What We Learned About Astrotech's (NASDAQ:ASTC) CEO Pay

Tom Pickens became the CEO of Astrotech Corporation (NASDAQ:ASTC) in 2007, and we think it's a good time to look at the executive's compensation against the backdrop of overall company performance. This analysis will also evaluate the appropriateness of CEO compensation when taking into account the earnings and shareholder returns of the company.

See our latest analysis for Astrotech

How Does Total Compensation For Tom Pickens Compare With Other Companies In The Industry?

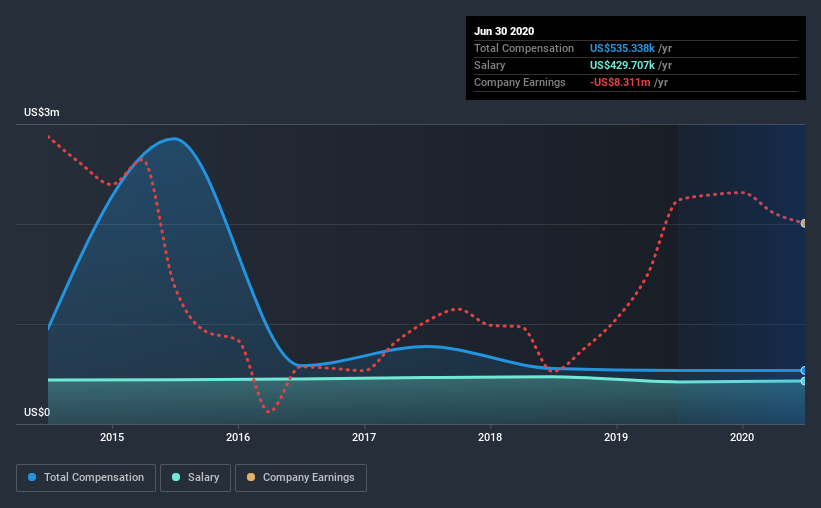

Our data indicates that Astrotech Corporation has a market capitalization of US$40m, and total annual CEO compensation was reported as US$535k for the year to June 2020. That's mostly flat as compared to the prior year's compensation. Notably, the salary which is US$429.7k, represents most of the total compensation being paid.

On comparing similar-sized companies in the industry with market capitalizations below US$200m, we found that the median total CEO compensation was US$429k. This suggests that Astrotech remunerates its CEO largely in line with the industry average. What's more, Tom Pickens holds US$3.9m worth of shares in the company in their own name, indicating that they have a lot of skin in the game.

Component | 2020 | 2019 | Proportion (2020) |

Salary | US$430k | US$421k | 80% |

Other | US$106k | US$114k | 20% |

Total Compensation | US$535k | US$535k | 100% |

On an industry level, roughly 17% of total compensation represents salary and 83% is other remuneration. Astrotech pays out 80% of remuneration in the form of a salary, significantly higher than the industry average. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

A Look at Astrotech Corporation's Growth Numbers

Astrotech Corporation's earnings per share (EPS) grew 30% per year over the last three years. It achieved revenue growth of 285% over the last year.

This demonstrates that the company has been improving recently and is good news for the shareholders. The combination of strong revenue growth with medium-term EPS improvement certainly points to the kind of growth we like to see. Although we don't have analyst forecasts, you might want to assess this data-rich visualization of earnings, revenue and cash flow.

Has Astrotech Corporation Been A Good Investment?

With a three year total loss of 29% for the shareholders, Astrotech Corporation would certainly have some dissatisfied shareholders. This suggests it would be unwise for the company to pay the CEO too generously.

To Conclude...

As we touched on above, Astrotech Corporation is currently paying a compensation that's close to the median pay for CEOs of companies belonging to the same industry and with similar market capitalizations. At the same time, the company has logged negative shareholder returns over the last three years. But EPS growth is moving in a favorable direction, certainly a positive sign. Overall, we wouldn't say Tom is paid an unjustified compensation, but shareholders might not favor a raise before shareholder returns show a positive trend.

It is always advisable to analyse CEO pay, along with performing a thorough analysis of the company's key performance areas. We did our research and identified 5 warning signs (and 3 which shouldn't be ignored) in Astrotech we think you should know about.

Important note: Astrotech is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

Yahoo Finance

Yahoo Finance