Lattice Semiconductor Corp (LSCC) Q1 2024 Earnings: Aligns with EPS Projections Amid Industry ...

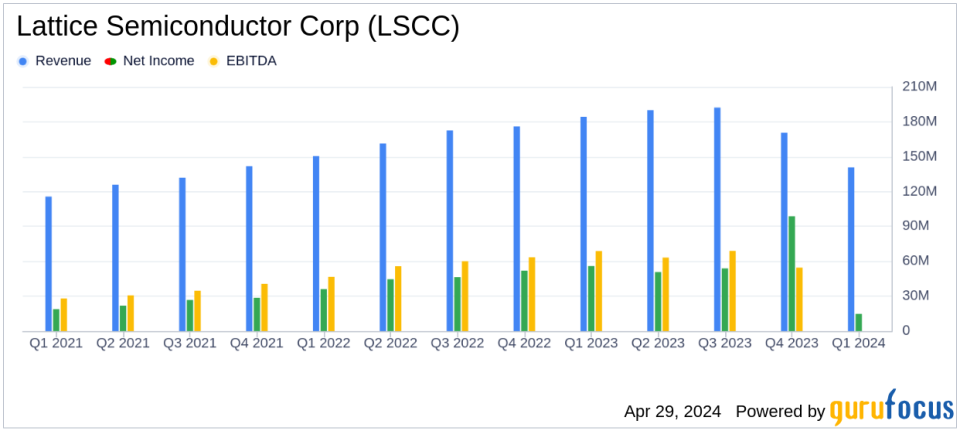

Revenue: Reported at $140.8 million for Q1 2024, slightly above the estimated $140.14 million.

Net Income: GAAP net income stood at $14.8 million, significantly below the estimated $39.43 million.

Earnings Per Share (EPS): GAAP EPS was $0.11, falling short of the estimated $0.28; non-GAAP EPS was $0.29, slightly surpassing the estimate.

Gross Margin: GAAP gross margin was 68.3%, with non-GAAP gross margin slightly higher at 69%.

Year-over-Year Comparisons: Revenue decreased by 23.6% from Q1 2023, and GAAP net income dropped by 73.5%.

Quarterly Expense Trends: Research and Development expenses as a percentage of revenue increased significantly year-over-year, from 19.5% to 28.8%.

Future Outlook: Expects Q2 2024 revenue to be between $120 million and $140 million with a non-GAAP gross margin around 69%.

Lattice Semiconductor Corporation (NASDAQ:LSCC), a leader in low power programmable solutions, disclosed its financial outcomes for the first quarter ended March 30, 2024, as per its recent 8-K filing. The company reported a revenue of $140.8 million and a GAAP net income of $0.11 per diluted share. On a non-GAAP basis, the net income per diluted share stood at $0.29, aligning closely with analyst expectations of $0.28.

Lattice Semiconductor, headquartered in Hillsboro, Oregon, serves a global client base with its innovative semiconductor technology, focusing on consumer, communications, and industrial markets. The company's core business includes silicon-based products, intellectual property licensing, and associated services.

Financial Performance Overview

The reported revenue of $140.8 million for Q1 2024 reflects a significant decline from the previous year's $184.3 million, indicating a 23.6% year-over-year decrease. This reduction mirrors the cyclical downturns the industry is currently facing. Despite these challenges, Lattice maintains a strong gross margin of 69% on a non-GAAP basis, slightly down from the previous year's 70.3%.

Operating expenses have risen, with R&D and SG&A expenses marking increases both quarterly and annually, signaling ongoing investments in innovation and market expansion despite the revenue dip. Net income has notably decreased to $14.8 million from $55.9 million in the prior year, a stark reflection of the current industry headwinds impacting the sector.

Strategic Initiatives and Industry Recognition

Amidst financial pressures, Lattice Semiconductor continues to innovate, highlighted by new AI-PC integrations with Dell Latitude models and enhancements in its FPGA design tools. The company's commitment to innovation and quality has earned it multiple industry accolades, including the 2024 Top Workplace USA and BIG AI Excellence Awards.

CEO Jim Anderson emphasized the strategic long-term positioning despite short-term industry challenges, stating,

First quarter 2024 results came in as expected and reflect the near-term impact of cyclic industry headwinds. Despite near-term headwinds, the Company is well-positioned for the long-term as we execute on the largest product portfolio expansion in our history."

Looking Ahead

For the second quarter of 2024, Lattice anticipates revenues to be between $120 million and $140 million, with a non-GAAP gross margin percentage around 69%. The forecast reflects cautious optimism, balancing the ongoing industry challenges with effective cost management and strategic growth initiatives.

Lattice's disciplined approach to capital management is also evident in its consistent shareholder returns, with the company marking its fourteenth consecutive quarter of share repurchases, as highlighted by CFO Sherri Luther.

In conclusion, while Lattice Semiconductor navigates through turbulent industry conditions, its focus on long-term growth strategies and maintaining robust operational disciplines underlines its resilience and commitment to delivering shareholder value. Investors and stakeholders will likely watch closely how the company's strategic initiatives unfold in the coming quarters.

For detailed financial figures and further information, please refer to the full earnings release on Lattice Semiconductor's website.

Explore the complete 8-K earnings release (here) from Lattice Semiconductor Corp for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance