Lear (LEA) Earnings & Revenues Beat Estimates in Q3, Down Y/Y

Lear Corporation LEA third-quarter 2019 adjusted earnings came in at $3.56 per share, down from $4.09 recorded in the prior-year quarter. However, the bottom line surpassed the Zacks Consensus Estimate of $3.14. At the end of third-quarter 2019, adjusted net income was $217 million compared with $269 million in the prior-year quarter.

In the reported quarter, revenues declined 1% year over year to $4.8 billion. The downside was caused by lower production on key Lear platforms and net foreign exchange rate fluctuations, partly offset by the addition of business. However, the top line surpassed the Zacks Consensus Estimate of $4.73 billion.

The company’s core operating earnings declined to $338 million from $399 million in third-quarter 2018.

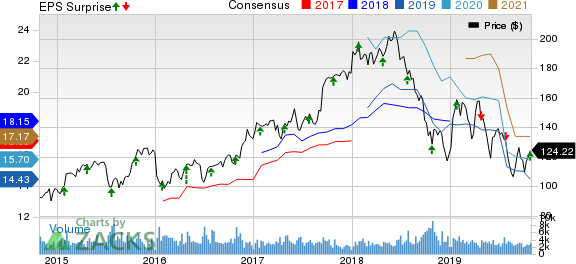

Lear Corporation Price, Consensus and EPS Surprise

Lear Corporation price-consensus-eps-surprise-chart | Lear Corporation Quote

Segment Performances

In the reported quarter, margins and adjusted margins for the Seating segment were 7.6% and 8.2% of sales, respectively.

For the E-Systems segment, margins and adjusted margins were 6.7% and 7.6% of sales, respectively.

Share Repurchase

During the reported quarter, Lear repurchased 616,635 shares for $76 million. At the end of the quarter, the company had remaining share-repurchase authorization of $1.2 billion, which will expire on December 31, 2021. The figure represents approximately 17% of Lear’s total market capitalization at current market prices.

Financial Position

The company had $1.3 billion of cash and cash equivalents as of Sep 28, 2019, compared with $1.49 billion recorded as of Dec 31, 2018. It had long-term debt of $2.29 billion as of Sep 28, 2019, compared with $1.94 billion recorded as of Dec 31, 2018.

At the end of the quarter under review, Lear’s net operating cash inflow was $343.4 million compared with $267.9 million as of Sep 29, 2018. During the period, its capital expenditure amounted to $150.8 million, down from $160.5 million recorded in the prior-year quarter.

Trimmed Outlook

The company trimmed its outlook for 2019 mainly due to the estimated effect of a labor strike at its largest customer.

Lear now expects net sales of $19-$19.5 billion versus $19.8-$20.3 billion stated earlier. Adjusted net income is anticipated to be $765-$845 million for the current year compared with previously mentioned $885-$965 million. Further, the company projects capital spending of roughly $625 million for the year compared with $650 million stated previously.

Zacks Rank & Stocks to Consider

Lear currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the Auto-Tires-Trucks sector are BRP Inc DOOO, currently sporting a Zacks Rank #1 (Strong Buy), as well as Sonic Automotive, Inc SAH and Lithia Motors, Inc LAD, carrying a Zacks Rank of 2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

BRP has an expected earnings growth rate of 18.4% for 2019. The company’s shares have gained 67.3% year to date.

Sonic Automotive has an estimated earnings growth rate of 37.8% for 2019. Its shares have gained 139% year to date.

Lithia Motors has an estimated earnings growth rate of 15.1% for 2019. Its shares have gained 104.4% year to date.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look.

See the pot trades we're targeting>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Sonic Automotive, Inc. (SAH) : Free Stock Analysis Report

Lithia Motors, Inc. (LAD) : Free Stock Analysis Report

Lear Corporation (LEA) : Free Stock Analysis Report

BRP Inc. (DOOO) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance