Lennox International Inc. Reports Strong Q1 Earnings, Surpassing Analyst Estimates

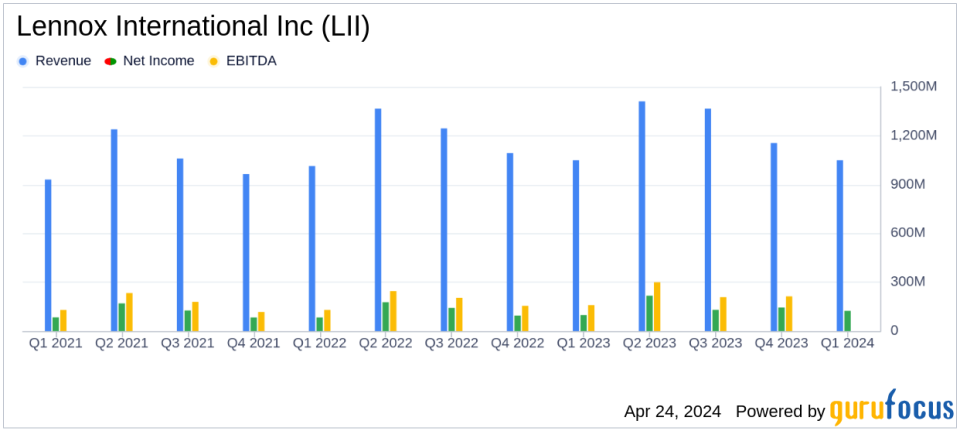

Revenue: Reported at $1.05 billion, aligning with estimates of $1050.44 million.

Net Income: Reached $124 million, surpassing the estimated $111.38 million.

Earnings Per Share (EPS): GAAP diluted EPS was $3.47, exceeding the estimated $3.16.

Operating Income: Increased by 20% year-over-year to $167 million, with operating profit margin expanding by 264 basis points to 15.9%.

Segment Performance: Building Climate Solutions segment revenue grew 21% to $373 million, with segment profit up 56% to $78 million.

Full-Year Guidance: EPS guidance for 2024 revised to $19.00-$20.00, from the previous range of $18.50-$20.00.

Capital Expenditures: Amounted to $30 million, a decrease from $35 million in the prior-year quarter.

On April 24, 2024, Lennox International Inc (NYSE:LII) disclosed its first-quarter financial results through an 8-K filing, revealing a robust performance with several financial metrics surpassing analyst expectations. The company, a prominent player in the HVACR industry, announced a quarterly revenue of $1.05 billion and adjusted earnings per share (EPS) of $3.47, both exceeding the forecasted figures of $1.05044 billion and $3.16 respectively.

Company Overview

Lennox International manufactures and distributes heating, ventilating, air conditioning, and refrigeration products primarily to North American markets. Post the divestiture of its European operations in late 2023, the company has sharpened its focus on the North American segment, where residential HVAC accounts for 68% of its sales, and commercial HVAC and Heatcraft refrigeration make up the remaining 32%.

Performance Highlights and Strategic Initiatives

The company reported a flat year-over-year revenue at $1.05 billion but highlighted a 6% increase in core revenue, excluding the impact of the European divestiture. This growth was partly fueled by strategic acquisitions contributing 2% to the revenue increase. Operating income rose impressively by 20% to $167 million, with the operating profit margin expanding by 264 basis points to 15.9%.

CEO Alok Maskara credited the success to Lennox's transformation plan, which focuses on distribution expertise, customer experience, innovative platforms, pricing excellence, and productivity. Despite challenges such as residential destocking, the company managed to enhance its margin resilience through effective pricing strategies and operational improvements.

Segment Analysis

The Home Comfort Solutions segment experienced a slight revenue decline of 1%, attributed to destocking activities, but segment profit margin improved slightly. Conversely, the Building Climate Solutions segment saw a remarkable revenue increase of 21%, with organic growth of 15% driven by enhanced production volume and product mix.

Financial Position and Outlook

Lennox reported a net income of $124 million, or $3.47 per diluted share, up from $98 million, or $2.75 per share, in the prior-year quarter. The adjusted net income remained stable at $124 million, or $3.47 per diluted share. The company ended the quarter with $58 million in cash and cash equivalents and has managed to reduce its operating cash flow usage significantly from the previous year.

Looking ahead, Lennox has raised its EPS guidance for 2024 to a range of $19.00 to $20.00, up from the previous forecast of $18.50 to $20.00. The company also anticipates a revenue growth of approximately 7% for the full year, with a projected free cash flow of $500 million to $600 million.

Conclusion

Lennox International Inc's first-quarter results demonstrate a solid start to 2024, underpinned by strategic initiatives that bolster operational efficiency and profitability. With improved financial guidance and a clear focus on core growth areas, Lennox is well-positioned to maintain its leadership in the HVACR industry and deliver value to its stakeholders.

Investors and analysts can access more detailed information and participate in the earnings discussion during the conference call hosted by Lennox, or review the archived call on the company's investor relations website.

Explore the complete 8-K earnings release (here) from Lennox International Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance