LendingTree (TREE) Q3 Earnings Top Estimates, Revenues Up

LendingTree TREE reported a positive earnings surprise of 34.7% in third-quarter 2019. Adjusted net income per share of $2.25 outpaced the Zacks Consensus Estimate of $1.67. Further, the figure comes in higher than the prior-year quarter’s $1.92 per share.

The company’s results were driven by higher revenues, with major contribution from non-mortgage products revenues. Also, adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) displayed impressive growth. However, rise in expenses was a major drag.

The company reported GAAP net income of $24.5 million or $1.67 per share compared with the $28.4 million or $2.05 recorded in the year-ago quarter.

Revenue Growth Partially Offset by Higher Expenses

Total revenues surged 58% year over year to $310.6 million in the third quarter. This upside primarily stemmed from higher non-mortgage product revenues as well as mortgage revenues. Furthermore, the reported figure outpaced the Zacks Consensus Estimate of $295.2 million.

Total costs and expenses came in at $279.4 million, flaring up 58% from the prior-year quarter. This upswing primarily resulted from rise in almost all components of cost.

Adjusted EBITDA totaled $63 million, up 39% from the $45.3 million reported in the prior-year quarter.

As of Sep 30, 2019, cash and cash equivalents were $50.5 million, slumping nearly 52% from Dec 31, 2018. Long-term debt was up 4% from the prior-year end to $261 million. Total shareholders' equity was $389.3 million, up 12.4% from the Dec 31, 2018 level.

Outlook

Concurrent with the third-quarter results, management issues revised full-year 2019 estimates.

Full-Year 2019

Total revenues of $1,100-$1,115 million predicted, up from the previous projection of $1,080-$1,100 million.

Adjusted EBITDA anticipated in the $197-$205 million band, up from the prior forecast of $195-$205 million.

Variable Marketing Margin projected at $395-$405 million, up from the earlier estimate of $390-$405 million.

Conclusion

LendingTree put up a decent performance during the July-September period. The company’s expansion strategy for its non-mortgage business seems to be working well, suggested by the continued rise in non-mortgage revenues. This apart, LendingTree’s commitment to diversify product offerings beyond mortgage-related products augurs well for the long haul.

Nevertheless, escalating expenses remain a concern.

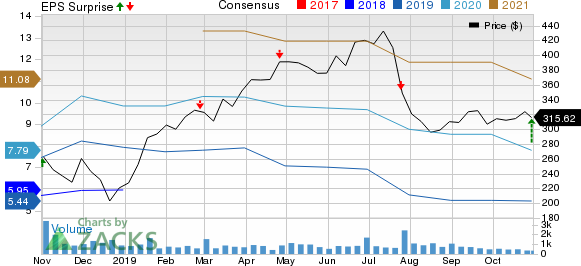

LendingTree, Inc. Price, Consensus and EPS Surprise

LendingTree, Inc. price-consensus-eps-surprise-chart | LendingTree, Inc. Quote

Currently, LendingTree carries a Zacks Rank #5 (Strong Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performance of Other Finance Stocks

UMB Financial UMBF delivered third-quarter 2019 net operating earnings of $1.27 per share, surpassing the Zacks Consensus Estimate of $1.17. The reported figure also compared favorably with the prior-year quarter’s earnings of $1.16.

Bank of Hawaii Corporation BOH reported a negative earnings surprise of 6.5% in the September-end quarter. Earnings per share of $1.29 lagged the Zacks Consensus Estimate of $1.38. Further, the reported figure compared unfavorably with the $1.36 earned in the prior-year quarter.

Texas Capital Bancshares Inc. TCBI posted earnings per share of $1.70 in the third quarter, outpacing the Zacks Consensus Estimate of $1.49. Results compared favorably with the prior-year quarter’s $1.65 as well.

Free: Zacks’ Single Best Stock Set to Double

Today you are invited to download our just-released Special Report that reveals 5 stocks with the most potential to gain +100% or more in 2020. From those 5, Zacks Director of Research, Sheraz Mian hand-picks one to have the most explosive upside of all.

This pioneering tech ticker had soared to all-time highs and then subsided to a price that is irresistible. Now a pending acquisition could super-charge the company’s drive past competitors in the development of true Artificial Intelligence. The earlier you get in to this stock, the greater your potential gain.

Download Free Report Now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

UMB Financial Corporation (UMBF) : Free Stock Analysis Report

Texas Capital Bancshares, Inc. (TCBI) : Free Stock Analysis Report

Bank of Hawaii Corporation (BOH) : Free Stock Analysis Report

LendingTree, Inc. (TREE) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance