Leisure Products Stocks Q1 Results: Benchmarking Johnson Outdoors (NASDAQ:JOUT)

Wrapping up Q1 earnings, we look at the numbers and key takeaways for the leisure products stocks, including Johnson Outdoors (NASDAQ:JOUT) and its peers.

Leisure products cover a wide range of goods in the consumer discretionary sector. Maintaining a strong brand is key to success, and those who differentiate themselves will enjoy customer loyalty and pricing power while those who don’t may find themselves in precarious positions due to the non-essential nature of their offerings.

The 16 leisure products stocks we track reported a mixed Q1; on average, revenues beat analyst consensus estimates by 4.3%. while next quarter's revenue guidance was 3.5% below consensus. Inflation progressed towards the Fed's 2% goal at the end of 2023, leading to strong stock market performance. The start of 2024 has been a bumpier ride, as the market switches between optimism and pessimism around rate cuts due to mixed inflation data, and leisure products stocks have had a rough stretch, with share prices down 6.9% on average since the previous earnings results.

Johnson Outdoors (NASDAQ:JOUT)

Operating in locations worldwide, Johnson Outdoors (NASDAQ:JOUT) specializes in innovative outdoor recreational products for adventurers worldwide.

Johnson Outdoors reported revenues of $175.9 million, down 13% year on year, topping analysts' expectations by 10.8%. It was a mixed quarter for the company: Johnson Outdoors missed on operating profit by a meaningful amount. The company called out "challenging marketplace conditions" and added that it is "continuing to work hard to improve our cost structure and reduce inventory levels."

“Our second quarter results reflect challenging marketplace conditions. In the season ahead, we are investing in marketing and promotions and supporting our new product launches, like the new Minn Kota Quest trolling motor line that is seeing positive response from the trade. We are also continuing to work hard to improve our cost structure and reduce inventory levels,” said Helen Johnson-Leipold, Chairman and Chief Executive Officer.

The stock is down 19.4% since the results and currently trades at $34.33.

Is now the time to buy Johnson Outdoors? Access our full analysis of the earnings results here, it's free.

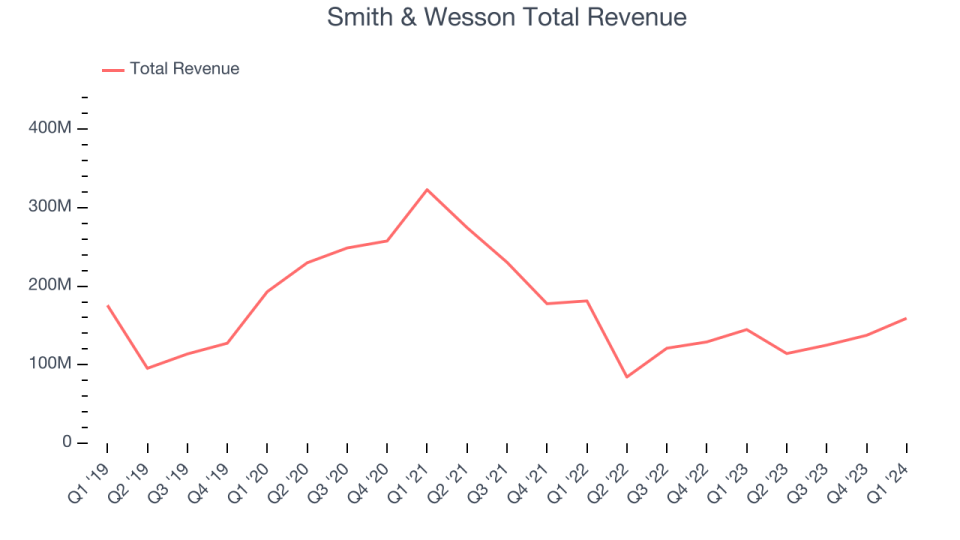

Best Q1: Smith & Wesson (NASDAQ:SWBI)

With a history dating back to 1852, Smith & Wesson (NASDAQ:SWBI) is a firearms manufacturer known for its handguns and rifles.

Smith & Wesson reported revenues of $159.1 million, up 9.9% year on year, outperforming analysts' expectations by 1.5%. It was a very strong quarter for the company: Smith & Wesson blew past analysts' EPS expectations this quarter. Its operating margin also outperformed Wall Street's estimates.

The stock is down 12.9% since the results and currently trades at $14.29.

Is now the time to buy Smith & Wesson? Access our full analysis of the earnings results here, it's free.

Weakest Q1: Ruger (NYSE:RGR)

Founded in 1949, Ruger (NYSE:RGR) is an American manufacturer of firearms for the commercial sporting market.

Ruger reported revenues of $136.8 million, down 8.5% year on year, falling short of analysts' expectations by 10.8%. It was a weak quarter for the company, with revenue and EPS falling below analysts' expectations.

Ruger had the weakest performance against analyst estimates in the group. The stock is down 10.9% since the results and currently trades at $41.3.

Read our full analysis of Ruger's results here.

Latham (NASDAQ:SWIM)

Started as a family business, Latham (NASDAQ:SWIM) is a global designer and manufacturer of in-ground residential swimming pools and related products.

Latham reported revenues of $110.6 million, down 19.7% year on year, surpassing analysts' expectations by 8.8%. It was a very strong quarter for the company, with an impressive beat of analysts' earnings estimates.

The stock is down 10.4% since the results and currently trades at $2.68.

Read our full, actionable report on Latham here, it's free.

Harley-Davidson (NYSE:HOG)

Founded in 1903, Harley-Davidson (NYSE:HOG) is an American motorcycle manufacturer known for its heavyweight motorcycles designed for cruising on highways.

Harley-Davidson reported revenues of $1.73 billion, down 3.3% year on year, surpassing analysts' expectations by 28.4%. It was an impressive quarter for the company, with a decent beat of analysts' earnings estimates.

Harley-Davidson delivered the biggest analyst estimates beat among its peers. The stock is down 19.2% since the results and currently trades at $31.86.

Read our full, actionable report on Harley-Davidson here, it's free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.