Leisure Stock Earnings to Watch on May 2: WYN, NCLH & More

The Q1 earnings season is in full swing and the trend so far appears impressive. Notably, the S&P 500 companies are likely to witness highest quarterly earnings growth rate in seven years.

Per the latest Earnings Preview, out of the 267 S&P 500 companies that have come up with their financial numbers, 76.8% outpaced earnings estimates, 73.8% exceeded top-line expectations and 61.4% outpaced on both the counts. Also, total earnings of these companies increased 25.1% from the same period last year on 10% higher revenues.

According to the report, total earnings for S&P 500 companies are expected to rise 22.6% year over year, with revenues likely to increase 8.4%. This compares favorably with year-over-year earnings growth of 13.4% but unfavorably with 8.6% year-over-year improvement in revenues in the last report.

Consumer Discretionary Sector on Growth Trajectory

Like some other high-flying sectors, the widely diversified Consumer Discretionary is likely to put up a stellar show in Q1. Currently, the domestic economy is favorable for this space owing to increased demand for goods and services. According to the Fed’s latest forecast, the economy will grow at a reasonable rate of 2.7% in 2018. Unemployment is predicted at 3.8% for the current year. Moreover, high real disposable income and low inflation are resulting in improved purchasing behavior. The fourth quarter of 2017 witnessed the highest consumer spending in three years.

Total earnings for the sector are anticipated to increase 12.1% in Q1, up from 0.8% in the last reported quarter. Revenues are projected to grow 6.6%, higher than 4.6% in the fourth quarter 2017. Margins are expected to increase 0.6% compared to a 0.4% decline in the fourth quarter of 2017. Notably, leisure stocks form part of the Consumer Discretionary sector.

Among the leisure stocks lined up to report on May 2, let’s take a look at five key picks from this sector.

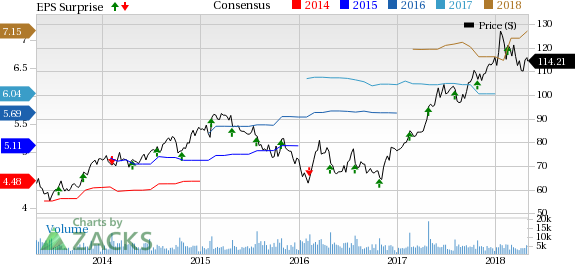

Wyndham Worldwide Corp. WYN is scheduled to report first-quarter 2018 before the opening bell. In the last reported quarter, its earnings have surpassed the Zacks Consensus Estimate by 10.4%.

The company believes that its efforts to enhance guest experience and raise occupancy will reflect in its first-quarter revenues. Also, it has been increasingly focusing on marketing campaigns, digital experiences, websites, on-property amenities, travel perks and marketing partnerships to drive its overall top-line performance. However, in the recent times, a tense macro-economic condition along with a slight dearth of tourists in the United States might affect the company’s revenues in Q1.

The Zacks Consensus Estimate for first-quarter earnings is pegged at $1.27, reflecting a year-over-year increase of 11.4%. Meanwhile, analysts polled by Zacks expect revenues of $1.23 billion, mirroring a decline of 6.4% from the year-ago quarter.

Wyndham Worldwide has a Zacks Rank #4 (Sell) and an Earnings ESP of -0.99%, a combination that does not indicate a beat. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter. (Read more: Wyndham to Report Q1 Earnings: What's in the Cards?)

Wyndham Worldwide Corp Price, Consensus and EPS Surprise

Wyndham Worldwide Corp Price, Consensus and EPS Surprise | Wyndham Worldwide Corp Quote

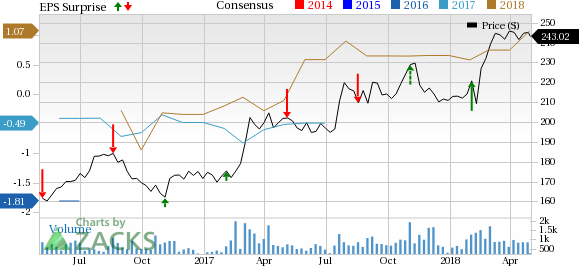

Norwegian Cruise Line Holdings Ltd. NCLH is slated to release first-quarter 2018 results before the market opens. In the fourth quarter of 2017, the company delivered a positive earnings surprise of 7.9%. Norwegian Cruise Line has also surpassed the Zacks Consensus Estimate for earnings in each of the trailing four quarters, with an average beat of approximately 5.9%.

However, things do not look rosy for the company in the soon-to-be reported quarter. High costs owing to the upsurge in fuel prices are likely to hurt results. In fact, the stock has been grappling with increase in operating expenses for quite some time. This is evident from the disappointing price movement in a year’s time.

We expect high costs to limit bottom-line growth at Norwegian Cruise Line in the first quarter of 2018. In the last reported quarter, an increase in cruise operating expenses affected the company’s earnings growth and the first quarter is unlikely to be any different. Rise in fuel costs are primarily responsible for pushing up total expenses. The company expects fuel price per metric ton, net of hedges, to be $450 for first quarter. Also, oil prices have been on an uptrend lately and were up approximately 8% in the January-to-March period. We note that high oil prices do not bode well for travel-focused companies like Norwegian Cruise Line as fuel costs account for a significant chunk of their expenditures.

Norwegian Cruise Line has a Zacks Rank #4 and an Earnings ESP of +0.47%, a combination that does not indicate a beat. (Read more: Will High Costs Mar Norwegian Cruise Line Q1 Earnings?)

Norwegian Cruise Line Holdings Ltd. Price, Consensus and EPS Surprise

Norwegian Cruise Line Holdings Ltd. Price, Consensus and EPS Surprise | Norwegian Cruise Line Holdings Ltd. Quote

The Madison Square Garden Company MSG, which is involved in the sports, entertainment and media industries, is scheduled to report third-quarter fiscal 2018 results before the opening bell. In the second-quarter fiscal 2018, the company recorded positive earnings surprise of 70.6%. However, in the trailing four quarters, the company’s earnings have missed the estimate, with an average of 7.1%. Madison Square Garden has a Zacks Rank #1 (Strong Buy) and an Earnings ESP of -24.24%. This is because the Most Accurate estimate is pegged at a loss of 41 cents while the Zacks Consensus Estimate stands at a loss of 33 cents. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Madison Square Garden Company Price, Consensus and EPS Surprise

The Madison Square Garden Company Price, Consensus and EPS Surprise | The Madison Square Garden Company Quote

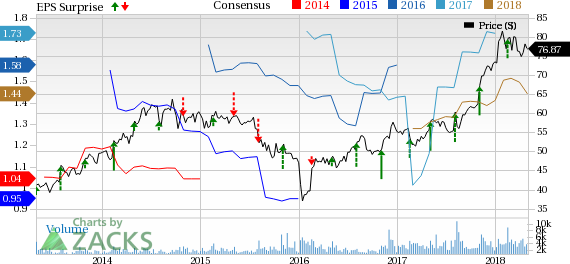

Hyatt Hotels Corporation H is scheduled to report first-quarter 2018 numbers after market close. In the last reported quarter, the company’s earnings surpassed the Zacks Consensus Estimate by 21.1%. Also, it outpaced earnings estimates in each of the trailing four quarters, with an average beat of 81.7%.

On the earnings front, Hyatt Hotels expects the first quarter of 2018 to be the weakest one. The company, which is likely to witness $67 million transaction impact in 2018, will incur nearly $38 million in the quarter under review. Moreover, comparable owned and leased margin contraction is expected to impact the company’s bottom line. The Zacks Consensus Estimate for owned and leased revenues is pegged at $502 million, down more than 12% year over year.

Hyatt Hotels has a Zacks Rank #3 (Hold) and an Earnings ESP of -3.30%, a combination that does not indicate a beat. (Read more: What's in Store for Hyatt Hotels This Earnings Season?)

Hyatt Hotels Corporation Price, Consensus and EPS Surprise

Hyatt Hotels Corporation Price, Consensus and EPS Surprise | Hyatt Hotels Corporation Quote

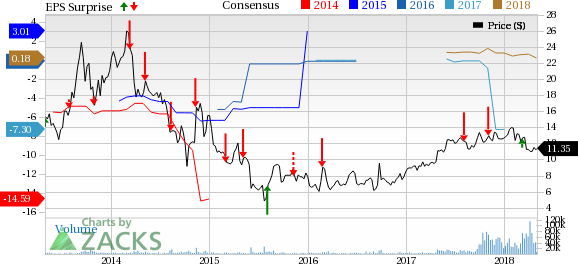

Caesars Entertainment Corporation CZR, a gaming company engaged in providing casino entertainment services, is slated to report first-quarter 2018 results after the market close. In the fourth-quarter 2017, the company’s earnings surpassed the consensus mark by 7.7%. However, the bottom line missed the estimate in two of the trailing three quarters, with an average of 97.5%.

Although Caesars Entertainment has a Zacks Rank #3, its Earnings ESP of 0.00% makes an earnings beat unlikely. The Zacks Consensus Estimate is currently pegged at a loss of 3 cents.

Caesars Entertainment Corporation Price, Consensus and EPS Surprise

Caesars Entertainment Corporation Price, Consensus and EPS Surprise | Caesars Entertainment Corporation Quote

Wall Street’s Next Amazon

Zacks EVP Kevin Matras believes this familiar stock has only just begun its climb to become one of the greatest investments of all time. It’s a once-in-a-generation opportunity to invest in pure genius.

Click for details >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Caesars Entertainment Corporation (CZR) : Free Stock Analysis Report

Wyndham Worldwide Corp (WYN) : Free Stock Analysis Report

Hyatt Hotels Corporation (H) : Free Stock Analysis Report

Norwegian Cruise Line Holdings Ltd. (NCLH) : Free Stock Analysis Report

The Madison Square Garden Company (MSG) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance