Lennar (LEN) Q1 Earnings & Revenues Top, Stock Up, Margins Dip

Lennar Corporation LEN reported impressive results for first-quarter fiscal 2023, where earnings and revenues beat the Zacks Consensus Estimate. Following the results, the company’s shares rose 3.41% in an after-hours trading session on Mar 14.

Pertaining to the prospect, Stuart Miller, executive chairman of Lennar, said, "As we have seen over the past quarters, interest rates are fluctuating and are likely to continue to move and the housing market will continue to rebalance pricing and interest rates. While we have a clear-cut strategy of execution, we will only give broad boundaries for deliveries and gross margin.”

Quarterly Numbers

LEN reported adjusted quarterly earnings (excluding mark-to-market losses on technology investments) of $2.12 per share, which surpassed the Zacks Consensus Estimate of $1.56 per share by 35.9% but decreased 21% year over year.

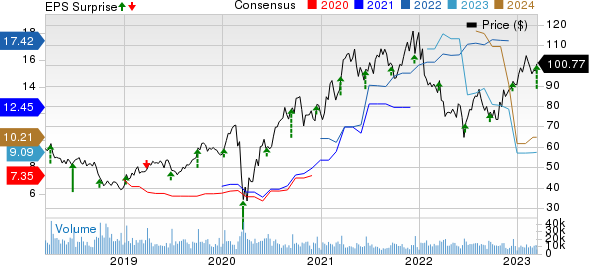

Lennar Corporation Price, Consensus and EPS Surprise

Lennar Corporation price-consensus-eps-surprise-chart | Lennar Corporation Quote

Revenues of $6.49 billion topped the Zacks Consensus Estimate of $6 billion by 8.1% and grew 5% year over year.

Segment Details

Homebuilding: The revenues of the segment totaled $6.16 billion, up 7% from the prior-year quarter. Under the Homebuilding umbrella, home sales contributed $6.1 billion to total revenues, up 7% from a year ago. Land sales accounted for $9.7 million, significantly down from $24 million in the prior-year quarter. The Other homebuilding unit contributed $52.8 million to homebuilding revenues, up from $6.5 million a year ago.

Home deliveries for the reported quarter improved 9% from the year-ago level to 13,659 units. The average sales price of homes delivered was $448,000, down 2% from the year-ago figure due to pricing to market and product mix as a larger percentage of deliveries occurred in the Company's Texas segment.

New orders declined 10% from the year-ago quarter to 14,194 homes, thanks to a cancellation rate of 21%, compared to 10% last year. The potential value of net orders also decreased 18% year over year, to $6.4 billion. Backlog at the fiscal first-quarter end declined 29% from a year ago to 19,403 homes. Potential housing revenues from backlog decreased 33% year over year to $9 billion.

The gross margin on home sales was 21.2% for the quarter, down 570 basis points (bps). The downside due to flat revenues per square foot as LEN priced homes to market while costs per square foot increased on higher materials and labor costs. Land costs also increased year over year.

Selling, general and administrative or SG&A expenses — as a percentage of home sales — improved 10 bps to 7.4% on improving its leverage combined with the benefits of the company's technology efforts.

Homebuilding’s operating earnings of $907 million decreased from the year-ago level of $1.1 billion. Net margin as a percentage of home sales contracted 560 bps to 13.8%.

Financial Services: The segment’s revenues increased year over year to $183 million from $176.7 million for the reported quarter. Operating earnings for the quarter fell to $78 million from $91 million a year ago.

Lennar Multi-Family: Revenues of $143.5 million in the segment were down from $267.4 million in the prior-year quarter. The segment registered an operating loss of $22 million for the quarter compared with earnings of $5 million a year ago.

Lennar Other: The segment’s revenues totaled $7.6 million, up from $7.3 million a year ago. The segment’s operating loss was $41 million for the quarter compared with $403 million in the comparable period of 2021.

Financials

As of Feb 28, Lennar had homebuilding cash and cash equivalents of $4.06 billion, up from $4.62 billion at the end of fiscal 2022. Total homebuilding debt was $4.03 billion as of Feb 28, slightly down from $4.05 billion at the fiscal 2022-end. Homebuilding debt to capital at the fiscal first-quarter end was 14.2%, down from 14.4% at the fiscal 2022-end and 18.3% from a year ago period.

LEN has no outstanding borrowings under the $2.6 billion revolving credit facility, thereby providing $6.7 billion of liquidity.

The company repurchased 2 million shares for $189 million at an average share price of $94.59 in fiscal first-quarter.

Guidance

For second-quarter fiscal 2023, the company expects deliveries within 15,000-16,000 homes with a gross margin on home sales of 21-21.5%. New orders are likely to be between 16,000 and 17,000 units and the ASP is expected to be between $435,000 and $445,000. SG&A expenses, as a percentage of home sales, are likely to be within 7.2-7.4% for the quarter. Financial Services operating earnings are expected to range in $70-$75 million.

For fiscal 2023, Lennar projects deliveries between 62,000 and 66,000 homes.

Zacks Rank & Stocks to Consider

Lennar currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Some better-ranked stocks in the Zacks Construction sector are:

Simpson Manufacturing Co., Inc. SSD: The company designs, engineers and manufactures high-quality wood and concrete building construction products designed to make structures safer and more secure that perform at high levels. It has been benefiting from product price increases and key growth initiatives.

Simpson’s earnings for 2023 are expected to decrease by 16.8%. It currently sports a Zacks Rank #1.

United Rentals, Inc. URI currently carries a Zacks Rank #2 (Buy). The long-term earnings growth rate of the company is 16.3%.

The Zacks Consensus Estimate for URI’s 2023 sales and EPS indicates growth of 20.3% and 28.3%, respectively, from the previous year’s reported levels.

Sterling Infrastructure, Inc. STRL currently carries a Zacks Rank #2. STRL has a trailing four-quarter earnings surprise of 19.3%, on average.

The Zacks Consensus Estimate for STRL’s 2023 sales indicates a 0.8% decline, while that for EPS suggests 10.8% growth.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Lennar Corporation (LEN) : Free Stock Analysis Report

United Rentals, Inc. (URI) : Free Stock Analysis Report

Sterling Infrastructure, Inc. (STRL) : Free Stock Analysis Report

Simpson Manufacturing Company, Inc. (SSD) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance