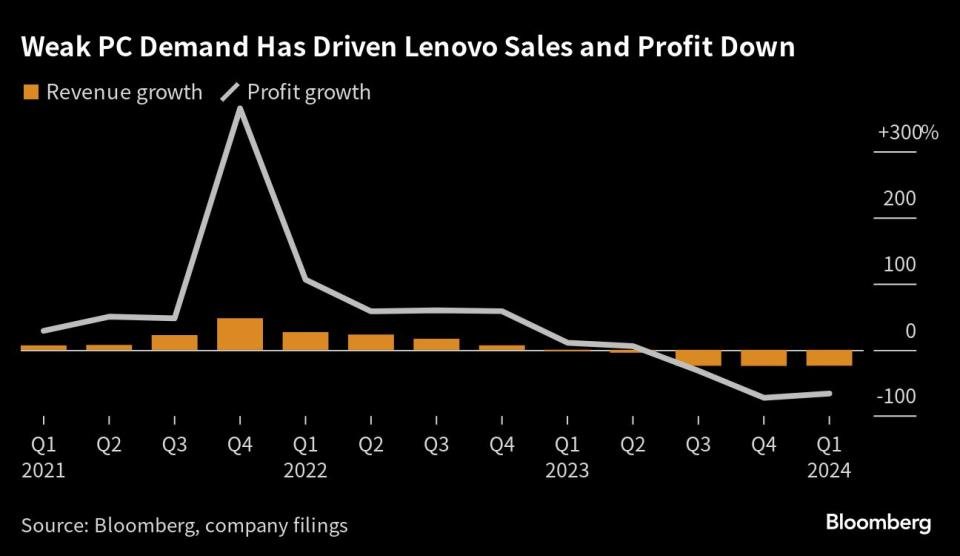

Lenovo Dives Most in Three Months After PC Slump Wallops Profit

(Bloomberg) -- Lenovo Group Ltd. fell its most in nearly three months after missing profit estimates for the second straight quarter, underscoring the depth of a global electronics market downturn.

Most Read from Bloomberg

Huawei Is Building a Secret Network for Chips, Trade Group Warns

Musk Told Pentagon He Spoke to Putin Directly, New Yorker Says

Goldman Is Cracking Down on Employees That Aren't in Office Five Days a Week

S&P 500 Up 1% as Yields Slide Amid Fed Pause Bets: Markets Wrap

The world’s biggest PC maker reported a larger-than-anticipated 66% slide in net income to $176.5 million for the June quarter, after revenue declined 24%. Its shares fell as much as 6.1% in Hong Kong, their biggest intraday fall since late May.

Chinese consumers are increasingly reluctant to buy smartphones, laptops and other devices as the world’s second-largest economy slides into deflation. Chief Executive Officer Yang Yuanqing is betting that corporate customers have mostly worked through their inventories of PCs, which should translate into more consistent growth. He predicted the slump should have bottomed out last quarter and Lenovo could return to revenue growth by calendar 2024.

AI demand should also catalyze demand for servers in the long run, he said. The company will spend $1 billion over the next three years to improve its AI capabilities, joining a global investment spree since OpenAI’s ChatGPT demonstrated the technology’s potential.

“I believe the last quarter was the lowest,” Yang told Bloomberg News. “Although in this quarter you will still see a decline, probably in next quarter we have a good chance to see a year-on-year increase.”

Lenovo fended off HP Inc. to keep the top position in global PCs during the past quarter but also saw shipments shrink 18.4%, according to IDC. The company said the unusual action of clearing inventory weakened profitability for its main business unit in the April to June period.

Uncertainties in the timing of a recovery in demand for PCs and storage gear could further cloud Lenovo’s prospects, Goldman Sachs analysts Verena Jeng and Allen Chang wrote in a note ahead of the earnings release. Fiercer-than-expected competition in smartphones and AI servers could also weigh on the company.

Global smartphone shipments are headed for their worst year for over a decade as prolonged economic volatility in China and beyond are hurting consumer spending, Counterpoint Research analysts estimate.

Read more: China Is Dragging Smartphone Market to Worst Year in a Decade

The advent of AI however could jumpstart Lenovo’s business. The Beijing-based company introduced a server brand tailored for the Chinese market, where a slew of local companies from Baidu Inc. to SenseTime Group Inc. are developing ChatGPT-like AI services.

The company sees the rapid development of AI applications generating numerous opportunities, it said in a statement.

“AI’s higher requirements of computing power and new AI functions will support demand for Lenovo’s end devices,” the Goldman analysts said. “In overseas market, Lenovo is well positioned with global leading clients and for overall servers business, we expect Lenovo to grow on market share gain, product mix upgrade and product lines expansion.”

--With assistance from Mayumi Negishi.

Most Read from Bloomberg Businessweek

Drug Benefit Firms Devise New Fees That Go to Them, Not Clients

Never Mind Shrinking Households, Builders Are Adding Bedrooms

‘Don’t You Remember Me?’ The Crypto Hell on the Other Side of a Spam Text

GOP Presidential Hopeful Ramaswamy Sued Over Strive’s Practices

©2023 Bloomberg L.P.

Yahoo Finance

Yahoo Finance