Lam Research Bumps Up Dividend & Share Buyback, Stock Gains

Following the announcement of a capital return program, shares of Lam Research Corporation LRCX moved up almost 5% to eventually close at $207.94 on Mar 6.

Per the plan, the company will pay a quarterly dividend payment of $1.10 per share, up 120%, from June. Lam Research currently pays a dividend of $2 per share on an annual basis.

Based on shares outstanding as of Dec 24, 2017, the dividend plan will return approximately $702 million to shareholders.

Lam Research also announced an additional $2-billion share repurchase program, which totaled the authorization to $4 billion till date. This company will execute the plan over the next 12 to 18 months.

Shares of Lam Research have returned 76.6% over a year, outperforming the industry’s rally of 62.4%. We believe portfolio strength and robust liquidity will support the shareholder-friendly initiatives. This will help the stock sustain momentum in the remainder of fiscal 2018 and beyond.

Impressive Fundamentals Drive Growth

Lam Research topped the Zacks Consensus Estimate in all of the trailing four quarters with an average of 9.16%.

In the last quarter, Lam Research reported non-GAAP earnings of $4.34 per share, which surged 94% on a year-over-year basis.

Further, revenues increased 37.1% year over year to $2.58 billion. The top-line growth was driven by strong equipment demand, robust performance from memory, logic and foundry segments and increase in the adoption of 3D NAND technology.

Lam Research believes that strong demand for bit growth in server DRAM and NAND will continue to expand, which will drive results in the long haul.

Moreover, aggressive share buyback will fuel the bottom line. The company expects current quarter’s non-GAAP earnings to be $4.35 per share which reflects 55.3% year-over-year growth. Non-GAAP revenues are projected to be $2.85 billion, reflecting a 32.5% increase on a year-over-year basis.

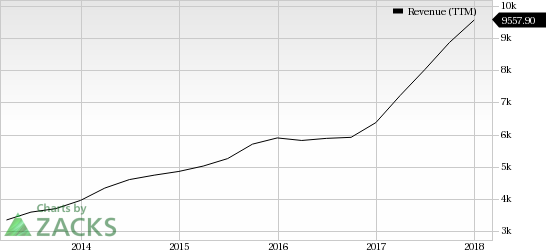

Lam Research Corporation Revenue (TTM)

Lam Research Corporation Revenue (TTM) | Lam Research Corporation Quote

Cash Flow Generation Remains Strong

We believe the Lam Research strong balance sheet and cash flow generation ability will support the shareholder-friendly initiatives.

Cash and cash equivalents, short-term investments, and restricted cash and investment balances were $5.7 billion as of Dec 24, 2017.

Moreover, Lam Research generated $28.7 million cash from operations in the last quarter. The company also paid $73.0 million in cash dividends and spent approximately $1.11 million on share repurchases.

Zacks Rank & Other Stocks to Consider

Currently, Lam Research sports a Zacks Rank #1 (Strong Buy).

Investors interested in the broader technology sector can also consider Applied Materials AMAT, Electro Scientific Industries ESIO and Teradyne TER. All of them flaunt a Zacks Rank #1. You can see the complete list of today’s Zacks #1 Rank stocks here.

Long-term earnings growth rate for Applied Materials, Electro Scientific Industries and Teradyne are currently pegged at 12%.

Breaking News: Cryptocurrencies Now Bigger than Visa

The total market cap of all cryptos recently surpassed $700 billion – more than a 3,800% increase in the previous 12 months. They’re now bigger than Morgan Stanley, Goldman Sachs and even Visa! The new asset class may expand even more rapidly in 2018 as new investors continue pouring in and Wall Street becomes increasingly involved.

Zacks has just named 4 companies that enable investors to take advantage of the explosive growth of cryptocurrencies via the stock market.

Click here to access these stocks >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Electro Scientific Industries, Inc. (ESIO) : Free Stock Analysis Report

Lam Research Corporation (LRCX) : Free Stock Analysis Report

Applied Materials, Inc. (AMAT) : Free Stock Analysis Report

Teradyne, Inc. (TER) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance