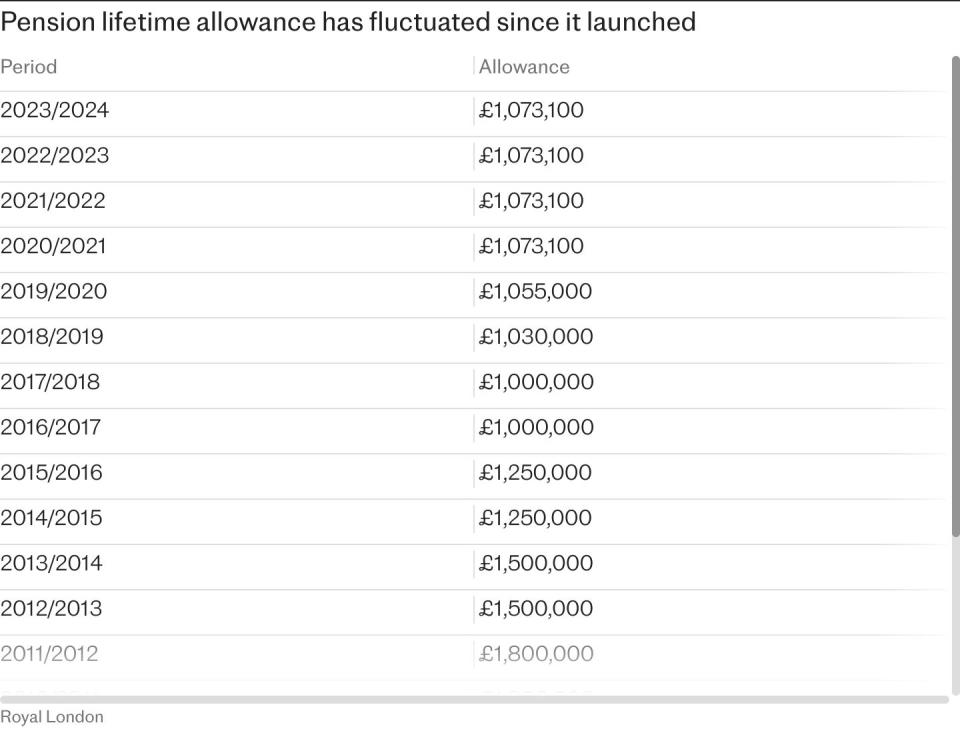

One source of revenue was initially expected to be the lifetime allowance – a tax charge on large pension pots. Labour did commit to reintroducing it immediately after the Tories said it would be abolished, but has now ruled this out.

However, the door is well and truly open for other changes.

Capital gains tax

Unlike the Tories, Labour did not commit to freezing capital gains and it has emerged that it’s being considered for a revenue-raising tax rise. Sir Keir Starmer has personally ruled out charging capital gains on someone’s first home, which is exempt under the current system, but stopped short of extending that to any rise.

An increase in the rate, or cut in the current £3,000 threshold at which it becomes due, would hit second homeowners, business owners, shareholders and those selling valuable assets.

Ms Coles added: “Labour hasn’t ruled out raising capital gains tax. It would enable the government to deliver on the promise not to raise taxes for ‘working people’, because it’s a tax on wealth. However, it’s a tough balancing act, because it doesn’t sit well with its plans to be a government that helps people create wealth. If they were to make changes, they’d have a wide range of options.

Mr Rudden added: “Labour pledged that it wouldn’t go after income tax or National Insurance and I don’t think they would renege on that straight away. However, I have a sneaking suspicion that capital gains tax is not safe. There is a good chance that Ms Reeves may realise that she doesn’t have as much money as she hoped to put their plans into action.

“However, the Treasury still hasn’t seen the full effect of the windfall that was created by Jeremy Hunt cutting the CGT allowance to £3,000. They might find that the increase in capital gains receipts will be plenty and so they don’t have to go after it further.

“In a world where it’s widely considered that the UK population doesn’t invest enough to support their future, putting a higher tax burden on investments puts a greater obstacle to getting people started.”

Inheritance tax raid

A leaked recording of a shadow frontbencher has raised fears that Labour could be planning a raid on family wealth after death. Darren Jones, the shadow chief secretary to the Treasury, told a public meeting in March that inheritance tax (IHT) could be used to “redistribute wealth” and address “intergenerational inequality”.

This has prompted concern that Labour could attack various reliefs that allow families to pay less inheritance tax.

Homeowners can pass on £500,000 – or £1m if they are a couple – as long as they leave their house to their children. Labour could choose to cut or lower this exemption, widening the scope of inheritance tax.

Alternatively Labour could attack various reliefs that allow people to give away their wealth earlier, without paying death duties.

Britain already has one of the highest inheritance tax rates in the OECD at 40pc.

If your estate is worth more £325,000 when you die, then your beneficiaries will pay this charge on everything above the threshold, called the nil-rate band. The tax-free exemption has been frozen at £325,000 since 2009, dragging thousands into the death duty net as house prices have soared.

According to official forecasts, the number of families paying the charge will hit nearly 44,000 a year by 2028-29, up from 33,000 this year. In total, almost 200,000 estates will pay the tax over the next five years.

Pensions

Charging inheritance tax on pensions is another option. Currently, pensions are not considered part of your estate when you die, meaning IHT is not due.

However, some fear that Labour might change this, which analysis shows could cost grieving families tens of thousands of pounds. It could also lower the maximum amount people can contribute to their pensions without losing tax relief, the so-called annual allowance.

Alice Haine, of fund shop BestInvest, said: “Although Labour appear to have ditched a previous pledge to reinstate the pensions lifetime allowance, it is possible it may explore other avenues for changing the taxation of pensions such as lowering the £60,000 annual allowance on pension contributions, reducing the generous tax relief on contributions, scrapping the 25pc tax-free lump sum accessible at the age of 55 and removing the inheritance tax exemption on pensions.”

Mr Tully added: “Labour appears to have ruled out any reintroduction of the lifetime allowance, at least in the short-term, but they could consider changing the current very attractive rules on passing on pension wealth tax-efficiently to families. One way to do this would be to include pension wealth within the estate for IHT purposes.”

Tax thresholds

Labour has committed to Tory plans to freeze income tax thresholds until at least 2028. However, it has not specified what will happen after that date, making it unclear when or if the rising tax burden will start to be lifted.

According to the Office for Budget Responsibility, freezing the thresholds until 2028 means nearly four million more people will be forced to pay income tax and 3.4 million more will move into a higher tax bracket.

Ms Coles added: “It’s almost nailed on that Labour will keep frozen tax thresholds in place. It’s an incredibly lucrative change that affects people’s future earnings, so while it costs them a small fortune, they don’t actually feel it as much as if the Government was dipping deeper into their existing income. It’s built into the maths around public finances, and it’s likely to have made the call that it’s easier to leave this in place than find another way to raise the same money.”

The triple lock

Labour has committed to maintaining the triple lock, ensuring the state pension will continue to increase by the highest of inflation, wages or 2.5pc. However, under current plans this would see it become taxable by 2028 as it will exceed the personal allowance, leaving some pensioners with a three-figure tax bill by the end of the current Parliament.

Labour has not revealed any plans to protect the state pension from tax. Currently, more than a million households rely solely on the state pension and benefits as their only income.

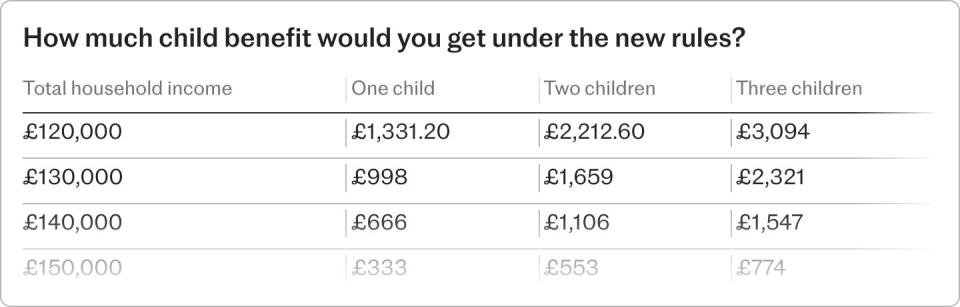

Child benefit

The Conservatives pledged to end a punitive quirk of the system, in which two parents earning £60,000 each can keep all their child benefit but a household with a parent earning more than that has to start repaying it. However, Labour has so far declined to match the policy.

Tax avoidance

Labour has pledged to tackle tax avoidance, which along with closing non-dom loopholes it says should generate £5bn a year by the end of its term. This will involve investing £855m a year more in HMRC and Labour has already allocated the additional revenue it will provide.

However, the move could have knock-on effects for people who legitimately aren’t paying tax.

Ms Haine said: “Tackling tax dodgers will also require Labour to invest heavily in HMRC to ensure it is resourced robustly enough to investigate claims and crack down on evasion. With the likelihood this will happen relatively quickly, fears are also mounting that the clampdown on so-called ‘loopholes’ may also be accompanied by a wider review of how tax reliefs are applied and used by savers, investors and households passing on wealth.

“Legitimate tax reliefs can sometimes find themselves pitched as loopholes when a government is in a hurry to raise revenue, something a new Labour leadership may be willing to do to push ahead with reforms quickly.”

Council tax

Labour MPs have given varying answers on whether or not council tax bands will change now it’s in government. Most recently, Mr Starmer himself refused to rule out the move, which could cost more than four million households over £1,200 on average.

There is no mention of council tax in the manifesto, leaving all options on the table for future reforms.

Yahoo Finance

Yahoo Finance