Lib Dems plot to double capital gains tax for highest earners

The Liberal Democrats are planning to double capital gains tax for top earners in order to fund a £5bn-a-year rescue package for the NHS.

The highest rate of capital gains tax would increase from 24pc to 45pc under the party’s proposals, announced on Monday.

As a result, a higher earner making a £110,000 profit from a house sale would pay £47,250 in tax, compared to £25,680 under current rules.

In an article published on its website, the Lib Dems said it wanted to cut taxes or keep them the same for most people while closing a “loophole” for the top 0.1pc of earners.

The plans, which it said would fix the “broken” capital gains tax system, are likely to put Labour under more pressure to commit to tax rises, after it ruled out increasing income tax, national insurance or VAT.

Currently capital gains tax is owed on the sale of investments or a second property when profits exceed £3,000. The Lib Dems want to increase this to £5,000 in order to protect those on lower incomes.

Gains of between £5,000 and £50,000 would then be taxed at 20pc, while those between £50,000 and £100,000 would be taxed at 40pc and those more than £100,000 would be taxed at 45pc.

The rate would be based entirely on gains, whereas at the moment it is based on tax bands and nature of the gains.

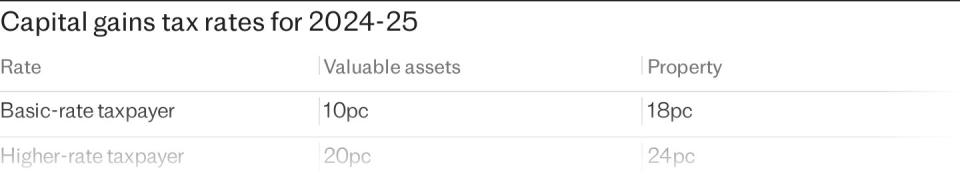

For example, basic rate taxpayers pay 10pc on shares and 18pc on second properties, compared to 20pc and 24pc for higher rate taxpayers.

This means a higher rate taxpayer with a £70,000 profit from a property sale would pay £26,000 in tax under the Lib Dems’ plans – compared to £16,080 today, an increase of £10,000.

The party also said it would introduce a new “inflation allowance” so that gains resulting from inflation would not be not taxed, as well as targeted relief for small businesses.

The Lib Dems said the money raised from the tax rises would fund a £5bn-a-year rescue package for the NHS, including 8,000 more GPs.

In the run up to the election there has been much speculation that Labour could be considering aligning capital gains tax rates with income tax rates.

The Office of Tax Simplification urged the government to consider closing the gap between the two taxes in 2020.

The now-disbanded agency said that the disparity between them “creates an incentive for taxpayers to arrange their affairs in ways that effectively re-characterise income as capital gains” and predominantly benefits the wealthy.

Speaking on Sky News on Sunday, Paul Johnson, of the Institute for Fiscal Studies, warned that politicians were “tying themselves in knots” over their promises not to slash taxes.

“I do wish they’d stop ruling things out because they may well find that they regret that when they assume office,” he said.

The Lib Dem article said: “Most people are paying far too much when they sell a property or a few shares, because the system doesn’t account for inflation over the time they’ve owned them.

“At the same time, a tiny number of super wealthy people – roughly the top 0.1% – exploit it as effectively one giant loophole, to avoid paying the rates of income tax everyone else does.

“According to the latest HMRC statistics, 14,000 multi-millionaires used the loophole to pay less than half the top rate of income tax on their combined £60bn income.

“We estimate that these reforms would raise £5.2bn a year in 2028-29, to invest in our NHS and improve local health services for everyone.”

Chris Etherington, of accountancy firm RSM, said there was a risk the Lib Dems’ plans could result in the Treasury losing money instead of raising more in tax receipts.

“Many taxpayers could simply choose to keep hold of their assets rather than sell them. A 45pc rate could result in the UK having one of the highest capital gains tax rates in the world, so a potential outcome is that some taxpayers may consider moving offshore as a result.”

The Lib Dems will unveil their manifesto on Monday, which is also expected to include social care reforms as well as plans to remove sewage from Britain’s waterways.

Yahoo Finance

Yahoo Finance