Lattice Semiconductor (LSCC) Q1 Earnings Meet, Revenues Dip Y/Y

Lattice Semiconductor Corporation LSCC delivered first-quarter 2024 non-GAAP earnings of 29 cents per share, in line with the Zacks Consensus Estimate. The bottom line declined 43.1% on a year-over-year basis.

Revenues of $140.8 million beat the Zacks Consensus Estimate of $140 million. The top line decreased 23.6% year over year.

Weakness in the communications and computing end-market led to a year-over-year decline in the top line. The sluggish industrial and automotive end-market was another concern.

Nevertheless, strong momentum across the consumer end market was positive.

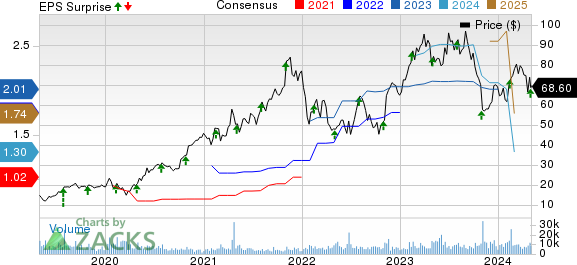

Lattice Semiconductor Corporation Price, Consensus and EPS Surprise

Lattice Semiconductor Corporation price-consensus-eps-surprise-chart | Lattice Semiconductor Corporation Quote

Revenue Details

By End Market:

Communications and Computing: Revenues generated from the market fell 17.6% year over year to $54.6 million (39% of the total revenues).

Industrial and Automotive: Revenues from the market declined 30.5% year over year to $75.3 million (53% of the total revenues) in the reported quarter.

Consumer: Revenues from the market were $10.9 million (8% of the total revenues), up 12.4% from the year-ago quarter.

By Geography & Channel:

Asia, Americas and Europe contributed 66%, 22% and 12% to total revenues in the reported quarter, respectively.

Revenues from distribution accounted for 87%, whereas direct revenues accounted for 13% of total revenues.

Operating Results

In the first quarter, the GAAP gross margin was 68.3%, which contracted 150 basis points (bps) year over year.

Non-GAAP operating expenses were $54.9 million, up 1.6% year over year. As a percentage of revenues, the figure expanded 970 bps year over year to 39% in the reported quarter.

Non-GAAP Research & development, and selling, general & administrative expenses expanded 660 bps and 330 bps year over year, respectively.

The non-GAAP operating margin was 30%, contracting 1100 bps from the prior-year quarter.

Balance Sheet

As of Mar 30, 2024, cash and cash equivalents were $107.5 million, up from $128.3 million as of Dec 30, 2023.

Accounts receivable was $98.9 million at the end of the first quarter, down from $104.4 million at the fourth-quarter end.

Guidance

For the second quarter of 2024, Lattice Semiconductor expects revenues between $120 million and $140 million.

The company anticipates a non-GAAP gross margin of 69% (+/-1%). Also, operating expenses are expected to be $54-$56 million on a non-GAAP basis.

Zacks Rank & Stocks to Consider

Currently, Lattice Semiconductor has a Zacks Rank #3 (Hold).

Some better-ranked stocks in the broader technology sector are Arista Networks ANET, Alphabet GOOGL and Badger Meter BMI, each sporting a Zacks Rank #1 (Strong Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

Shares of Arista Networks have gained 8.9% in the year-to-date period. The long-term earnings growth rate for ANET is 17.48%.

Shares of Alphabet have gained 16.5% in the year-to-date period. The long-term earnings growth rate for GOOGL is currently projected at 17.21%.

Shares of Badger Meter have gained 18.7% in the year-to-date period. The long-term earnings growth rate for BMI is 15.57%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Badger Meter, Inc. (BMI) : Free Stock Analysis Report

Lattice Semiconductor Corporation (LSCC) : Free Stock Analysis Report

Alphabet Inc. (GOOGL) : Free Stock Analysis Report

Arista Networks, Inc. (ANET) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance