Legion Partners Asset Management, LLC Increases Stake in Lifecore Biomedical Inc

Overview of the Recent Transaction

On October 3, 2024, Legion Partners Asset Management, LLC (Trades, Portfolio), a prominent investment firm, executed a significant transaction by acquiring 3,494,195 additional shares of Lifecore Biomedical Inc (NASDAQ:LFCR). This move not only increased the firm's total holdings in Lifecore Biomedical to 6,462,604 shares but also elevated the stock's presence in their portfolio to a substantial 8.93%. Priced at $4.705 per share, this transaction underscores the firm's growing interest in the pharmaceutical sector.

Profile of Legion Partners Asset Management, LLC (Trades, Portfolio)

Based in Beverly Hills, California, Legion Partners Asset Management, LLC (Trades, Portfolio) is known for its strategic investment approaches, focusing primarily on unlocking shareholder value through active engagement. With a portfolio that includes 14 stocks, the firm has significant holdings in sectors like Consumer Cyclical and Technology. Their top holdings include notable companies such as The Chefs' Warehouse Inc (NASDAQ:CHEF) and OneSpan Inc (NASDAQ:OSPN). The firm manages an equity portfolio valued at approximately $324 million.

Detailed Insights into the Trade

The recent acquisition by Legion Partners Asset Management has significantly impacted their portfolio, with Lifecore Biomedical now constituting 16.60% of their total investments. This strategic addition at a trade price of $4.705 per share reflects a calculated move to bolster their position in the pharmaceutical industry, particularly in the niche segment of complex sterile injectable pharmaceutical products.

Exploring Lifecore Biomedical Inc

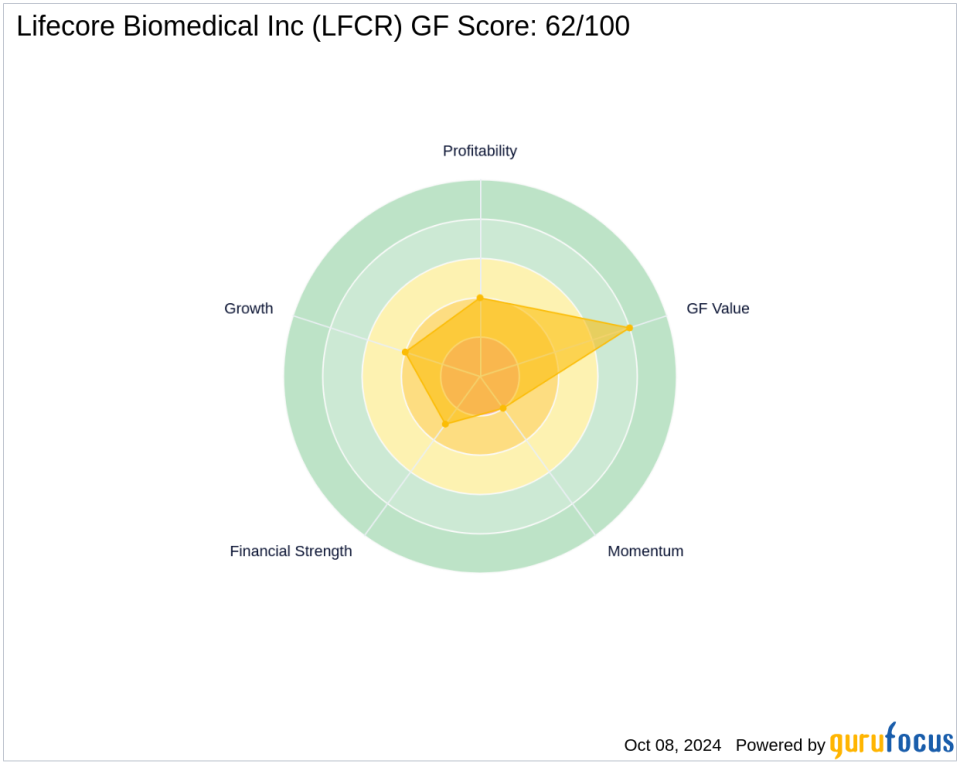

Lifecore Biomedical Inc, headquartered in the USA, operates as a fully integrated contract development and manufacturing organization (CDMO). Specializing in the development, filling, and finishing of sterile injectable pharmaceuticals, Lifecore Biomedical has carved a niche in manufacturing injectable-grade Hyaluronic Acid. Despite a challenging market, the company holds a modestly undervalued GF Value of $6.99, indicating potential for growth.

Financial Health and Market Performance

Lifecore Biomedical's financial metrics reveal a mixed picture. With a Return on Equity (ROE) of 475.50% and a Return on Assets (ROA) of 4.82%, the company shows strong profitability metrics. However, its cash to debt ratio stands at a low 0.07, reflecting potential liquidity risks. The stock has experienced a year-to-date decline of 20.22%, but recent gains post-transaction show an 8.18% increase, suggesting a positive market response to the firm's increased stake.

Comparative and Strategic Analysis

Compared to other major investors like GAMCO Investors, Legion Partners Asset Management, LLC (Trades, Portfolio)'s recent move positions them as a significant stakeholder in Lifecore Biomedical. This strategic decision likely stems from the firm's confidence in Lifecore's specialized pharmaceutical manufacturing capabilities and its potential for robust returns.

Conclusion

The recent acquisition by Legion Partners Asset Management, LLC (Trades, Portfolio) marks a notable development in their investment strategy, particularly within the pharmaceutical sector. By increasing their stake in Lifecore Biomedical Inc, the firm not only underscores their commitment to this industry but also sets the stage for potential future gains, aligning with their overall portfolio growth objectives.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.