LHC Group (LHCG) Q4 Earnings Meet Estimates, Revenues Lag

LHC Group Inc.’s LHCG fourth-quarter 2019 adjusted earnings per share (EPS) of $1.15 matched the Zacks Consensus Estimate. However, the bottom line improved 11.7% year over year.

For the full year, adjusted EPS was $4.47, up 25.9% from that of 2018. The figure also beat the consensus mark by 0.2%.

Revenues in Detail

The Zacks Rank #3 (Hold) company reported net service revenues of $531.3 million in the quarter, which missed the Zacks Consensus Estimate by 1.9%. However, the top line improved 4.2% on a year-over-year basis.

For full-year 2019, the company reported net service revenues worth $2.08 billion, which improved 14.9% from the previous year. However, the top line missed the Zacks Consensus Estimate by 0.4%.

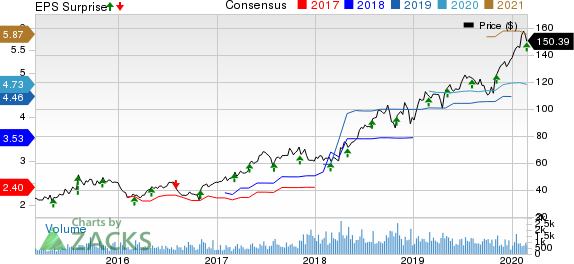

LHC Group, Inc. Price, Consensus and EPS Surprise

LHC Group, Inc. price-consensus-eps-surprise-chart | LHC Group, Inc. Quote

Q4 Highlights

In the quarter under review, total growth in home health admissions was 11.7% year over year and organic growth was 10.3%.

Total growth in home health revenues was 6.1% year over year and organic growth was 6.5%. While growth in hospice admissions was 9.7% year over year, organic growth advanced 5.6%.

During 2019 and year to date in 2020, the company acquired 27 home health, 11 hospice and three home and community-based services locations and one Long Term Acute Care (LTAC) hospital in 13 states and the District of Columbia, the majority of which are hospital joint ventures. These buyouts represent around $114.3 million in annualized revenues.

Margin

Gross profit in the quarter totaled $188 million, up 1.5%. Gross margin in the reported quarter was 35.4%, down 90 bps.

Operating income came in at $32.5 million, down 10.1% from the year-ago quarter’s $36.1 million. Operating margin was 6.1%, down 100 bps.

2020 Guidance

For full-year 2020, the company projects adjusted EPS to range between $4.60 and $4.80. The Zacks Consensus Estimate is pegged at $4.73.

LHC Group expects net service revenues in the band of $2.13-$2.18 billion in 2020. The Zacks Consensus Estimate stands at $2.23 billion.

For the full year, adjusted EBITDA is projected between $230 million and $240 million.

For first-quarter 2020, net service revenues are estimated to be in the band of $500-$510 million, while adjusted EPS is anticipated to be in the range of 70-80 cents. Adjusted EBITDA is projected to be in the range of $33 million to $40 million.

Wrapping Up

LHC Group exited the fourth quarter on a mixed note, wherein earnings came in line with the consensus mark, while revenues missed the same. The company continues to gain from its home health services and hospice admissions, which rose year over year in the reported quarter. Substantial increase in the top and bottom lines also instill optimism. Management continues to remain optimistic about the Almost Family acquisition, which has proven accretive in the quarter. LHC Group is also anticipated to gain from joint ventures. Strong 2020 outlook paints a bright picture as well.

However, a highly competitive home healthcare market adds to woes. The company also witnessed contraction in both gross and operating margins in the quarter under review.

Earnings of Other MedTech Majors at a Glance

Some better-ranked stocks that reported solid results this earning season are Stryker Corporation SYK, Accuray Incorporated ARAY and IDEXX Laboratories, Inc. IDXX. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Stryker delivered fourth-quarter 2019 adjusted EPS of $2.49, outpacing the Zacks Consensus Estimate by 1.2%. Fourth-quarter reported revenues of $4.13 billion surpassed the Zacks Consensus Estimate by 0.7%. The company carries a Zacks Rank #2 (Buy).

Accuray reported second-quarter fiscal 2020 adjusted earnings per share (EPS) of a penny, beating the Zacks Consensus Estimate of a loss of 7 cents. Net revenues of $98.8 million outpaced the Zacks Consensus Estimate by 0.3%. The company sports a Zacks Rank #1.

IDEXX Laboratories reported fourth-quarter 2019 adjusted EPS of $1.04, which beat the Zacks Consensus Estimate of 91 cents by 14.3%. Revenues were $605.4 million, surpassing the Zacks Consensus Estimate by 0.9%. The company carries a Zacks Rank of 2.

Today's Best Stocks from Zacks

Would you like to see the updated picks from our best market-beating strategies? From 2017 through 2019, while the S&P 500 gained and impressive +53.6%, five of our strategies returned +65.8%, +97.1%, +118.0%, +175.7% and even +186.7%.

This outperformance has not just been a recent phenomenon. From 2000 – 2019, while the S&P averaged +6.0% per year, our top strategies averaged up to +54.7% per year.

See their latest picks free >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Stryker Corporation (SYK) : Free Stock Analysis Report

Accuray Incorporated (ARAY) : Free Stock Analysis Report

LHC Group, Inc. (LHCG) : Free Stock Analysis Report

IDEXX Laboratories, Inc. (IDXX) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance