Lending Tree (TREE) Rises on Q3 Earnings Beat, Revenues Miss

Lending Tree, Inc. TREE reported an adjusted net loss per share of 36 cents in third-quarter 2022. The Zacks Consensus Estimate was pegged at a loss of 89 cents. The reported figure compares unfavorably with an income of 75 cents reported in the prior-year quarter.

Likely reflecting the better-than-expected results, the stock gained 7.5% following the release of the results. Third-quarter results of Lending Tree were aided by lower costs, while a decline in revenues was a spoilsport.

LendingTree reported a net loss from continuing operations of $158.7 million or $12.44 per share against a net income of $4.4 million or 33 cents per share reported in the year-ago quarter.

Revenues Decline, Expenses Fall

Total revenues were down 20% year over year to $237.8 million in the third quarter. The downside primarily stemmed from a decline in Home and Insurance segment revenues. Also, the reported figure missed the Zacks Consensus Estimate of $240.7 million.

The total cost of revenues was $14.1 million, down 6.1% from the prior-year quarter. Also, there was a decline in general and administrative expenses, while product development costs increased.

Adjusted earnings before interest, taxes, depreciation and amortization (EBITDA) totaled $9.8 million, down 76% year over year. The variable marketing margin was at $74.7 million, down 29%.

Outlook

For fourth-quarter 2022, total revenues are estimated to be $202-$217 million. Adjusted EBITDA and the variable marketing margin are anticipated to be $9-$14 million and $70-$80 million, respectively.

For 2022, total revenues are estimated to be $985-$1,000 million. Adjusted EBITDA is anticipated to be $77-$82 million. The variable marketing margin is expected to be $330-$340 million.

Conclusion

The company’s total revenues were affected mainly by the decline in Home and Insurance segment revenues. Nonetheless, the company remained focused on maintaining the balance between near-term profitability and aligning it for long-term success.

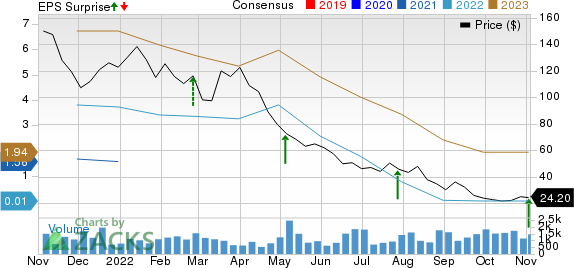

LendingTree, Inc. Price, Consensus and EPS Surprise

LendingTree, Inc. price-consensus-eps-surprise-chart | LendingTree, Inc. Quote

Currently, LendingTree carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performance of Other Finance Stocks

Charles Schwab’s SCHW third-quarter 2022 adjusted earnings of $1.10 per share handily beat the Zacks Consensus Estimate of $1.05. The bottom line rose 31% from the prior-year quarter.

SCHW’s results benefited from higher rates, which led to a rise in net interest income. Thus, revenues witnessed an improvement despite higher volatility hurting the trading income. Also, the absence of fee waivers and solid brokerage account numbers acted as tailwinds in the quarter. However, higher expenses were headwinds for SCHW.

Interactive Brokers Group’s IBKR third-quarter 2022 adjusted earnings per share of $1.08 handily surpassed the Zacks Consensus Estimate of 99 cents. The bottom line reflects a rise of 38.5% from the prior-year quarter.

Results were primarily aided by an improvement in revenues. Also, the capital position remained strong. However, higher expenses and a fall in daily average revenue trades were headwinds for IBKR.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The Charles Schwab Corporation (SCHW) : Free Stock Analysis Report

Interactive Brokers Group, Inc. (IBKR) : Free Stock Analysis Report

LendingTree, Inc. (TREE) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance