Lear (LEA) Earnings & Revenues Beat Estimates in Q4, Down Y/Y

Lear Corporation’s LEA fourth-quarter 2019 adjusted earnings came in at $2.64 per share, down the $4.05 recorded in the prior-year quarter. However, the bottom line surpassed the Zacks Consensus Estimate of $2.25. Higher-than-expected revenues in both its Seating and E-Systems segments led to this outperformance.

At the end of fourth-quarter 2019, adjusted net income was $161 million compared with the prior-year quarter’s $261 million.

In the reported quarter, revenues declined 2.51% year over year to $4.8 billion. This downside resulted from lower production on key Lear platforms and net foreign-exchange rate fluctuations, partly offset by the addition of business and the Xevo acquisition. However, the top line surpassed the Zacks Consensus Estimate of $4.5 billion.

The company’s core operating earnings declined to $241 million from the $389 million reported in fourth-quarter 2018.

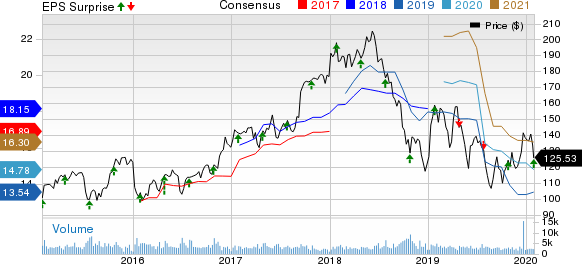

Lear Corporation Price, Consensus and EPS Surprise

Lear Corporation price-consensus-eps-surprise-chart | Lear Corporation Quote

Segment Performances

In fourth-quarter 2019, sales in the Seating segment totaled $3,629 million, down 2.82% year over year. Adjusted segment earnings were $212.7 million compared to $299.4 million in the fourth quarter of 2018. However, it topped the Zacks Consensus Estimate of $201 million in the quarter. Adjusted margins for the Seating segment was 5.9% of sales.

Sales in the E-Systems segment totaled $1,188.5 million, marking a decline of 1.62% year over year, in fourth-quarter 2019. Adjusted segment earnings amounted to $91.9 million in the quarter compared to $136 million in the fourth quarter of 2018. However, it surpassed the consensus mark of $71 million. For the E-Systems segment, adjusted margins were 7.7% of sales.

Share Repurchase

During the fourth quarter, Lear repurchased 215,200 shares for $25 million. At the end of the quarter, the company had remaining share-repurchase authorization of $1.2 billion, which will expire on Dec 31, 2021. The figure represents approximately 15% of Lear’s total market capitalization at current market prices.

Financial Position

The company had $1,487 million of cash and cash equivalents as of Dec 31, 2019, compared with $1,493 million recorded as of Dec 31, 2018. It had long-term debt of $2.29 billion as of Dec 31, 2019, compared with $1.94 billion recorded as of Dec 31, 2018. The long-term debt to capital ratio stands at 33.8%.

At the end of the quarter, Lear’s net operating cash inflow was $485 million compared with $758.2 million as of Dec 31, 2018. During the period, its capital expenditure amounted to $193.8 million, up from the $184.3 million recorded in the prior-year quarter. Free cash flow came in at $291.2 million, down from the year-ago figure of $573.9 million.

2020 Outlook

For full-year 2020, Lear expects net sales of $19.4-$20.2 billion. Adjusted net income is anticipated in the band of $780-$880 million. Further, the company projects capital spending of roughly $600 million, while free cash flow is expected between $600-$700 million.

Zacks Rank & Stocks to Consider

Lear currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the Auto-Tires-Trucks sector include Gentex Corporation GNTX, Tesla, Inc. TSLA and SPX Corporation SPXC, each carrying a Zacks Rank of 2 (Buy), at present. You can see the complete list of today’s Zacks #1 (Strong Buy) Rank stocks here.

Gentex Corporation has an estimated earnings growth rate of 7.32% for 2020. The company’s shares have appreciated 40.3% in a year’s time.

Tesla has a projected earnings growth rate of 6,460% for the ongoing year. Its shares have surged 83.6% over the past year.

SPX has an expected earnings growth rate of 8.09% for the current year. The stock has rallied 73.2% in the past year.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look.

See the pot trades we're targeting>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Tesla, Inc. (TSLA) : Free Stock Analysis Report

Gentex Corporation (GNTX) : Free Stock Analysis Report

Lear Corporation (LEA) : Free Stock Analysis Report

SPX Corporation (SPXC) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance