Le Pen’s Far Right Wins First Round, Chases French Majority

(Bloomberg) -- Marine Le Pen’s National Rally scored an emphatic victory in the first round of France’s legislative election and set its sights on an absolute majority as President Emmanuel Macron and her other opponents began maneuvering to keep the far right from power.

Most Read from Bloomberg

24-Hour Stock Trading Is Booming – and Wall Street Is Rattled

Trump as President or Private Citizen: Why Supreme Court’s Immunity Ruling Is a Test

France’s Market Rally Falters as Investors See Enduring Risk

Justice Department to Charge Boeing, Seeks Guilty Plea From Planemaker

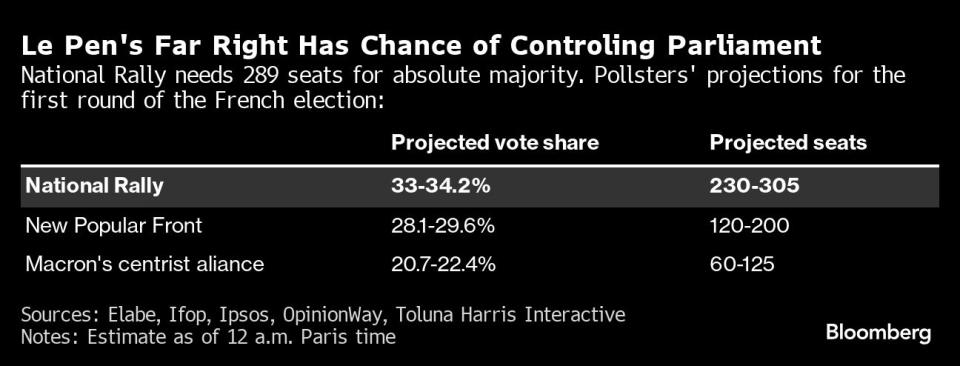

The party was projected to get as much as 34% of the vote, according to analysis from five polling companies late Sunday. The left-wing New Popular Front coalition was set to get about 29% and Macron’s centrist alliance between 21% and 22%.

After weeks of market turbulence since Macron called the snap election, the second round next Sunday will come down to one basic question: will Le Pen secure an absolute majority?

Pollsters’ projections suggested she is in with a chance, although it’s not the most likely outcome.

“The second round will be decisive,” Le Pen told jubilant supporters at her constituency in northern France. “To lead the reforms that the country needs, we need an absolute majority.”

The euro traded 0.2% higher against the dollar in Asian hours with the most extreme scenario, a victory for the left, off the table and a Le Pen majority looking less likely. Euro Stoxx 50 futures were up 1%, while French bond futures edged higher.

Already on Sunday night, Macron was reaching out to allies to try to prevent Le Pen from completing her victory.

“The far right is at the gates of power,” his prime minister, Gabriel Attal, said in a grim statement to reporters after the first projections were released. “Our objective is clear: to prevent the National Rally from having an absolute majority.”

What Bloomberg Economics Says...

“The main economic risk is that an RN government, emboldened by a big electoral mandate, attempts to implement a long list of ambitious and expensive policies. That could trigger a bond market selloff and bring growth to a halt.”

—Eleonora Mavroeidi, Maeva Cousin, Jamie Rush. Click here for their FRANCE REACT

The French political world is now embarking on an intense two-day period of horsetrading as each party tries to maximize its chances in the final ballot next weekend.

In more than half of the 577 constituencies, three people qualified for the runoffs. In those situations, the third-placed candidate can withdraw to boost the chances of another mainstream party defeating the National Rally.

Jean-Luc Melenchon of the New Popular Front, an alliance of left-wing parties, said that he would encourage third-placed candidates from his group to withdraw, while Macron himself released a statement calling for “a broad, clearly democratic and republican alliance for the second round.”

Macron’s Renaissance party said it would pull third-placed candidates where they placed third to help those who respect “the values of the republic” beat the far right.

That’s the catch though — Melenchon’s France Unbowed has proposed a raft of spending that would flout European Union budget rules and potentially alarm investors. So it’s not clear whether Macron’s party will withdraw in races where the far left would benefit.

The deadline for filing papers for the second round is 6 p.m. on Tuesday, and at that point the picture will become clearer.

In an early sign that Macron’s team is seeking to build alliances with the left, the prime minister decided Sunday evening to suspend the implementation of an unpopular change to unemployment insurance. The government had said the plans would encourage people into work by paring back the generosity of welfare, but opposition parties widely criticized the move at a time when joblessness has risen.

Even though Macron’s presidency isn’t formally at stake – and he’s said he has no plans to resign – Sunday’s result indicates he’ll either have to share governing responsibilities with Le Pen’s group or manage a parliament that is basically gridlocked.

The National Rally opposes most of Macron’s priorities, from migration and pension reform to strengthening the EU, and investors would prefer gridlock. The National Rally has said that it won’t lead the next government unless it has full control of the legislature.

Markets have been in turmoil since Macron called the snap election on June 9, leading to the worst bond rout since the sovereign debt crisis and erasing nearly $200 billion from the value of French stocks. The extra yield investors demand to hold 10-year French debt over similar German government bonds rose to 86 basis points on Friday, the most since 2012.

If alliances forming to block Le Pen from absolute power start to look credible, French markets would likely recover, according to Kathleen Brooks, research director at XTB.

“A hung parliament could make it hard to get anything done in France in the current parliament, which is exactly what the markets would like,” she said.

--With assistance from Cormac Mullen.

(Updates with latest projections in second paragraph, markets in sixth)

Most Read from Bloomberg Businessweek

Japan’s Tiny Kei-Trucks Have a Cult Following in the US, and Some States Are Pushing Back

The Fried Chicken Sandwich Wars Are More Cutthroat Than Ever Before

RTO Mandates Are Killing the Euphoric Work-Life Balance Some Moms Found

The FBI’s Star Cooperator May Have Been Running New Scams All Along

©2024 Bloomberg L.P.

Yahoo Finance

Yahoo Finance